Net trade drives third quarter GDP higher

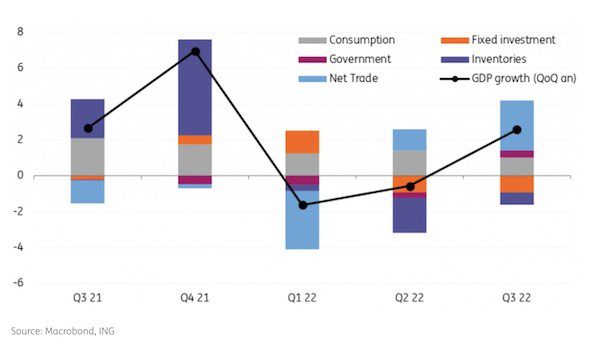

The US economy met the technical definition of a recession when GDP fell in both the first and second quarters of the year, but it didn’t feel like a real downturn. Consumer spending and business capital expenditure rose, while the economy created more than 3.5mn jobs. Instead, it was volatility in trade and inventories, a legacy of the long-running supply chain problems around the globe, that led to the contraction.

But the picture has begun to look quite different through the third quarter. Overall GDP grew by 2.6% on an annualised basis, with net trade doing a lot of the leg work. But this decent headline reading masks some less encouraging trends beneath the surface. Consumer spending growth has slowed, albeit perhaps not as much as expected. Personal consumption grew by 1.4% in the third quarter, compared to 2% in the second.

Meanwhile, residential investment is now exerting a massive drag, given the rapid slowdown in housing transactions. This component shaved 1.4% off the overall GDP figure in the third quarter, a symptom of a housing market that is moving from a period of significant excess demand to one with modest excess supply.

Contributions to US quarterly annualised GDP growth

Recession will feel much more real in 2023

With the Fed signaling that it is prepared to accept weaker activity, and even tolerate recession, to get inflation under control, next week’s widely expected 75bp interest rate hike won’t be the last move from the Federal Reserve.

Rising borrowing costs throughout the economy and the strong dollar are creating a massive headwind. At the same time, the weak external environment is adding to the downside risks to growth, led by Europe’s forthcoming energy-driven recession, and China still being constrained by Covid containment measures.

So while the US may have just exited a technical recession, the cold winds are set to get a whole lot chillier this winter and make recession feel much more real in early 2023.