Dirty tanker freight rates

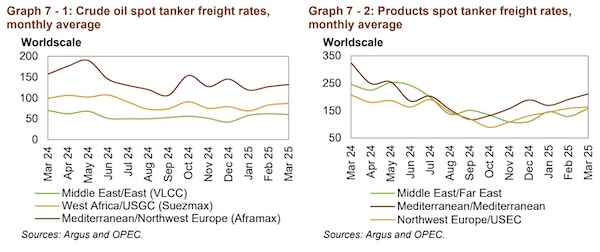

Very large crude carriers (VLCC)

VLCCs declined on all monitored routes in March as support from uncertainties regarding sanctioned crude flows eased. On average, VLCC spot freight rates declined 4%, m-o-m. VLCC spot rates were down 18% from the strong levels seen in the same month last year.

On the Middle East-to-East route, rates averaged WS60 in March, representing a decline of 3% compared to the previous month, amid a decline in flows to South Korea and China. Rates were 14% lower, y-o-y. Spot freight rates on the Middle East-to-West route declined by 6%, m-o-m, to average WS34, amid lower flows to the US amid trade uncertainties. Compared with the same month in 2024, rates were down 28%. Spot freight rates on the West Africa-to-East route fell 3%, m-o-m, to average WS61 in March, despite a jump in VLCC flows out of Nigeria. Compared with the same month in 2024, rates were down 14%

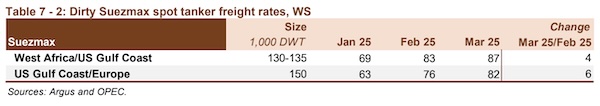

Suezmax

Spot freight rates for Suezmax vessels in the Atlantic basin continued to edge higher in March, supported by a step up in flows from Brazil and, to a lesser extent, Canada. Spot rates rose 6%, m-o-m, on average, but were down 10%, y-o-y.

On the West Africa-to-USGC route, spot freight rates in March averaged WS87, representing an increase of 5%, m-o-m. Spot rates were 12% lower compared with the same month in 2024. Rates on the USGC-toEurope route increased by 8% to average WS82. Compared with the same month in 2024, rates were 7% lower.

Aframax

Aframax spot freight rates posted further modest gains, rising a further 7%, m-o-m, in March. Aframax spot rates were down 16% compared with last year’s good performance. Rates on the Indonesia-to-East route rose 7%, m-o-m, to an average of WS131 in March. Y-o-y, rates on the route were down 22%.

The Caribbean-to-USEC spot freight rates jumped 12%, m-o-m, to average WS137. Compared with the same month last year, rates were 11% lower. Cross-Med spot freight rates were up 4%, m-o-m, to average WS137. Y-o-y, spot rates on the route were down 14%. Similarly, rates on the Med-to-Northwest Europe (NWE) route were up 4%, m-o-m, to average WS132. Compared with the same month in 2024, rates were down 16%.

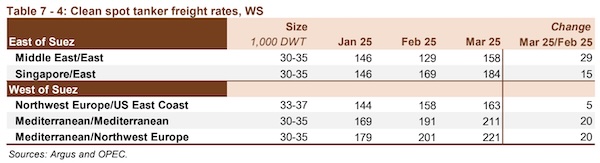

Clean tanker freight rates

Clean spot freight rates rose, m-o-m, in March. East of Suez rates gained 15% on average, while West of Suez rates rose 8%. Compared to the previous year, East of Suez rates were down 35%, while West of Suez rates fell 31%.

Rates on the Middle East-to-East route jumped 22%, m-o-m, to average WS158. Compared with the same month in 2024, rates were down 36% lower. Clean spot freight rates on the Singapore-to-East route rose 9%, m-o-m, to average WS184 in March. This represents a 34% decline compared with the same month in 2024.

Over in the Atlantic basin, clean rates on the NWE-to-USEC route averaged WS163. This was a gain of just 3%, m-o-m, but a 21% decline, y-o-y. Rates around the Mediterranean rose 10%, m-o-m, on both the CrossMed and Med-to-NWE routes. Y-o-y, spot freight rates around the Med were down by about 35%.

Nikos Roussanoglou, Hellenic Shipping News Worldwide