The regulation should level the playing field for alternative fuels such as ammonia and methanol. Due to the significantly higher costs of building and operating alternative-fueled vessels, these vessels are at a significant economic disadvantage compared to conventional-fueled vessels, unless use of conventional fuel oils are financially penalized.

Whilst it is difficult to provide precise predictions on future value movements, there are several general predictions that can be made in terms of the S&P market:

1. Increased demand for dual fuel capable vessels.

These vessels have more flexibility to react to future volatility in conventional and alternative fuel prices. Under the new IMO GHG regulation, owners of these vessels can also use their “excess compliance” (gained from using low carbon fuels) to offset the deficit from use of cheaper fuels , which should further incentivize ownership of these vessels and offset their higher CAPEX and OPEX.

2. Older vessels built before EEDI criteria potentially considered for early scrapping.

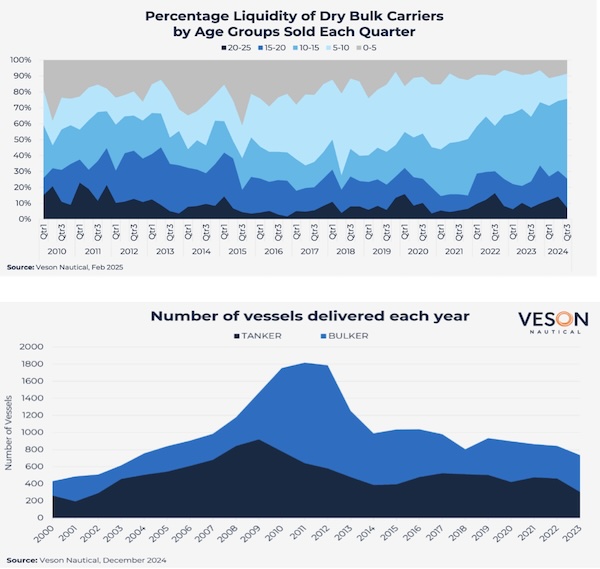

Before EEDI was enforced in 2013, there were no efficiency criteria for newbuild vessels. Combined with the shipbuilding boom in late /early 2010s, this has meant there are a large portion of low quality, poor efficiency vessels in the fleet that are aging to the 15YO+ age range.

Now that there are financial penalties set to be enforced for excessive emissions, these vessels are set to become increasingly uneconomical, unless expensive retrofits are carried out.

The use of biofuels is also an option for compliance with the new IMO GHG scheme, however the higher cost of this fuel will be compounded by the lower fuel efficiency of older vessels.

3. Increased demand for newbuild vessels and increased S&P demand (and higher premiums) for modern efficient vessels.

The latest generation of vessels must be built to EEDI phase 3 criteria (from build year 2025 a 30% improvement in efficiency compared to 2009 baseline). This has led to considerable improvements in fuel efficiency performance (and is also part of the reason for climbing newbuild costs in recent years).

In the strong bulker S&P market of 2024, we saw a large increase in 10-15YO vessels being sold which suggests that owners were keen to offload older vessels to fund fleet renewal for modern high efficiency vessels.

As mentioned above, decreasing economic viability of older generation vessels will also likely spur on newbuild demand and S&P demand for young vessels.

As the IMO’s new fuel intensity target approaches implementation, its effects are already beginning to shape decision-making across the maritime sector. From accelerating the shift toward dual-fuel and high-efficiency vessels to prompting early scrapping of older tonnage, the regulation stands to significantly influence both operational and investment strategies. While uncertainties remain around pricing and compliance mechanisms, one thing is clear: aligning fleet composition with future emissions targets will be critical to staying competitive in a decarbonizing market.

Source: By Oliver Kirkham, Senior Valuation Analyst, Veson Nautical