So far this year, The Baltic Exchange Dirty Tanker Index (BDTI) has on average been 86% higher than during 2021 and The Baltic Exchange Clean Tanker Index (BCTI) has on average been 113% higher.

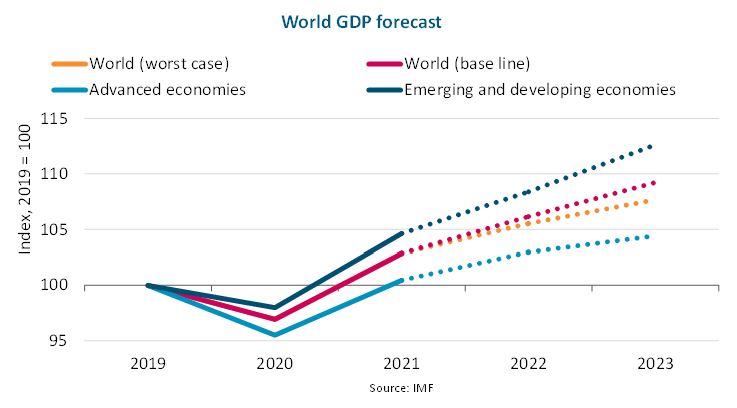

– The IMF has lowered its global economic growth forecast to 3.2% for 2022 and 2.9% for 2023, and highlights that the risk of a global recession has increased.

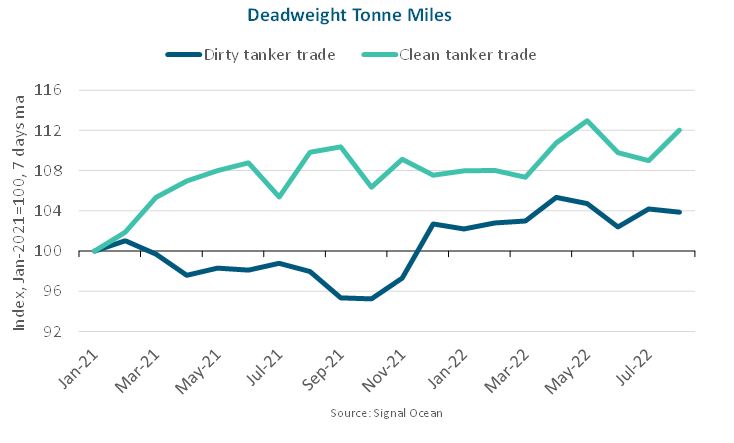

– Year-to-date dirty tanker tonne miles have on average been 5.1% higher than the 2021 full-year average, whereas clean tanker tonne miles are up 2.9%.

– We estimate demand growth to approach 5% in 2022 and 2023 for both markets. Solid production and consumption increase drive 2022, while increased sailing distances due to the EU’s ban on Russian oil and oil products will provide most support in 2023.

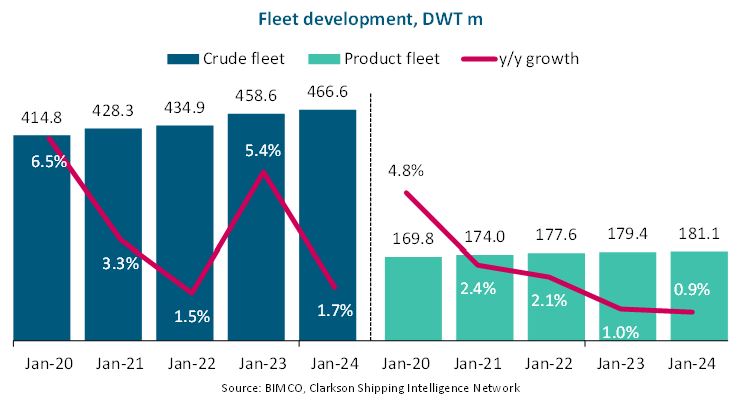

– Contracting has remained low, and the order book has reduced to 4.7% and 5.4% of the crude and product tanker fleet sizes respectively.

