Asia’s diesel markets were brimming with spot refiner sale activities for November as sellers cashed in on front-month market premiums, with timespreads extending gains and spot premiums.

Spot selling interest from a handful of refiners for November resurfaced despite nearing the month-end, with China-origin barrels also up for grabs.

South Korea’s GS Caltex offered both 10ppm and 500ppm sulphur gasoil cargoes via a tender that closes on Friday, while a key Japanese refiner sold at least two first-half November loading cargoes at premiums of up to 60-70 cents per barrel, traders say.

Likewise for jet fuel markets, at least one of China’s main exporters offered first-half November cargoes via a spot tender that closes today.

The 10ppm sulphur gasoil refining margins (GO10SGCKMc1) soared to slightly more than three-month highs of $22.2 a barrel, reflecting the sentiment push from fresh U.S. sanctions on Russia.

Jet fuel margins went back to slightly more than 1 1/2-year highs of slightly above $22 a barrel, echoing the diesel movements.

Cash differentials (GO10-SIN-DIF) climbed further to $2.22 a barrel, its highest.

Regrade (JETREG10SGMc1) fell back to discounts of 1 cent per barrel, reflecting the firmer gasoil market performance.

SINGAPORE CASH DEALS

– One gasoil deal, no jet fuel deal

INVENTORIES

– U.S. crude oil, gasoline and distillate inventories fell last week as refining activity and demand strengthened, the Energy Information Administration said on Wednesday.

– Singapore turned a net importer of jet fuel for the week ended October 22, while diesel net exports fell by 13% week on week, official government data showed on Thursday.

REFINERY NEWS

– A hydrocracker remained offline at Chevron’s CVX.N 285,000-barrel-per-day El Segundo refinery in Southern California three weeks after a large fire at a jet-fuel-producing unit earlier this month, sources said on Wednesday.

NEWS

– Indian refiners are poised to sharply curtail imports of Russian oil to comply with new U.S. sanctions on two top Russian producers, industry sources said on Thursday, potentially removing a major hurdle to a trade deal with the United States.

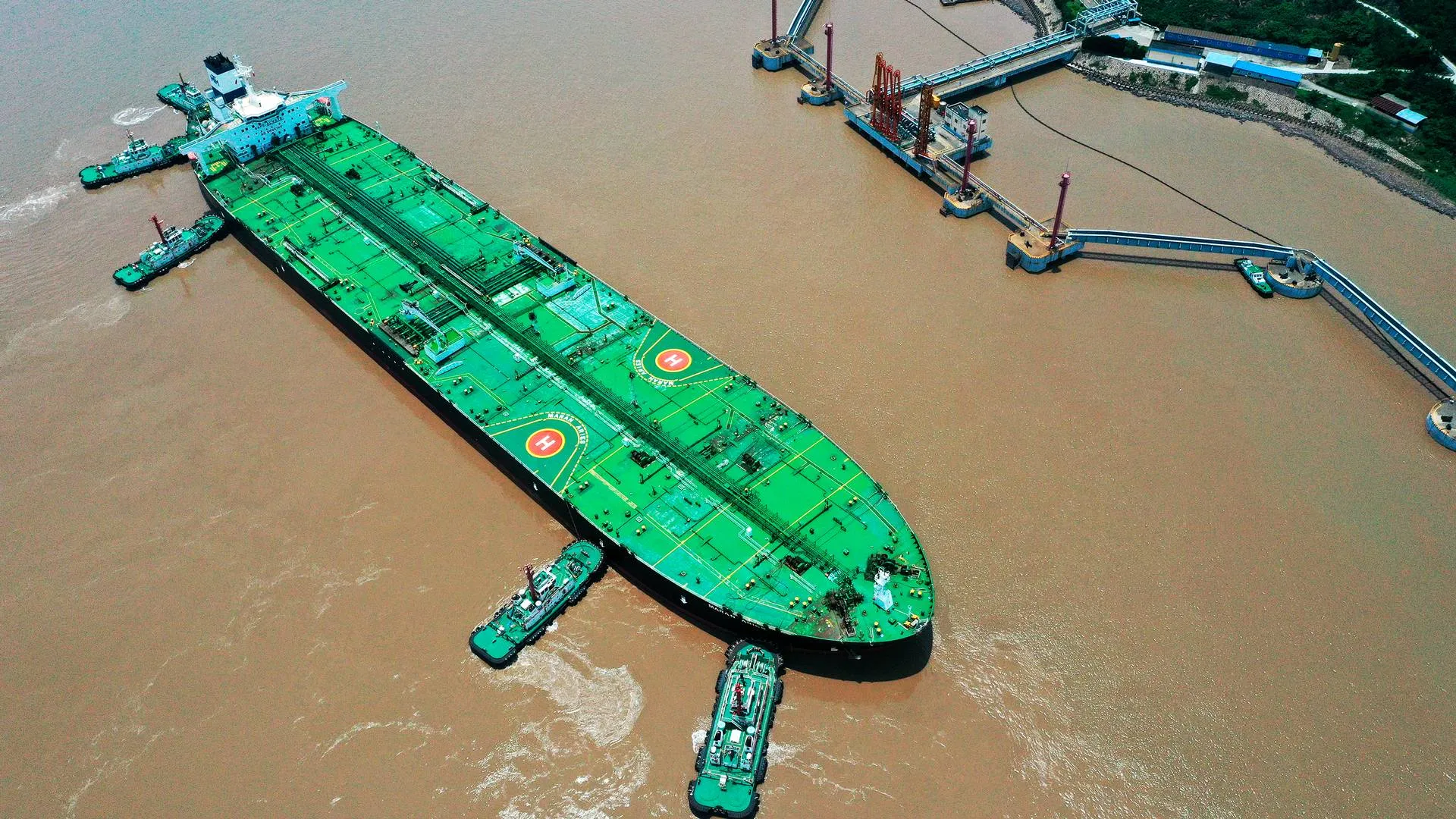

– Several suppliers have cancelled sales of Middle Eastern and Canadian oil to China’s Yulong Petrochemical after the UK imposed sanctions on the refiner, which is likely to push it to buy more Russian crude, multiple sources familiar with the deals said.

– U.S. President Donald Trump hit Russia’s two biggest oil companies with sanctions in his latest sharp policy shift on Moscow’s war in Ukraine, prompting global oil prices to rise by 3% on Thursday and India to consider cutting Russian imports.

– The European Union has added two Chinese refiners with a combined capacity of 600,000 barrels per day and Chinaoil Hong Kong, a trading arm of PetroChina 601857.SS, to its Russia sanctions list, the EU’s Official Journal showed on Thursday.

Source: Reuters