If you are yearning for a wee Honda Civic, you’ll be waiting a while.

That’s according to Aric Curtice, a sales and leasing consultant at Superior Honda of Omaha, Nebraska. He’s warned recent customers asking for a Honda Civic that they’ll have to wait up to two months for their vehicles. Wannabe pickup truck or SUV drivers, though, only have to wait about a month.

We have plenty of full-size pickup trucks, and not a lot of compact or mid-size cars. (Cox Automotive)

We have plenty of full-size pickup trucks, and not a lot of compact or mid-size cars. (Cox Automotive)

This is partially why new vehicles are unusually pricey right now. The average asking price for a new vehicle in September was $46,294, according to Cox. Compare that to the price in September 2019: $37,110.

There’s a decent supply of expensive, giant cars but relatively few affordable, tiny ones. Experts say you can blame the supply chain, as you’re already likely used to doing. And unfortunately, such reduced supply of vehicles more generally is likely to outlast the current supply chain crunches.

Automakers are ditching sedans for SUVs because, well, they can make more money

Supply chain professor Susan Golicic of Colorado State University worked at Chrysler as a logistics consultant before she entered academia. She said a single vehicle nowadays might require more than 1,000 microchips.

Many of the components used in each vehicle require microchips. If, say, your door lock module is missing its chips, that means your overall production will be delayed.

“When you need that many [chips] for a single vehicle, it all compounds as you move further upstream,” Golicic said.

Companies can’t make the same volume of vehicles they would like to in order to meet demand. So they’re prioritizing high-margin vehicles that they know will sell well. For many automakers, that means more pickup trucks and fewer compact cars.

“They’re having to allocate which vehicles they actually want to produce,” Golicic said. “Typically, they’re going to choose the most profitable. When Ford has to make a decision on what vehicles to produce, knowing they don’t have parts to build all of them, they’re going to build an F150.

“When a business has to make decisions about ‘I can’t build everything, what am I going to build,’ they’re going to build what they make the most money on,” Golicic said. “Generally speaking, that’s going to be their most expensive product.”

A new Honda Passport SUV starts at $41,100. A Honda Civic starts at less than $24,000.

You might expect that Curtice, the Omaha-area Honda salesman, would be seeing far more demand for smaller, inexpensive vehicles — but that hasn’t been the case. About half of his buyers are seeking SUVs or pickup trucks.

“People have adapted to inflation,” Curtice said. “You had that sticker shock initially and now they’re evolving to what’s out there, what’s available.”

As American options for small cars diminish, customers have typically turned to Asian or European brands. Asian manufacturers, however, have struggled with their supply chain this year amid lockdowns in China, Michelle Krebs, a Cox Automotive executive analyst, said. A looming energy crisis in Europe threatens manufacturing across the Atlantic too.

You don’t want a pick-up truck? Too bad! (Jim / )

You don’t want a pick-up truck? Too bad! (Jim / )

I reached out to the biggest automotive manufacturers to learn more about this. Representatives from Ford, Stellantis, Toyota, GM and Hyundai my inquiry. (Awkward …) A Honda representative told me they didn’t have enough time to respond based on my deadline.

A Volkswagen representative sent along a statement noting that the company has adapted to the ongoing supply chain crisis and that localizing production to North America has been key to resiliency. The VW representative highlighted its Chattanooga, Tennessee, plant. (I’ve heard of that place!)

Vehicle prices may have been the ‘leading edge’ of our current inflation crisis

In the halcyon days of early 2021, when historic inflation hadn’t yet wracked the U.S. economy, one area had emerged as troublesome: used car prices. Omair Sharif, founder and president of Inflation Insights, said used car prices “kicked off” our ongoing inflation spiral in the second quarter of 2021.

Stimulus checks and folks moving to areas of the country requiring cars were all part of the increased demand for vehicles. Sharif highlighted a more insidious, less spoken of driver for vehicle demand, though. There was a key structural change in the used car market in early 2021.

“You had somebody who was a natural seller into the market become a buyer,” Sharif said. “That’s just not something that anyone had ever seen.”

Semiconductor shortages drove up the cost of new vehicles even more.

“Used vehicles in some sense were the leading edge of the inflation increase that’s been with us for the last 18 months,” Sharif said. “It materialized there first before it really did anywhere else.”