– The crude fleet is expected to grow by 5.4% in 2022 and by 1.7% in 2023, whereas product tanker fleet growth is forecast at only 1.0% in 2022 and 0.9% in 2023. Capacity supply in both segments is expected to grow slower than the fleet during 2023 and may even drop by 2-3% compared to 2022 due to reductions in sailing speed arising from EEXI, CII, and ETS implementation.

– Overall, we expect further and solid improvements for both tanker markets in 2023 although headwinds for the global economy remain a risk.

Recent developments

Both the dirty and clean tanker markets have benefitted from a recovery in oil production and consumption as well revised trade patterns following Russia’s invasion of Ukraine. Average deadweight tonne miles are up by 5.1% and 2.9% year-to-date versus the 2021 average for the dirty and clean tanker trade respectively, whereas deadweight tonne days are up by 3.2% and 4.5%. The most noteworthy developments have been disappointing Chinese crude demand, whereas UK/Continent product demand has been a welcome surprise. Lower economic activity in China following COVID lockdowns and refineries struggling with lower export quotas and domestic price caps have led average year-to-date tonne miles to reduce by 8.1% compared to the 2021 average. In the UK/Continent area, Russia’s invasion of Ukraine has led the EU and UK to replace Russian products and seek imports from further afield. This has led average year-to-date tonne miles to increase by 17.2% over the 2021 average.

The Baltic Exchange Dirty Tanker Index (BDTI) has on average been 86% higher year-to-date than during 2021, increasing by 58% since the war began, while The Baltic Exchange Clean Tanker Index (BCTI) has performed better still; year-to-date, it has been on average 113% higher than during 2021, increasing by74% since the beginning of the war. Time charter rates have followed the freight index upwards although crude tankers are lagging product tankers. Since the beginning of the year, average one-year time charter rates are up 35.0% for crude tankers and 83.9% for product tankers.

Second-hand asset prices have, as expected, tracked the freight and time charter rates upwards and average five-year-old product tanker prices have increased just beyond 80% of the newbuilding prices to 81.7%, with MRs and LR2s being the most expensive relative to newbuilding prices. In the crude tanker sector, prices for five-year-old ships have on average increased by 18.8% since the beginning of the year and are now on average valued at 75.4% of newbuilding prices. Aframaxes are the relatively most expensive ships as prices for five-year-old ships are 86.2% of newbuilding prices.

Newbuilding prices have continued to rise, but only by 4.0% and 4.7% since the beginning of the year for crude and product tankers respectively, compared with an average 25% increase during 2021.Lower steel prices and lower contracting activity across all sectors appear to be having an impact.

Demand drivers

Demand drivers

The International Monetary Fund (IMF) has again lowered its forecast for the global economy. Central Banks have raised interest rates and tightened their monetary policies in an attempt to contain further increases in inflation, while the IMF estimates that global GDP in Q2 2022 was lower than in Q1 2022. The baseline growth forecast from July estimates global economic growth of 3.2% in 2022, down from 6.1% in 2021, and that growth will stand at 2.9% in 2023. Further downside risks exist, and the IMF’s worst-case scenario forecasts a possible further reduction in global GDP to 2.6% and 2.0% in 2022 and 2023 respectively.

Growth forecasts have been reduced for most key economies. Of particular concern to the crude tanker market is that forecasts for the Chinese economy have been lowered by 1.1 pp and 0.5 pp for 2022 and 2023 respectively. At 3.3% in 2022 and 4.6% in 2023, growth in China is expected to hit its lowest levels since 1990. The People’s Bank of China has cut its interest rates, one of the few central banks in the world to so, but economic stimulus has otherwise been increased minimally. Special Purpose Bonds issued by local governments are on par with 2021, but lower than in 2020. The central government has recently also committed further funds for infrastructure development, which could increase overall activity but may not have much impact in the short term.

In the latest forecast, India remains the fastest-growing economy despite higher reductions than average compared to the April forecast. Growth is now projected at 7.4% and 6.1% for 2022 and 2023 respectively. Elsewhere in Asia, projections for Japan and ASEAN-5 countries have also been lowered.

The EU and the US are also expected to see slower growth than initially expected. The growth projection for the EU now stands at 2.8% and 1.6% in 2022 and 2023 respectively, whereas the US economy is estimated to slow to growth of 2.3% and 1.0%, down from 5.7% in 2021.

