Strong job creation continues

The US added 263k jobs in September with 11k of upward revisions to the past 2 months – close to the consensus 255k. The payrolls data shows solid gains in most areas with manufacturing rising 22k despite the ISM employment index moving into contraction territory. Construction rose 19k while private service providing firms increased payrolls by 244k. Within services it was a little more mixed with retail (-1k), financial (-8k) and /transport (+3k) well down on recent months job gains while leisure and hospitality (+83k) and /health (+90k) look strong. Government is a drag once again, losing 25k jobs. This leaves total payrolls at 153.0mn, a new record high and half a million above the February 2020 pre-pandemic high.

But it could have been even stronger with demand still exceeding supply

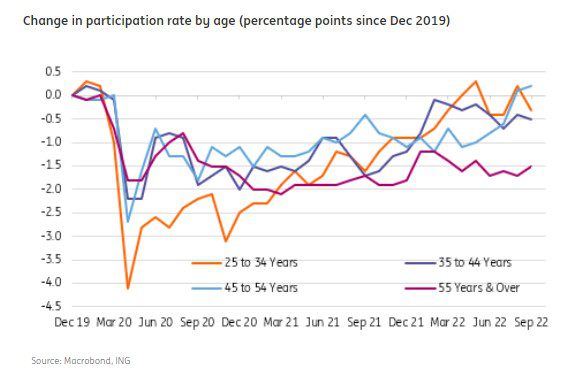

Meanwhile, the household survey shows the unemployment rate dropped back to 3.5% from 3.7% thanks to the combination of rising employment (+204k) on this survey’s calculations and people leaving the workforce (-57k). We had suspected the unemployment rate would fall given the big rise in the participation rate last month of 0.3pp to 62.4% is rarely ever held onto in the subsequent month. The 3.5% unemployment rate matches the low seen in July. The chart shows the weakness in participation is primarily due to older (55+) workers not having returned to the workforce, which suggests early retirements or possible health worries remain a major factor behind the lack of workers to fill vacant job positions.

Rounding out the report, wages were in line with consensus at 5% year-on-year, down from 5.2% in August and the average work week remained at 34.5 hours.

Inflation pressures remain strong so another 75bp is on its way

The report is on the stronger side of expectations overall, with payrolls growth more constrained by a lack of suitable workers to fill positions rather than any meaningful downturn in hiring intentions – there are still 4mn more vacancies that there are unemployed Americans to fill the positions. This indicates that the Fed has more work to do to slow the economy in order to get inflation under control. In this regard note next week’s core CPI inflation rate (published 13 October) is expected to RISE to 6.5% from 6.3% next week. We were down at “only” 5.9% in June and July and this unfavourable shift when the labour market remains so tight means that a 75bp hike at the 2 November Federal Open Market Committee meeting remains the obvious call.