Factory stockpiles in China totalled 750,000 teu at the end of September

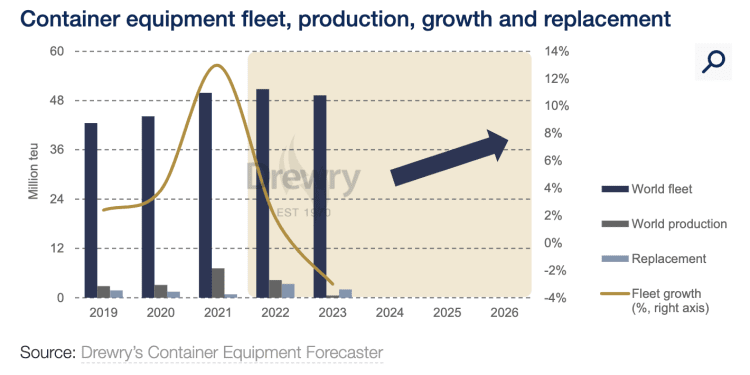

The fleet of container equipment in service is forecast to decline by 3% in 2023, according to Drewry, which cited the war in Ukraine and soaring inflation impacting the container shipping industry.

With supply chain congestion easing, the surplus amount of equipment that has built up in the fleet over the past two years is being removed.

As container shipping cargo demand is slowing, carriers are idling more tonnage and vessel scrapping is rising.

Therefore, fewer shipping containers are needed at a time when surpluses of over 6m teu are estimated to be in the fleet, according to Drewry’s latest assessments published in its Container Equipment Forecaster.

Last year, more than 7m teu was produced and lessors and ocean carriers refrained from retiring older boxes because of congestion issues.

Ageing containers are increasingly being sold into the secondary market as both shipping lines and, particularly, lessors tackle overcapacity.

Companies are looking to organise their container pools to bring them back in line with existing and short-term demand and vessel capacity projections, noted Drewry.

Since the summer, there has been a notable increase in equipment being off-hired and returned to lessors as shipping lines have not renewed /or extended their contracts.

This is expected to continue into 2023 with lessors streamlining their fleets accordingly, according to the analyst.

Lessors are impacted by decisions of ocean carriers to directly own more of their equipment, it added.

Year-to-date, close to 70% of dry freight containers delivered have been for the accounts of transport operators, a reversal in the trend of the past decade when lessors dominated the orderbook.

With factory stockpiles of empty containers in China rising to more than 750,000 teu by the end of September and likely to increase further, the demand for new container orders is extremely weak.

Drewry forecasts that production will fall drastically in 2023 as few owners are expected to expand their fleets and not every container being retired will be replaced with a new one.

Globally, the pool of equipment in service will decline from 50.8m teu in 2022 to 49.3mm teu in 2023 and production slump to an estimated 497,000 teu, a number only slightly above that recorded in 2009, following the global financial crisis.