Wheat imports from Egypt, the world’s largest buyer, are expected to decline in the marketing year 2022-23 (July-June), as the country emphasizes on higher flour extraction from wheat to raise domestic availability of the food grain at a time of high food inflation environment.

Wheat is the staple food grain for Egypt, which annually consumes 20 million-22 million mt of the grain,but produces only around 9 million-10 million mt in a year, according to data from the US Department of Agriculture.

The North African country has decided to increase its flour extraction to 87.5% from 82% earlier. This move is likely to reduce the country’s wheat purchases by at least 500,000 mt for MY 2022-23, traders and sources told S&P Global Commodity Insights.

Egypt is expecting to increase its flour production by at least 500,000 mt, with the likely higher extraction.

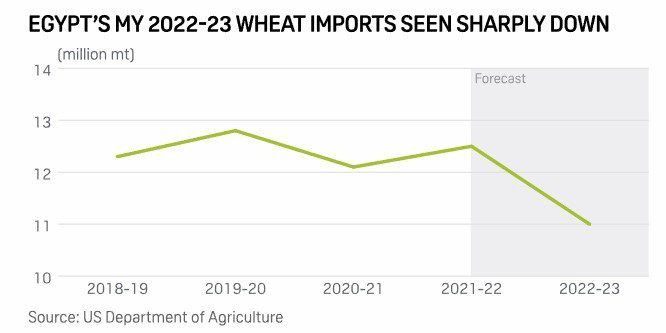

The Cairo attaché of the US Department of Agriculture’s Foreign Agricultural Service slashed Egypt’s wheat imports in MY 2022-23 to 11 million mt, down 8.4% from the estimates for MY 2021-22.

“If Egypt is able to increase flour extraction in the current marketing year that is likely to lead to a decrease in wheat exports of European Union,” a trader based in Paris said.

In MY 2021-22, the EU became a key supplier of wheat to Egypt as Russia’s invasion of Ukraine dried up supplies from Black Sea.

Egypt imported 2.7 million mt wheat from the EU in MY 2021-22, up from 1.1 million mt in MY 2020-21.

Except for the EU, Indian traders are also fearing that Egypt may turn its back on Indian wheat in the next few months.

Egypt has been reeling under severe food inflation since Russia invaded Ukraine in February, hit by narrowing availability of global wheat supplies.

Over the past few years, Russia accounted for around 50% of wheat supplies into Egypt, followed by Ukraine at 30% and the EU at 20%, USDA data showed.

The Ukrainian crop for the MY 2022-23 has been already hit due to the ongoing conflict, while weather concerns over the EU crop could pressure exports, a Romanian trader said.

Egypt’s inflation concerns

Apart from the food shortage fears, a sharp increase in global wheat prices over the past few months has also spurred an increase in Egypt’s food inflation.

Egypt’s food inflation in May rose 25% on the year, latest government data showed. To rein in the rising food costs, Egypt also reduced its subsidies on bread for the first time in four decades.

Global wheat prices started rising sharply over the past three months as Russian invasion in Ukraine muted supplies from the region, which usually accounts for around 30% of global wheat supplies.

A drop in supplies shot up wheat prices, making it difficult for Egypt to procure cheaper wheat.

“Although there is no such shortage of food at bakeries and local markets at the moment, prices are sharply higher than last year,” a Cairo-based trader said.

Egypt has been struggling to secure cheap supplies of wheat and has been looking for supplies from non-traditional origins.

It had also put in orders to India, which emerged as a key supplier of wheat for a few months since the war. However, with India also banning wheat exports in May, Egypt has been seeking a deal with India to swap fertilizers and other products for around 500,000 mt wheat, according to Indian commerce ministry officials.

Despite initially intending to purchase 500,000 mt wheat from India, Egypt is likely to buy around 180,000 mt in the next few months as quality concerns cloud Indian wheat crop, sources said.

Egypt had also banned exports or re-exports of wheat and wheat products to keep adequate supply in the domestic markets.

“Since the exports of wheat and wheat products are very low, it is unlikely to relieve the domestic supply tightness,” another Cairo-based trader said.