But the relief was short-lived. Over the weekend, Russian missiles hit the Black Sea port city of Odesa. On Monday, Russian state-owned energy producer Gazprom said gas exports through the Nord Stream 1 pipeline to Germany will drop to 20% of capacity from Wednesday, down from 40%, and blamed further problems with a turbine.

The Bloomberg Commodity Index, which broke a five-week decline to climb 2.7% last week, at the time of writing has risen another 2.4% so far this week, and we expect further gains for commodities:

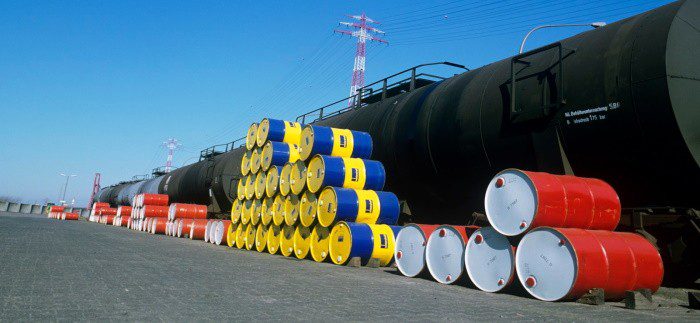

Energy supply remains fragile. Reduced gas supply to Europe through the Nord Stream 1 pipeline will keep upward pressure on energy prices—European wholesale gas prices (Dutch TTF) rose 11% on Monday. Reduced flow will also hamper the region’s ability to add to storage levels ahead of winter: Current storage levels are only at 60%, well below the EU’s target of 80% by 1 November. Meanwhile, the EU is planning to ban most Russian oil imports by the end of the year. OPEC+ is already producing oil near its capacity limits, so any pledge to raise production targets would likely be ineffective.

Ukraine grain exports in doubt despite agreement. Even with the blockade lifted, the war in Ukraine will continue to impede production and transportation. Over 20 million tonnes of grain are stuck at the port of Odesa, although Ukraine expects to begin the first shipments early this week. Ukrainian President Volodymyr Zelenskyy said increased damage to shipping infrastructure would impact Ukraine’s ability to export more than 60 million tonnes of grain over the next nine months and could extend the timeline to export this volume of grain to 24 months. Meanwhile, severe drought in grain-producing countries due to the La Niña weather pattern has affected the crop development of wheat, corn, and soybeans.

Recession fears insufficient to trigger oil demand destruction. Although recession fears have led to a wave of liquidation in oil positions by investors, we think that the supply situation remains too tight for demand destruction to offset the imbalance. Furthermore, while oil demand from OECD countries has been lackluster lately, it is strong in non-OECD countries, especially China, where we believe the economic recovery is on track, as well as India and Mexico. Oil inventories are still at multiyear lows, and short-term available spare capacity is set to fall below 2mbpd in August. We think higher prices are needed to trigger the kind of demand destruction that can bring supply and demand back into balance.

So, we retain our most preferred view on commodities, and we see another 10–15% upside in the broad commodities index. We expect Brent crude to rise to USD 130 a barrel by September and remain around USD 125 through to the middle of 2023, underlining our positive view on energy equities. We prefer an active commodity strategy, buying longer-dated oil contracts, and selling volatility in crude oil, copper, aluminum, platinum, corn, sugar, and live cattle. Food and energy security are also important components of our era of security investment theme.

Main contributors – Mark Haefele, Patricia Lui, Wayne Gordon, Giovanni Staunovo, Vincent Heaney, Daisy Tseng