BNSF’s first-quarter 2022 net profit rose 10% despite a 3% decline in volumes, the company reported Monday.

First-quarter 2022 net income was $1.37 billion, compared with $1.25 billion in the first quarter of 2021. BNSF is a privately held company whose parent is Berkshire Hathaway (NYSE: BRK.B).

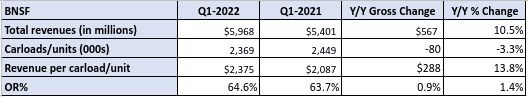

Total revenues grew 10% to nearly $5.97 billion amid a 14% gain in average revenue per unit, which in turn was supported by higher fuel surcharge revenue.

Volumes slipped 3%, with gains in industrial products and coal volumes unable to offset declines in consumer and agricultural products.

Consumer products volumes, which includes BNSF’s intermodal traffic, slipped 8% amid lower international intermodal volumes and lower automotive shipments. However, domestic intermodal volumes rose in the quarter, BNSF said, while overall revenue rose 10% to $2.08 billion.

Agricultural products volumes slipped 4% on lower grain exports, although ethanol volumes overall were higher year-over-year. Revenue increased 4% to nearly $1.36 billion.

Industrial products volumes grew 1% while revenues increased to nearly $1.3 billion.

Coal volumes climbed 14% on increased electricity generation, higher natural gas prices and improved export demand, BNSF said. Coal revenues jumped 30% to $889 millon.

Meanwhile, operating expenses grew 12% to $3.9 billion amid higher fuel expenses.

Operating income rose 8% to $2 billion, while operating ratio (OR) was 64.6%, compared with 63.7% a year ago. Investors sometimes use OR to gauge the financial health of a company, with a lower OR implying improved health.

The unveiling of BNSF’s first-quarter results comes as Berkshire Hathaway held its annual shareholders meeting in Omaha, Nebraska, this past weekend.