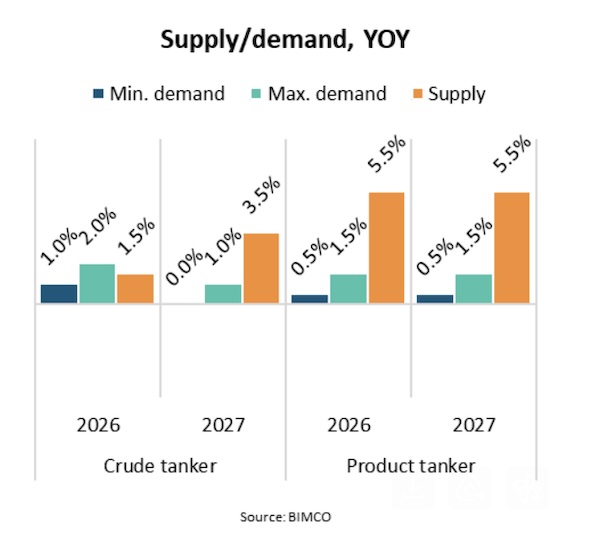

We forecast crude tanker demand growth of 1-2% in 2026 and 0-1% in 2027. Supply growth is forecast at 1.5% and 3.5% in 2026 and 2027 respectively.

In the product tanker segment, supply growth is forecast at 5.5% for both 2026 and 2027 and demand growth is estimated at 0.5-1.5%

“According to the International Energy Agency (IEA), global oil oversupply could average 4.1 million barrels per day in 2026. We expect that inventory building will continue in 2026 and support crude tanker demand, but we foresee that may end in 2027,” says Rasmussen.

The IEA predicts that oil demand and refinery throughput will continue to grow in the emerging and developing economies of Asia and Africa. Developing economies are meantime expected to see lower refinery throughput and only very minor demand growth.

The Houthis have confirmed an end to their attacks on ships in the Red Sea as the Gaza ceasefire still holds. So far, the announcement has not resulted in a significant increase in tankers transiting the Red Sea and Suez Canal. Should routings fully normalise, we forecast a 2-3% reduction in demand compared to our forecast.

The latest US, UK and EU sanctions and US pressure on buyers could reduce Russian oil exports. In recent weeks, we have noticed a 20% reduction in crude tanker loadings while product tankers appear unimpacted. In addition, Russian oil in floating storage has tripled, possibly indicating a challenge in finding buyers.

As Russia has historically been successful at evading sanctions, we have not yet included the effects of lower Russian exports in our forecast. Any reduction in the exports is likely to reduce demand for sanctioned tankers while increasing demand for mainstream tankers as importers turn to unsanctioned markets to replace Russian oil.

“Despite an expected weakening of market conditions in 2027, crude tankers are overall forecast to fare better than product tankers during 2026 and 2027. Mainstream crude tankers could see further support if Russian exports suffer due to sanctions. On the other hand, both sectors could see slower demand if Red Sea routings normalise,” says Rasmussen.

Baltic Exchange Dirty Tanker Index was down 21% year-on-year in the first half of the year but is so far up 13% in the second half of the year. The Baltic Exchange Clean Tanker Index has been down 32% and 4% year-on-year in the first and second half of the year respectively.

In 2026, we expect crude tanker spot rates in line with 2025 averages but weakening product tanker rates. The expectation is aligned with our /demand forecast but could, as mentioned, be impacted by developments in Russian exports and Red Sea and Suez Canal routings. As supply growth is forecast to outpace demand growth, we forecast weakening spot rates for both sectors in 2027. We do not consider it likely that demand can grow much faster than forecast but higher recycling activity than we have forecast could help dampen the blow.

Time charter rates have so far in 2025 mirrored the development between the two halves of the year. However, time charter rates have suffered more than spot freight rates and are down on last year’s level in both the first and second half of the year.

Recently, crude tanker time charter rates have, however, improved to levels above those at the same time of last year. Prices for five-year-old ships have been down compared to 2024 levels throughout 2025.

Like spot freight rates and time charter rates, product tanker asset values have suffered more than crude tanker values. We expect time charter rates and secondhand ship prices to mirror the future development in spot freight rates. However, as second-hand ships remain expensive compared to contracting a new ship, the development in prices may be weaker than spot rate developments. Newbuilding prices have seen a small gradual decrease throughout 2025 even though the global order book has remained mostly stable. Year-to-date 2025, global contracting has been half of the 2024 total. If the pattern continues, the global order book will eventually decrease in size, and more newbuilding price decreases could be seen.

Source: BIMCO