Preliminary results for July show ArcBest’s consolidated revenue is 36% higher y/y, with all of its divisions seeing increases.

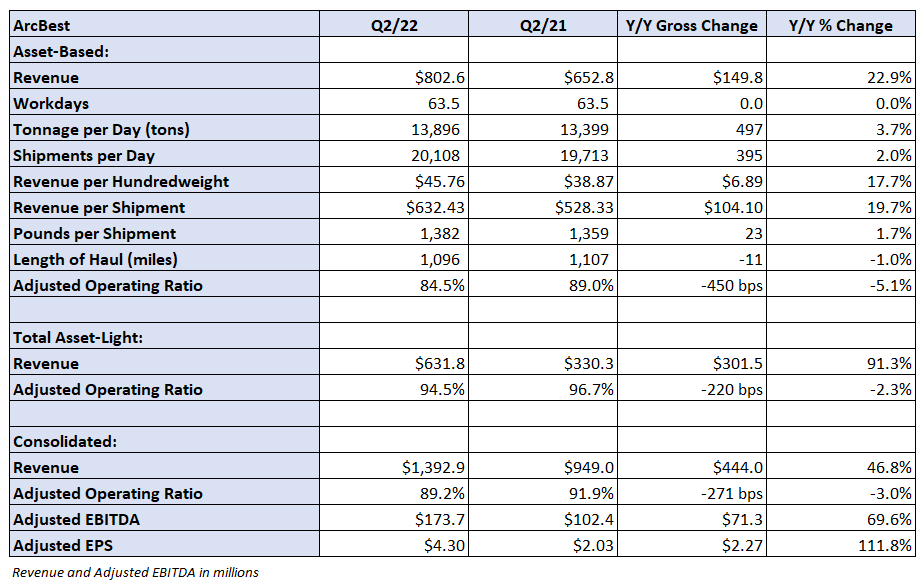

Table: ArcBest’s key performance indicators

Table: ArcBest’s key performance indicators

Revenue in the asset-based unit increased 23% y/y to $803 million in the quarter. Tonnage was 3.7% higher, and revenue per hundredweight, or yield, increased 17.7%. The yield metric benefited from higher fuel surcharges. Excluding fuel, LTL yield was up by a “percentage in the double digits,” a separate filing showed. Contract renewals in the division increased 8% y/y in the quarter, compared to a 9% y/y growth rate in the 2022 first quarter.

The improved yield metrics led to 450 basis points in OR improvement (84.5% adjusted OR). The salaries, wages and benefits line as a percentage of revenue in the asset-based segment was the biggest mover, down 540 bps y/y.

So far in July, asset-based revenue per day is 18% higher y/y. Tonnage is up 6% and yield inclusive of fuel surcharges is 11% higher.

Asset-light revenue, which includes brokerage, increased 91% y/y to $632 million. The division saw 220 bps of y/y margin improvement, posting a 94.5% OR. Daily revenue is 76% higher y/y in July.

ArcBest reeled in its 2022 capex budget. The company now plans to incur net capital expenditures between $240 million and $250 million, $35 million lower at the midpoint of the range. The spending will include $115 million in equipment purchases and $45 million to $50 million in real estate outlays.

ArcBest will host a call with analysts at 9:30 a.m. Friday to discuss results.