Compared to our last report, the US Energy Information Administration (EIA) has marginally lowered their production estimate for 2022-2023 combined. 2022 production has been increased by 0.23 mbpd, whereas 2023 has been reduced by 0.27 mbpd. They now estimate that 2023 production will end 5.65 mbpd higher than in 2021, equal to year-on-year increases of 4.6% in 2022 and 1.2% in 2023. Production in 2023 is estimated at 101.33 mbpd, 1.1% higher than 2019. OPEC countries and North America are still expected to contribute most of the production increase, whereas Eurasian production in 2023 is expected to end 1.37 mbpd lower than in 2021 due to lower production in Russia.

EIA’s consumption estimates have also been revised slightly downwards compared to our last report, but India and the Middle East are still expected to see the highest growth in consumption compared to 2021. In 2023, consumption is expected to be 12.5% and 8.7% higher than 2021 in India and the Middle East respectively. The USA and China are expected to post growth of around 5% in the same period, whereas the rest of the world will only contribute around 2% growth and combined consume 4.4% less than in 2019.

The expected changes in trade patterns once the EU’s ban on Russian oil and oil products takes effect late /early 2023 are, however, of greater importance to the market than the expected increase in cargo volume. The EU will have to look to new suppliers, while Russia will have to find new buyers and combined this will increase tonne miles demand for both crude and product tankers. A share of current pipeline volumes between Russia and the EU will also be banned and will add to seaborne volumes. We estimate that the change in EU’s trading patterns will add 3-4% to both crude and product tanker demand on top of the general recovery in production and consumption. Changes in Russia’s trading patterns are more complicated to estimate. For example, if we estimate that Russia will sell more crude oil to China, we must then also estimate where China will import less from instead. In addition, we must factor in that the EIA estimates that Russian production will drop by 15% in 2023. All in all, we are not certain that changes to Russian export patterns will add much to global demand and estimate the total effect of the EU ban on Russian oil and oil products to be a demand increase of 4-5% for both crude and product tankers on top of global volume increase.

The EIA estimates that Brent crude prices will dip below USD /barrel towards the end of 2022 and average USD 95/barrel in 2023. The high prices can still present a risk to demand, along with the risk of further adverse developments in the global economy and the heightened risk of a global recession.

Supply

Contracting has remained very low during the first seven months of 2022. Crude tanker contracting is the lowest in our records that date back to 1996, while product tanker contracting is the lowest since 2011. Relative to the size of the fleet, the order books now stand at 4.7% and 5.4% for crude and product tankers respectively. This will significantly limit deliveries in the coming years and, factoring in our demolition estimate, we forecast crude tanker fleet growth of 5.4% and 1.7% in 2022 and 2023 respectively, whereas product tanker contracting is forecast to grow by only 1.0% in 2022 and 0.9% in 2023.

As we forecast improved trading conditions in both tanker segments, we have estimated relatively low demolition in 2023, but it could still increase if some owners find it uneconomical to retrofit older vessels in order to comply with EEXI.

In the past, we would assume that sailing speed should increase in an improving market. With EEXI and CII implementation as well as ETS in the EU it is, however, more likely that sailing speeds will decrease, and that capacity supply will grow slower than the fleet. We therefore assume that capacity will not grow in 2023 and we consider it likely that it instead will decrease by 2-3%.

Conclusion

Since our update in June, the risk of a global recession has increased and activity in China still disappoints following the extensive COVID lockdowns. Potential downsides therefore remain for the tanker markets, but our base case still calls for further strengthening of both the crude and product markets.

Combined, the EU’s ban on Russian oil and oil products and increases in oil production and consumption point towards demand growth in 2022 and 2023 approaching 5% in in both markets. The crude fleet is estimated to grow by 5.4% in 2022, but by only 1.7% in 2023. Product fleet growth is estimated at around only 1% in both years. Capacity supply is expected to grow at a slower rate than the fleet during 2023 as reductions in sailing speed are likely and supply may reduce by 2-3% in both markets.

While uncertainties remain, everything points towards a solid strengthening of both the crude and product markets in 2023, and higher freight rates, time charter rates, and second-hand ship prices.