BIMCO published its Q4 Shipping Market Overview & Outlook, noting that capacity supply is expected to reduce by 10% due to sailing speed and schedule changes related to EEXI and CII regulations.

Highlights

Recent developments

As Niels Rasmussen, BIMCO’s Chief Shipping Analyst explains, the container market has remained on the path towards “normalisation”. The time charter rates and second-hand prices for ships have followed the freight rates downwards.

Compared to two and a half months ago, average time charter rates and average second-hand prices are down 64% and 33% respectively. In contrast, average newbuilding prices are only 2% lower as the market depends on costs and /demand developments for shipyards rather than on the freight market

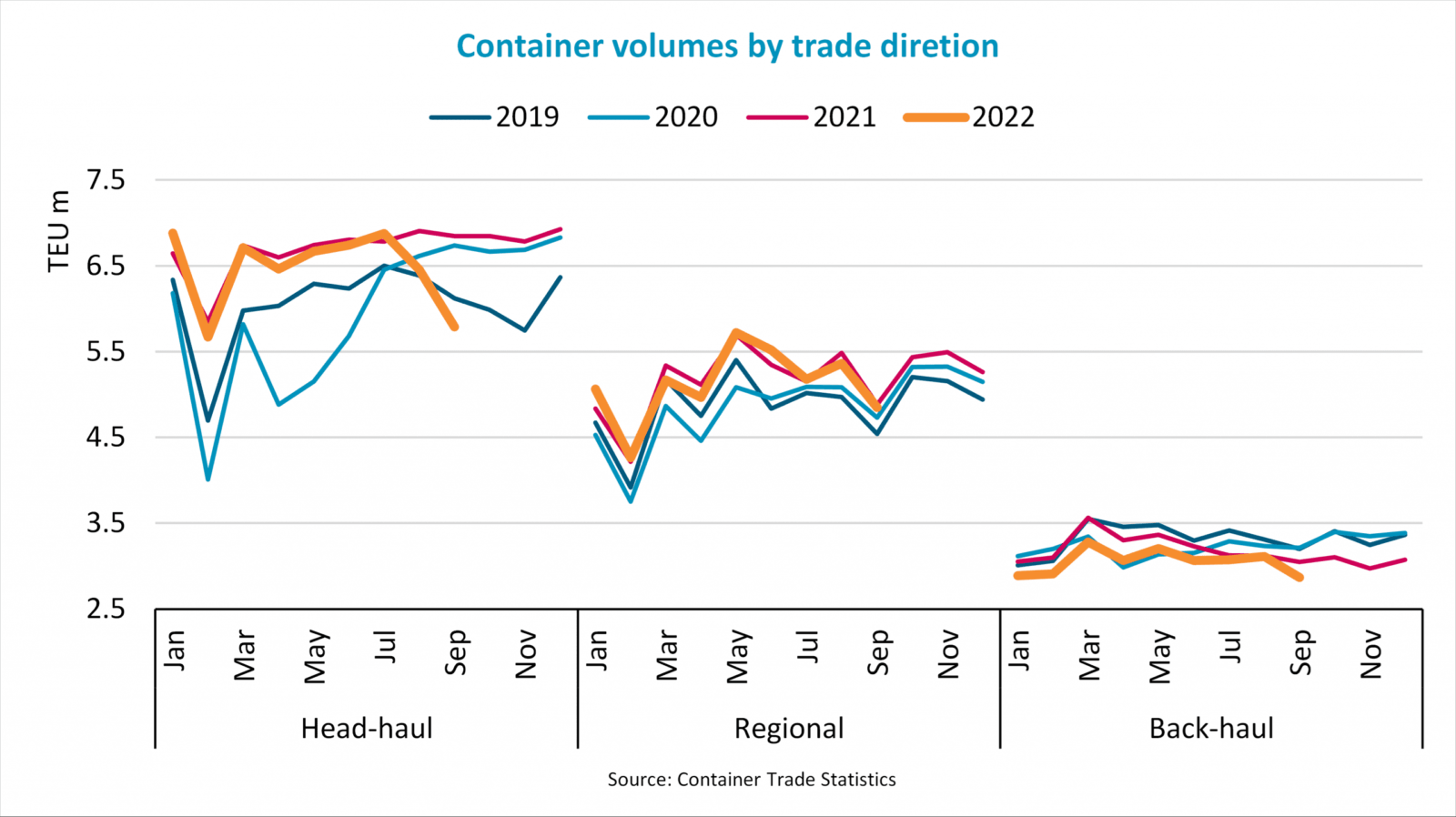

The rates and prices have been driven down by lower demand and increased supply due to reduced congestion. In September, head-haul volumes were down 15.5% on last year, while regional and back-haul trade volumes fell by 0.7% and 5.9% respectively.

Transpacific trade volumes have been the key driver of the unprecedentedly strong market during the last two years but equally led the losses in September. Its volumes dropped by 24.5% y/y in September and were 3.8% lower than in September 2019.

Losses also mounted in the Far East to Europe trade, with volumes in September down 20.3% y/y and 18.8% lower than in 2019. All in all, thirty-three trade lanes out of forty-nine saw lower volumes in September 2022 than last year, while twenty-five saw volumes lower than in September 2019.

At the same time, port congestion has eased, and the Kiel Institute for the World Economy estimates that 10% of shipped cargo is currently caught in congestion vs. nearly 14% at the height of congestion problems and 7-8% pre-COVID.

