According to VesselsValue trade figures, Russia has already begun to shift its crude exports towards Asia as we identify changes in trade flow patterns.

Of the top 10 destinations for wet exports from Russia since the start of the conflict, the Netherlands has remained in the top spot. However, volumes exported have fallen considerably from 407 journeys in the period between March and October in 2021 to 376 for the same period last year. On the other hand, cargoes to China, ranking as the second most popular destination for Russian wet exports, have increased from 2021 by 52% to 344 journeys. Similarly, journeys to Türkiye, who rank third, have increased by 30% to 283. India, who was previously unranked in 2021, is now in fourth place with a total of 238 journeys.

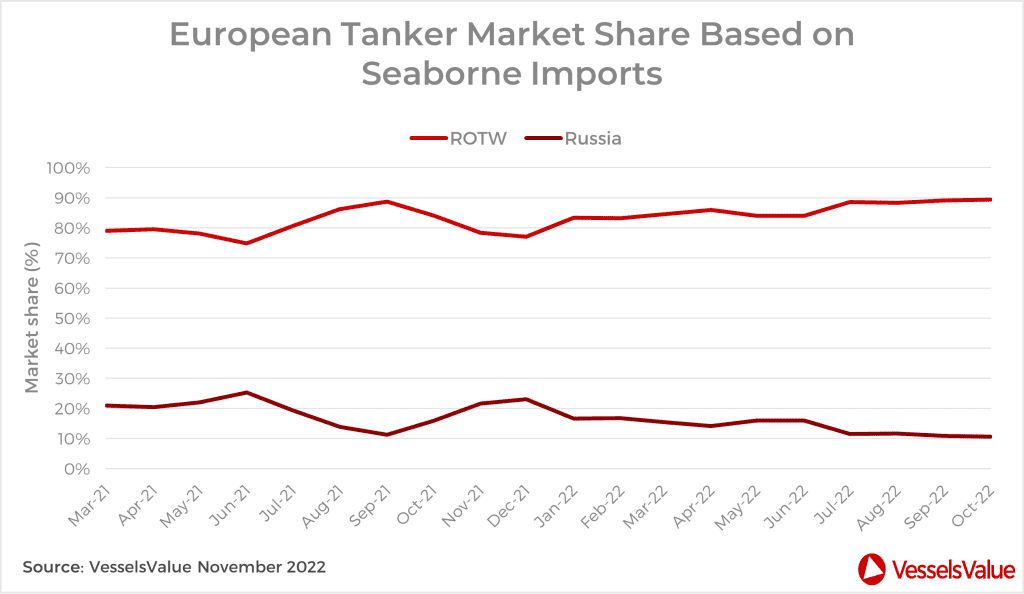

Tankers

In terms of the European Tanker market share based on imports, in March 2021 over a quarter of cargoes were from Russia at 28%, or 17 mil mt, with the remaining 72% sourced from the rest of the world. However, by October 2022, European destined cargoes have shifted away from Russian imports. Shares had fallen by 33% to 11 mil mt, or 13% of the market share, with 87% coming from ROTW sources.

Figure 3: Percentage of the European Tanker market share by imports, based on estimates for dirty and clean cargoes.

Figure 3: Percentage of the European Tanker market share by imports, based on estimates for dirty and clean cargoes.

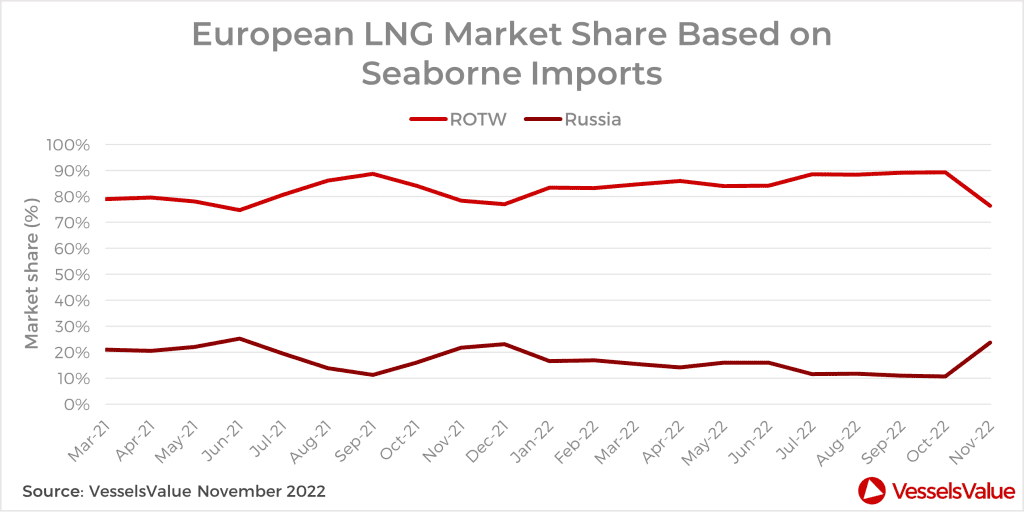

LNGs

For the European LNG market, based on seaborne trade only (in 2021 c.90% of Russian gas came through pipelines), 21% of imports were coming from Russia, with 79% from the ROTW in March 2021. By October 2022, European imports had dropped to 11%, with imports from the ROTW up to 89% based.

Figure 4: Percentage of the European LNG market share based on imports.

Figure 4: Percentage of the European LNG market share based on imports.

Outlook

The impending sanctions have caused a spike in demand for vintage Tanker tonnage, consequently showing an increase in values for this sector. Tankers that continue to trade in the ‘dark fleet’ will tighten vessel supply, which could continue to support this sector in terms of earnings and values. In addition, changes in trade patterns for Russian crude can be seen as trading steers away from Europe. China and India are emerging as key destinations for Russian wet exports, as imports continue to increase from the two countries in Asia. As a result, these imports will continue to further support the Tanker sector.