Black Sea grain cargo flows recovered on the week despite congestion and inspection delays weighing on grain shipments amid lingering uncertainty regarding the renewal of the UN-brokered safe passage agreement due Nov. 19.

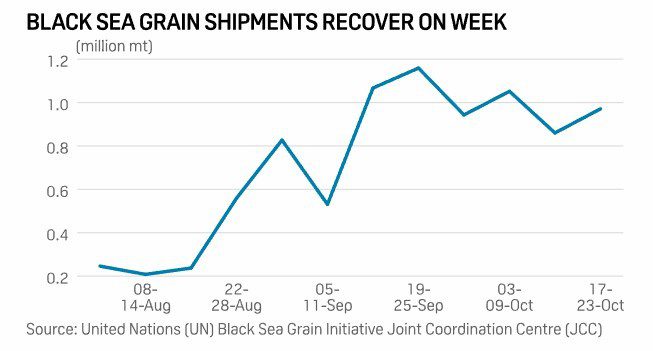

Cumulative grain shipments under the safe passage agreement have reached close to 8.7 million mt as of Oct. 24, with weekly flows also rebounding from the previous week’s lows. However, flows continued to tread below the September peak, according to data released by the Black Sea Grain Initiative Joint Coordination Centre, or JCC.

Earlier in July, the Russian Federation, Turkey, Ukraine, and the UN agreed to a safe passage deal enabling the resumption of exports of grain and fertilizer from the three key Ukrainian ports of Chornomorsk, Odesa and /Pivdennyi from the Black Sea to the rest of the world, with the first shipment having departed Aug. 1.

During the Oct. 17-23 period, total Black Sea grain shipments under the safe passage deal settled just below 971,000 mt, marking a 13% jump on the week but continuing to tread over 81,000 mt lower than the early October levels and more than 16% below the recent peak of almost 1.2 million mt of weekly grain shipments observed Sept. 19-25, according to the JCC.

Congestion and delays have been a major source of disruption of the cargo flows, with an Oct. 24 statement from the Ministry of Foreign Affairs of Ukraine accusing Russia’s inspectors assigned to the Istanbul Joint Coordination Centre of “significantly prolonging the inspection of vessels, which are heading to Ukraine’s ports for grain loads, or have already been loaded and are on their way to the final destination,” starting from Oct. 14, with some 165 vessels stuck close to the Bosporus Strait as a result.

“The situation with inspection is not getting better as vessels are rejected for artificial reasons – I heard that a vessel was rejected because a difference in bunker quantity was discovered,” a shipping executive operating out of Odessa said. “Due to the reduced number of vessels, the port silos are completely full, which has caused further difficulties through the supply chain including the congestion of wagons and trucks.”

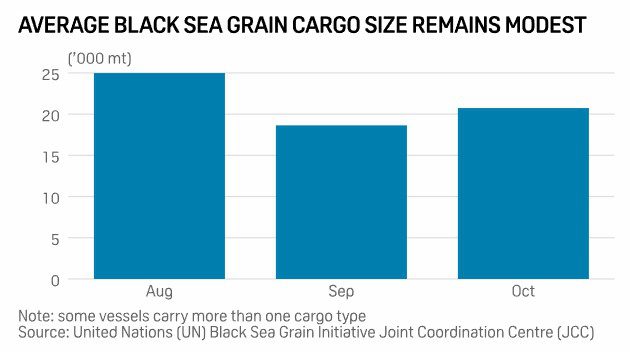

One of the contributing factors to inspection delays has been the average size of individual cargoes, which remains close to 21,000 mt for October so far, an 11% increase from the September lows but still below the 25,000 mt average observed during August. Additionally, some vessels were carrying more than one cargo type, data from the JCC showed.

So far, the largest vessel loading under the agreement has been the 2012-built 179,718 dwt Maran Astronomer bulk carrier that departed from the terminals of /Pivdennyi in late August with a 74,500 million mt cargo of corn.

In terms of cargo types, about 42% of the shipments have been corn and 29% have been wheat, with the rest consisting of various agricultural goods, including sunflower oil, rapeseed and barley, according to the JCC.

JCC acts to reduce vessel backlog

Amid reports of significant vessel congestion causing delays in cargo shipments, the JCC has been launching a series of initiatives to accelerate the inspection process and ease congestion in light of the approaching harvest potentially leading again to brimming Ukrainian port silos.

“The JCC is concerned that the delays may cause disruption in the supply chain and port operations,” a JCC information note published on Oct. 24 said. “Over the last few days, the JCC has started registering again new vessels to join the Initiative.”

The JCC has recently increased the inspection personnel to five teams, while its delegations have been discussing “ways to improve its operational procedures and efficiencies, including easier submission of paperwork, smoother clearances of vessels and approval processes,” the Oct. 24 information note said.

The JCC reported that 113 vessels had been registered for inspection as of Oct. 24, while a further 60 vessels were waiting to join the Black Sea Grain Initiative in Turkish territorial waters.

Markedly, JCC reported that the potential cargoes for the inbound vessels totaled approximately 1.9 million mt, equal to more than a fifth of the exports already made under the agreement since the start of August.

Looking ahead, participants will remain focused on any signals regarding the potential renewal or modification of the 120-day Black Sea Grain Initiative signed on July 22, with operators likely growing weary of getting vessels stuck in the region as the Nov. 19 deadline approaches, in the event of a termination of the deal.