Mexico was No. 2, as its total trade with the U.S. increased 19% year over year (y/y) to $67.9 billion in June, compared to the same period in 2021. China rated third with $60.3 billion.

The top U.S. exports to Canada were gasoline, passenger vehicles and oil. Trade between the U.S. and Canada for the first five months of the year totaled $399.2 billion.

Imports from Mexico totaled $39.4 billion in June, a 19% y/y increase from 2021. Computers, passenger vehicles and auto parts were the top three imports.

Ed Habe, vice president of Mexico sales for Averitt Express, said it continues to see all types of truckload and less-than-truckload freight moving across the border.

“We are currently handling more volume in these lanes than ever before, especially outbound, or northbound, freight from Mexico into the U.S.,” Habe told . “Our three primary border service centers in Laredo, El Paso and Harlingen, Texas, are experiencing record numbers in daily cross-border shipments.”

“We are currently handling more volume in these lanes than ever before, especially outbound, or northbound, freight from Mexico into the U.S.” — Ed Habe, vice president of Mexico sales for Averitt Express

The U.S.-Mexico port of entry in Laredo, Texas, remained No. 3 among the nation’s 450 airports, seaports and border crossings in June. The Port of Los Angeles ranked No. 1 among U.S. gateways, followed by Chicago O’Hare International Airport.

Total trade at Port Laredo increased almost 19% y/y to $25.8 billion in June, with imports increasing 20.6% y/y to $15.7 billion and exports rising 16% y/y to $10.1 billion.

Port Laredo’s top three imports included auto parts, passenger vehicles and heavy-duty trucks. Auto parts, diesel engines and gasoline were the port’s top three exports.

“In my opinion, [increased imports from Mexico] are a result of a first phase of nearshoring, where our customers that have existing operations within Mexico are increasing volumes and relocating more production lines to Mexico, resulting in higher volumes of finished goods coming into the U.S. for distribution,” Habe said.

Averitt Express has been receiving a higher-than-normal volume of inquiries from shippers about anticipated pricing if they were to move operations to Mexico as they consider nearshoring operations, Habe said.

“Because of this, we are working now to gear up to be prepared for another phase of companies shifting their production and vendors to Mexico in anticipation of a future need for increased capacity in these lanes,” Habe said.

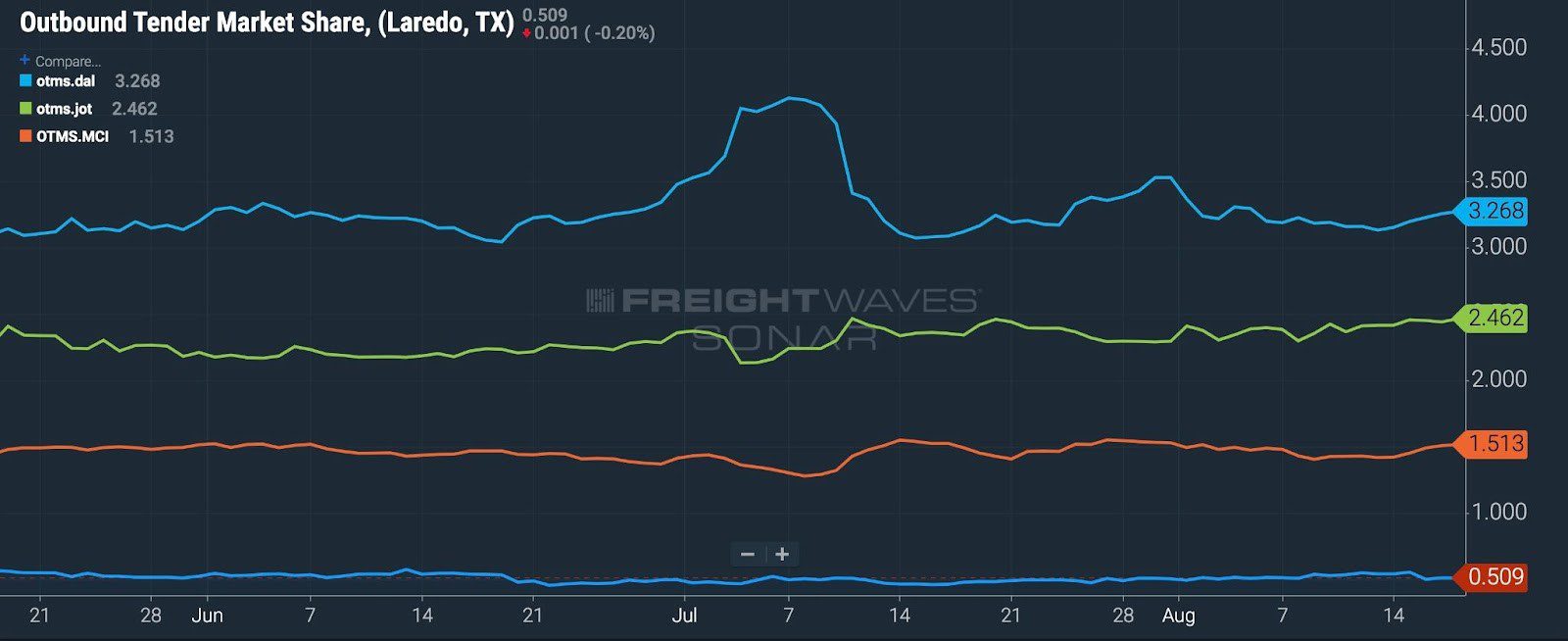

The SONAR platform includes the outbound tender market share index that measures the relative percentage of outbound tender volumes in each market in the U.S., adding up to 100.

The Laredo market accounted for 0.51% of the total outbound truckload demand recently, much smaller than markets such as Chicago (Joliet), Kansas City, Missouri, and Dallas in the SONAR chart below. While 0.51% doesn’t sound like much, three weeks ago Laredo was registering more inbound freight than outbound.