Fitch Ratings’ mid-2022 corporate sector outlook review revealed that the Asia-Pacific (APAC) region saw the largest number of sector outlook revisions globally, though the overall outlook remains neutral. The revisions were largely caused by global commodity price movements associated with the Russia-Ukraine war and the economic fallout from lockdowns under China’s ‘dynamic zero’ Covid-19 policy.

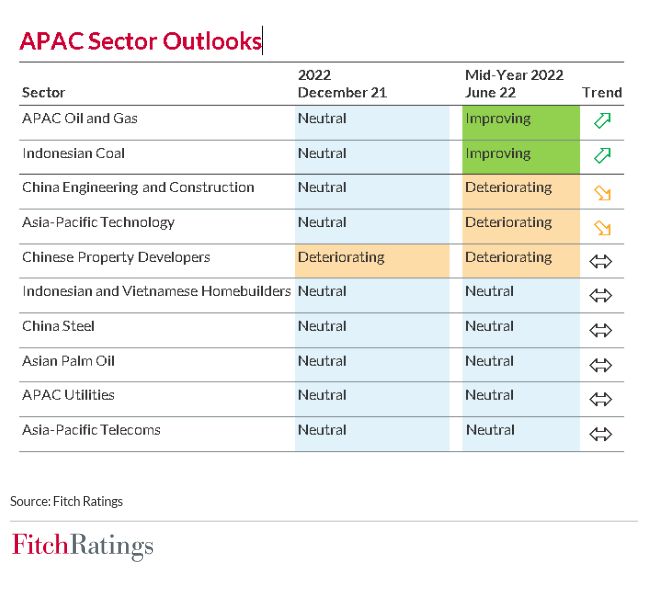

We revised the outlook on two sectors – APAC oil and gas and Indonesian coal mining – to improving, from neutral, and the outlook on two further sectors – China engineering and construction (E&C) and APAC technology – to deteriorating, from neutral. The outlook on Chinese property developers remained unchanged, at deteriorating, following steep 1Q22 falls in new housing sales. We also expect capital market access to remain limited this year for most Chinese developers. The outlook on APAC’s five remaining sectors is neutral.

Our outlook revision for APAC oil and gas and Indonesian coal mining was based on our higher assumptions for oil, gas and coal prices following the invasion of Ukraine. Higher prices will boost cash flow for upstream and integrated oil and gas producers, part of which we expect to be used to pay down debt and improve credit metrics. Europe’s sanctions on Russian coal exports will become effective in August 2022, which could further increase demand for Indonesian coal.

Our outlook revision for APAC oil and gas and Indonesian coal mining was based on our higher assumptions for oil, gas and coal prices following the invasion of Ukraine. Higher prices will boost cash flow for upstream and integrated oil and gas producers, part of which we expect to be used to pay down debt and improve credit metrics. Europe’s sanctions on Russian coal exports will become effective in August 2022, which could further increase demand for Indonesian coal.

Chinese E&C activity was subdued in 1H22, due to the operational challenges caused by the country’s Covid-19 control measures. However, we expect construction activity to pick-up in 2H22, as the front-loading of local government special-bond issuance this year should lift infrastructure spending. That said, we believe China’s E&C sector is vulnerable to new Covid-19 outbreaks. If pandemic-related restrictions constrain construction in the next few months, it would be challenging for the sector to increase activity going into the winter months. The resulting challenges in collecting working capital could lead to liquidity pressure at Chinese E&C firms.

Within the APAC technology sector, China’s slower consumption spending, stringent Covid-19 lockdowns and the aftermath of last year’s regulatory tightening will dampen the short-term profitability and cash generation of its internet majors. Stringent pandemic lockdowns and the aftermath of last year’s regulatory tightening are also having adverse effects. Overall demand for APAC consumer hardware is weakening, exacerbated by the war in Ukraine and China’s lockdowns, while rising input costs will pressure profitability. We expect companies with limited ability to pass through incremental costs to customers to suffer the most in the heighted inflationary environment. Meanwhile, persistent chip shortages and various logistical issues will add to supply-side disruption. However, we expect robust demand for Indian IT services, supported by a strong digital transformation pipeline, and wage inflation in line with our previous expectations at end-2021. This should see revenue increase by a double-digit percentage.

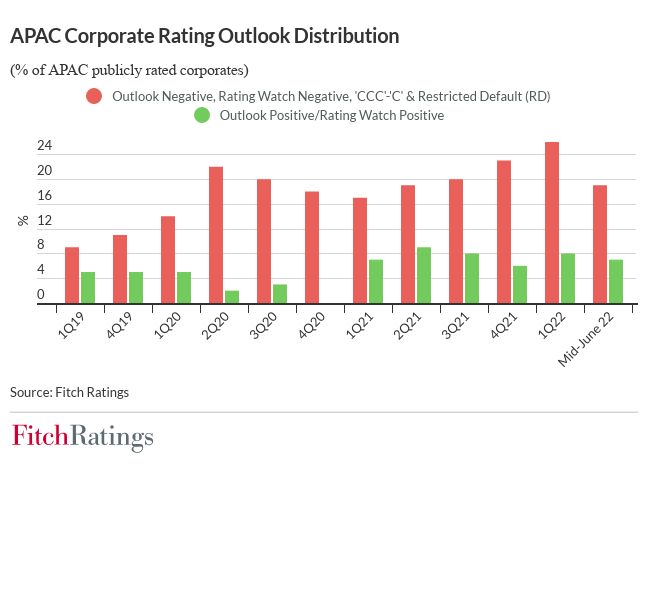

The proportion of APAC corporates ratings at ‘CCC+’ or below, on Negative Outlook or on Rating Watch Negative dropped to 19% as of mid-June 2022, from 26% in 1Q22, after we revised the Outlook to Stable, from Negative, on the ratings of 13 Indian corporates. This followed our June 2022 Outlook revision on India’s sovereign rating (/Stable).