Automakers want to keep inventories low so they can make more money

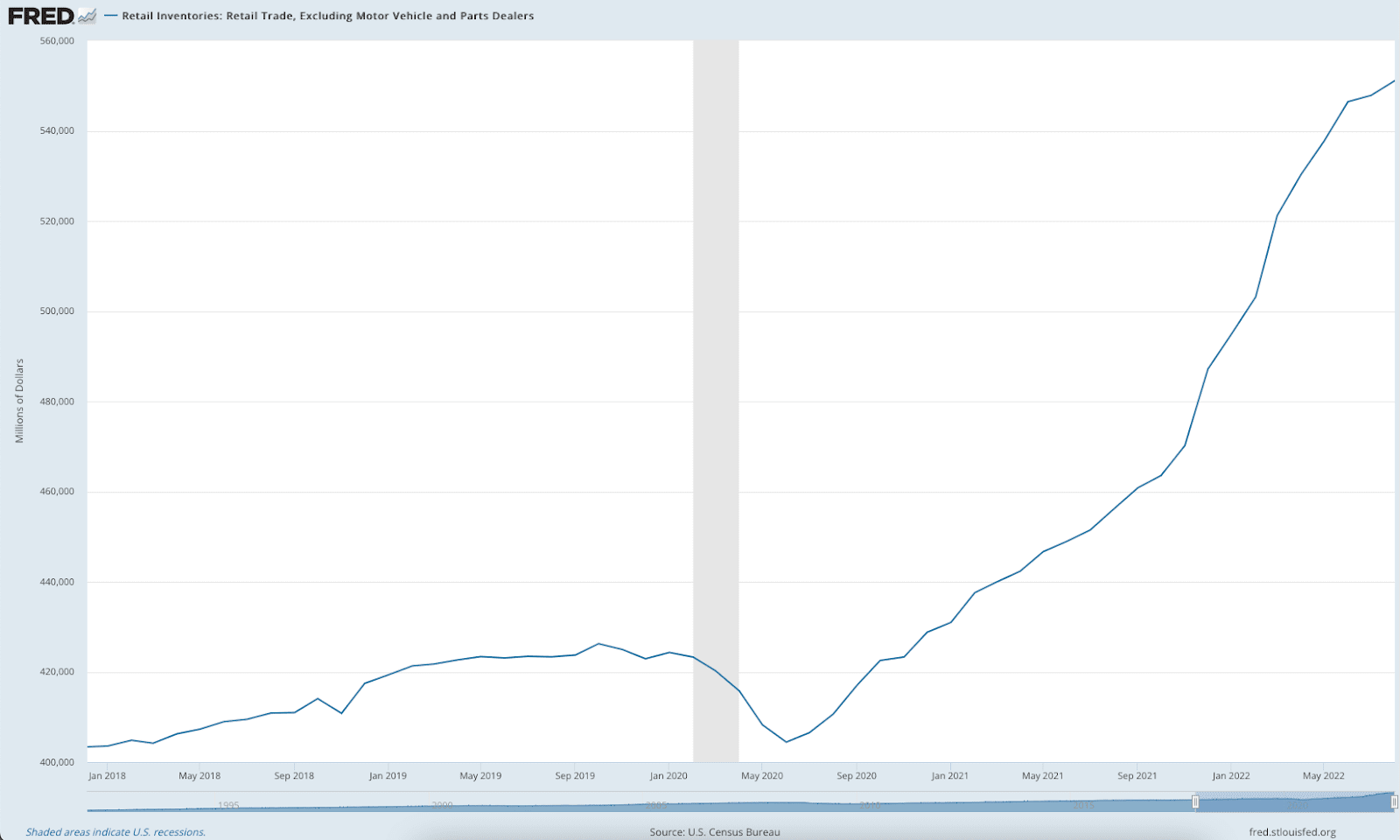

Retailers have too much stuff. (St. Louis FRED)

Retailers have too much stuff. (St. Louis FRED)

Meanwhile, the automotive industry can’t seem to catch up to its pre-pandemic inventory norms. According to Cox, the active inventory of vehicles the first week of October totaled under 1.4 million with 45 days of supply. That same week in 2019, we had nearly 3.4 million vehicles and 80 days of supply.

At Curtice’s Honda dealership, there were 200 to 300 vehicles on the new car lot before the pandemic. Now it’s around 70, he said.

