Vessel capacity on the Asia–North America West Coast (NAWC) trade has dropped back to pre-tariff-pause levels as demand weakens, Sea-Intelligence reports.

Issue 724 of Sea-Intelligence Sunday Spotlight shows a clear reversal in vessel capacity deployment on the Asia–NAWC trade lane.

The brief surge in supply has ended, with levels now returning to pre-tariff-pause conditions.

After the pause in the China – US trade war, US importers rushed to move cargo held back during the 145 per cent tariff period.

Analysts also expected importers to front-load cargo ahead of the Q3 peak season, in case tariffs resumed. In response, shipping lines planned large capacity increases to meet this temporary demand.

However, continued regulatory uncertainty led importers to slow down. The latest data from Sea-Intelligence’s Trade Capacity Outlook (TCO) shows shipping lines now pulling back on those initial plans.

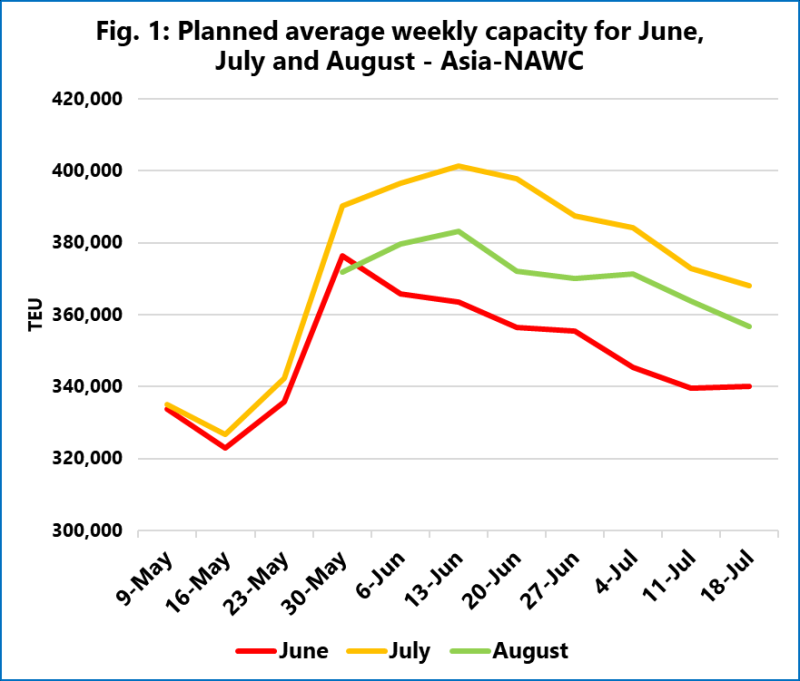

In late May, average weekly capacity for June had jumped by 43,000 TEU in just three weeks. But by the end of June, actual deployment returned to levels planned before the pause was announced.

The same pattern has emerged for July. Lines initially planned a sharp increase, but recent weeks saw several blank sailings. August plans, once optimistic, are also being cut in the latest data.

The data highlights a shift in strategy. Shipping lines first responded to an expected demand spike. That demand never fully materialised. Lines are now scaling back planned deployments to reflect market conditions. On the Asia–NAWC trade lane, capacity is effectively back to square one.