Altera Infrastructure, formerly the Teekay Offshore division of Teekay Group, says operations will continue under the financial restructure

Altera Infrastructure said it has begun a financial restructure that will equitise more than US$750M in debt. The company has also secured US$50M in funds to support operations during the restructure.

Altera said its restructuring support deal has been agreed with 71% of its funded debt obligations, including controlling financial interest Brookfield Asset Management’s private equity company Brookfield Business Parters, to which Teekay Group sold its interest in Teekay Offshore in 2019. Brookfield has committed the US$50M ’debtor in possession financing’ to fund Altera’s operational costs.

“The Restructuring Support Agreement contemplates, among other things, addressing more than US$1Bn of secured and unsecured holding company debt, US$400M of preferred equity, and US$550M of secured asset-level bank debt (including unsecured guarantees of such debt issued by Altera Infrastructure LP), a comprehensive reprofiling of Altera’s bank loan facilities to better align cash flow with debt service obligations, and the continued support of Altera’s equity sponsor, Brookfield,” a statement from the company said.

Altera said its filings would allow the company to continue to operate its business without interruption while honouring obligations to employees, customers and suppliers to previously agreed schedules and terms.

The UK-headquartered company filed its petitions and Chapter 11 notice in the United States Bankruptcy Court for the Southern District of Texas.

Altera Infrastructure Group chief executive Ingvild Sæther said, “We enter into this phase of our balance-sheet restructuring with the support of the majority of Altera’s secured lenders and equity sponsor Brookfield. We are confident this Chapter 11 process will result in a comprehensive recapitalisation transaction that will not only stabilise liquidity, but also deleverage our balance sheet and better position Altera for future growth.

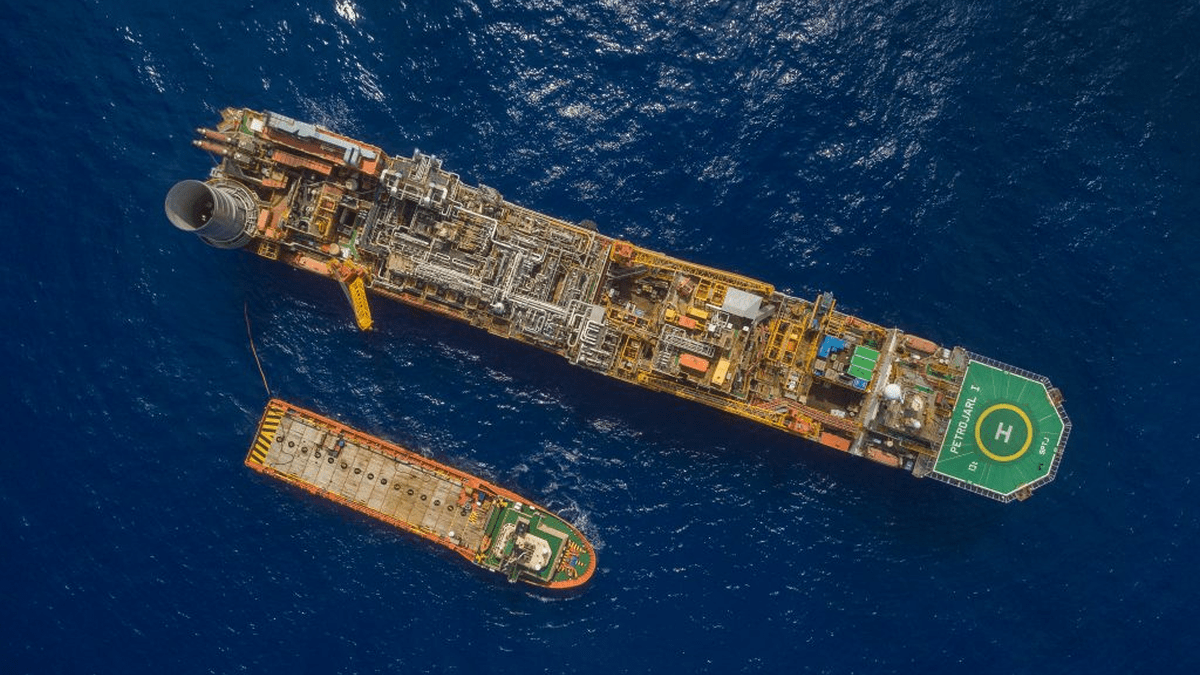

Altera’s fleet of 41 vessels include floating production, storage and offloading units, shuttle tankers, floating storage and offtake units, long-distance towing and offshore installation vessels and a unit for maintenance and safety. The majority of Altera’s fleet is employed on medium-term, stable contracts, the company said.