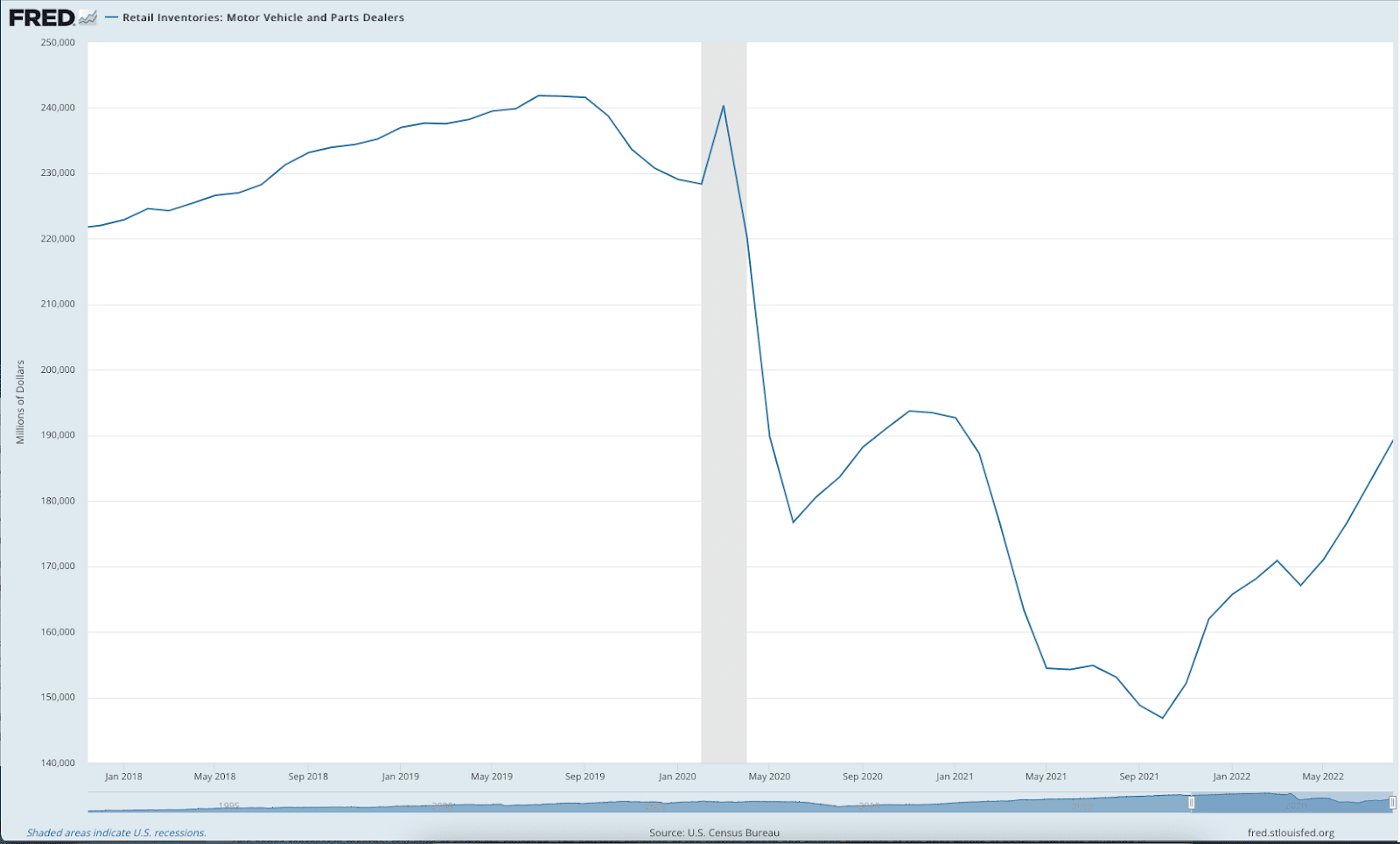

Dealerships are running low on inventories. That’s partially by design. (St. Louis FRED)

Dealerships are running low on inventories. That’s partially by design. (St. Louis FRED)

We will likely never return to those days of plentiful automotive supply, said Krebs of Cox. That means more expensive cars for the rest of us.

“[The automakers] have always overproduced,” Krebs said. “When you overproduce you still have to sell some way, so you do that by discounting. The automakers have realized if they keep supply more in line with demand, they can get the best price.”

By the way, I will be on vacation next week — mostly mourning the fact that automotive companies do not want to email me despite my deep Detroit roots. Look out for a guest column on trans-Pacific trade by my colleague JP Hampstead.

We will also have no MODES on Nov. 3 as that week is ’ Future of Freight Festival and I will be quite busy! Sorry!