Supply

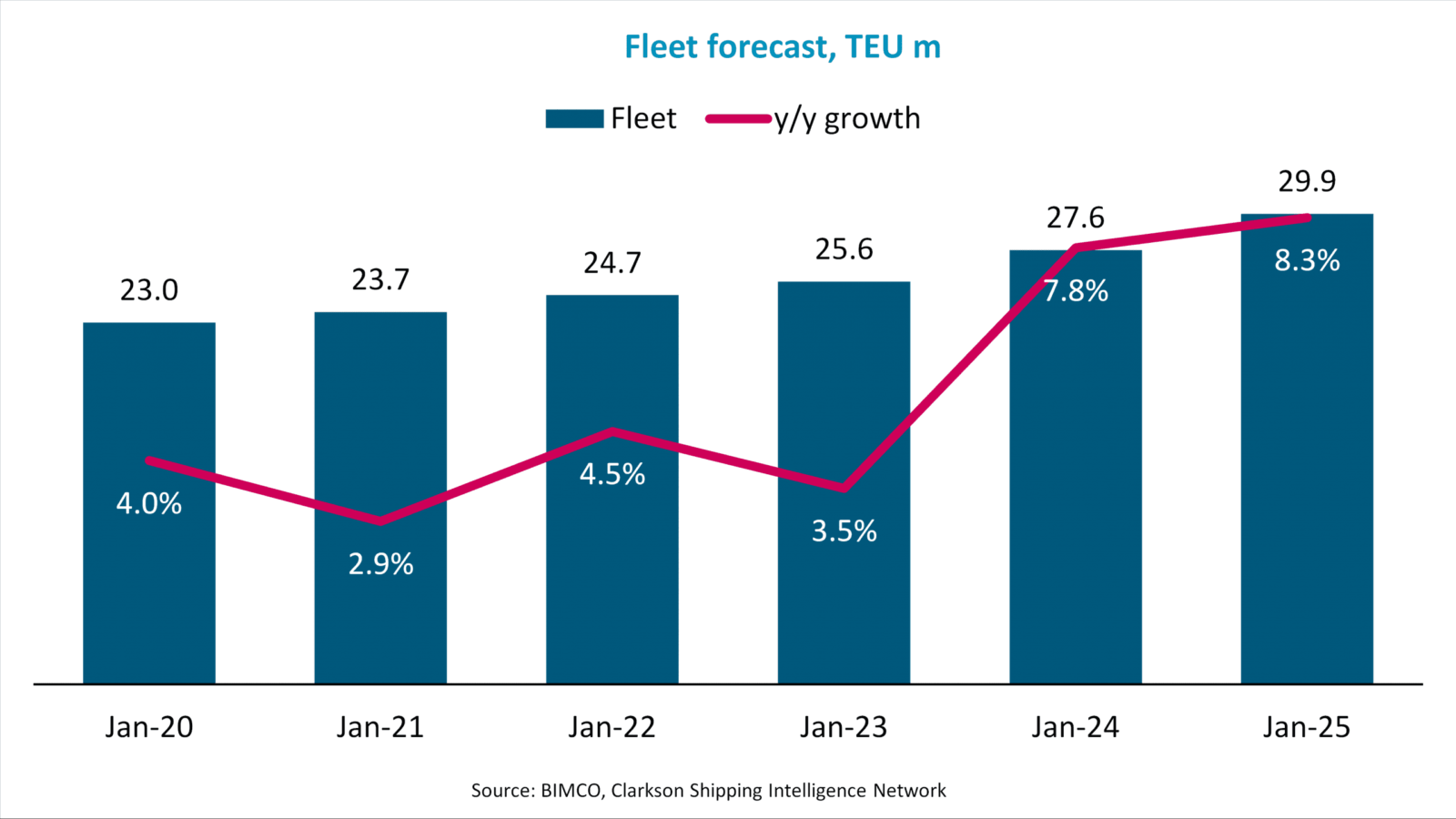

According to Mr. Rasmussen, contracting has continued at a significantly higher pace than the average for the past five years, and the orderbook is now 29% the size of the trading fleet.

So far, nearly 2.5 million TEU have already been contracted in 2022, and while we estimate that full year contracting will total 2.9 million TEU, we believe it will slow down significantly during 2023 and 2024

What is more, demolition has been almost non-existent during 2022. “Even though the /demand balance is worsening, we believe it will take some time for demolition to gather pace and have therefore estimated figures of 0.35 million TEU for 2023 and 0.48 million TEU for 2024,” BIMCO’s overview explains.

The key driver of ship supply during 2023 and 2024 will therefore be the delivery of the ships contracted during the last couple of years. Deliveries are estimated to be 2.4 million TEU in 2023, increasing to 2.8 million TEU In 2024.

What is more, BIMCO’s total fleet growth estimate stands at 3.5% for 2022, 7.8% for 2023, and 8.3% for 2024.

Reduction in congestion levels and the implementation of EEXI and CII regulations will meantime have a major impact on fleet efficiency and capacity supply in 2023.

Considering that head-haul volumes are significantly lower at present, we expect the remaining excess congestion to clear by early 2023 at the latest, and on average increase capacity supply in 2023 by around 10% vs. 2022. EEXI and CII regulations will instead reduce capacity supply

BIMCO concluded.

EXPLORE MORE at bimco’s Shipping Market Overview