Industry experts warn that unless corrective steps are taken quickly, these measures could erode export competitiveness, reduce employment, and fuel inflation.

Starting August 1, a 35 per cent tariff on Bangladeshi exports to the United States have taken effect as part of a reciprocal trade action by Washington. The US is one of Bangladesh’s largest export destinations, with ready-made garments (RMG) alone earning $7.4 billion in 2024. Already grappling with weak global demand, the sector is seeing early signs of order cancellations, raising fears of a significant downturn in trade flows in the coming months.

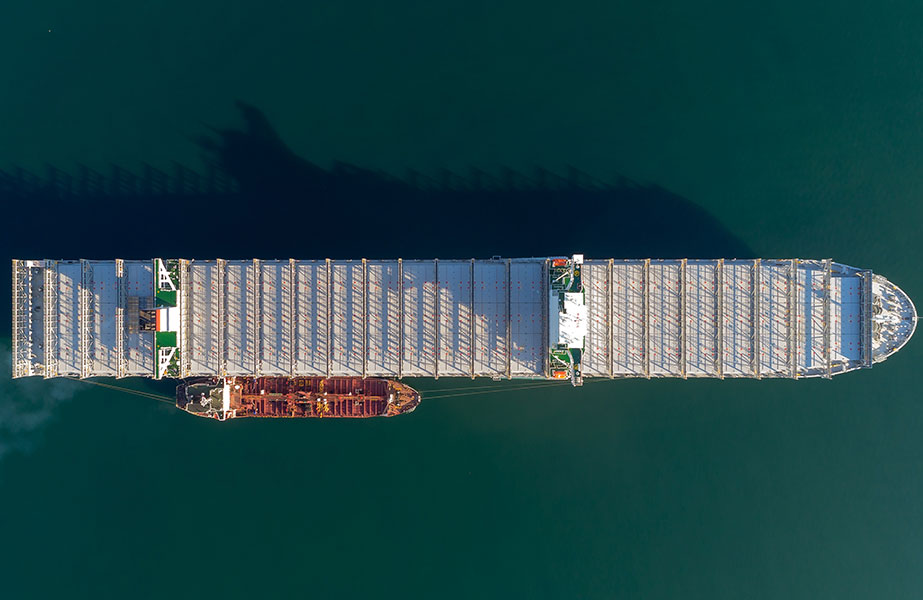

At home, the Chattogram Port Authority (CPA) is preparing to implement its first tariff revision in nearly four decades. The new structure, covering 56 service categories, features an average 40 per cent hike, with some charges rising as much as 440 per cent.

While the Ministry of Finance has issued its approval, and CPA argues that fees remain below those of comparable ports, exporters contend that the timing is ill-suited to the current fragile trade climate.

The tariff adjustment is expected to increase CPA’s annual revenue by Tk 1,500 crore, compared to Tk 3,912 crore in FY24. Adding further strain, private ICDs–which handle most export containers–will raise charges from September 1. Export container handling fees will rise by 36–44 per cent, and charges for empty containers will climb nearly 32 per cent, though import fees remain unchanged. Industry estimates suggest this could add another Tk 300 crore to annual logistics costs.

Taken together, the US tariff, port service hikes, and ICD fee increases threaten to undermine Bangladesh’s export-driven economy. The RMG sector, a cornerstone of national income and employment, is particularly vulnerable, with rising costs likely to squeeze margins and deter investment.

Amid concerns about job losses and inflation, stakeholders are urging government action–through dialogue with US trade authorities, a review of domestic tariff hikes, and efficiency improvements at ports and ICDs. The full impact is expected to unfold in the months ahead, with lasting implications for Bangladesh’s place in global trade.