August shipments data from Cass bucks the current sentiment on demand. (Photo: Jim / )

August shipments data from Cass bucks the current sentiment on demand. (Photo: Jim / )

“This data set stands above most other August freight indicators, but several of the soft August indicators are from the spot market,” ACT Research’s Tim Denoyer commented. “So, to some extent, the stronger Cass data reflect the ongoing shift from spot to contract.”

Denoyer also attributed the jump in volumes to other factors like China emerging from lockdowns, pre-holiday inventory stocking and easing supply constraints at the automotive manufacturers. He cautioned the “improvement may not be sustainable, especially as pressure increases on interest-rate sensitive sectors like capital goods and housing.”

| August 2022 |

y/y |

2-year |

m/m |

m/m (SA) |

| Shipments | 3.6% | 16.3% | 6.6% | 5.5% |

| Expenditures | 20.4% | 71.2% | 1.9% | 2.1% |

| TL Linehaul Index | 7.4% | 20.9% | -1.8% | NM |

Table: Cass Information Systems. SA (seasonally adjusted)

Deterioration in the truckload spot market has dominated industry discussions since the spring as load opportunities have fallen and a large number of drivers making the jump to operate under their own authority upset a very tight supply-demand dynamic. The change in fundamentals has pushed spot rates nearly 40% lower from the peak. However, carriers with the bulk of their loads tendered under contract, especially in dedicated capacity arrangements, have seen a much more subdued falloff in rates.

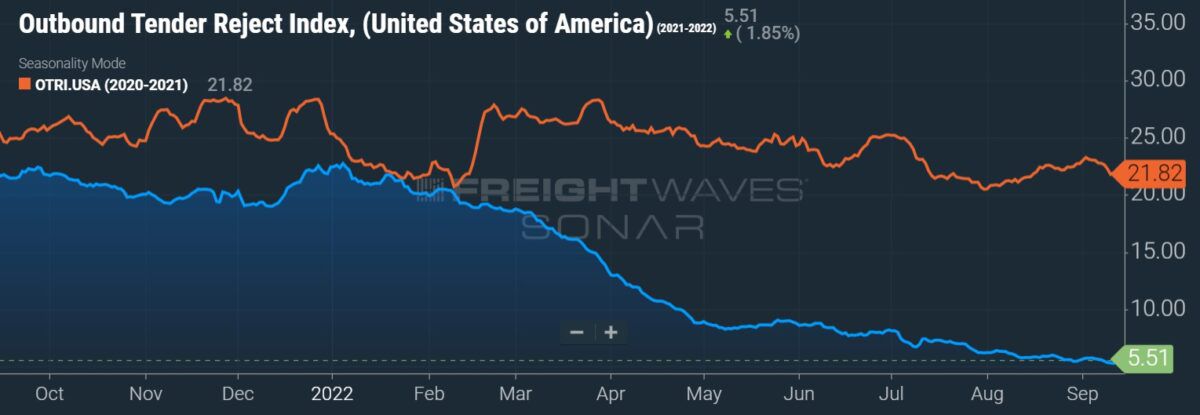

Chart: (SONAR: OTRI.USA)A proxy for truck capacity, the Outbound Tender Reject Index, shows the number of loads being rejected by carriers. The index has fallen to just 5.5% compared to a year ago when fleets were rejecting more than 20% of loads under contract.

Chart: (SONAR: OTRI.USA)A proxy for truck capacity, the Outbound Tender Reject Index, shows the number of loads being rejected by carriers. The index has fallen to just 5.5% compared to a year ago when fleets were rejecting more than 20% of loads under contract.

Cass expenditures data, measuring total freight costs including fuel, increased 20.4% y/y and was 2.1% higher than July when seasonally adjusted. The y/y growth rate in July was also revised 80 basis points higher. The increase in expenditures was due to a 5.5% rise in shipment counts, which was partially offset by a 3.2% decline in inferred rates. Inferred rates were up 16.3% y/y, the slowest increase since May 2021, as the comps have stiffened.

The report said 7 to 8 percentage points of the y/y growth rate in expenditures was likely tied to higher fuel prices. However, the decline in diesel prices from July to August was likely the driver of the sequential decline in rates during the month.

Assuming normal seasonality for the remainder of 2022, the index will increase 24% y/y for the full year. The forecast for when the expenditures data set may turn negative was pushed back two months to February.

“With the tight /demand balance in U.S. trucking markets easing considerably this year, industry rates are topping out and set to slow sharply in the months to come,” Denoyer continued. “While shippers aren’t seeing any real savings yet, such relief is now highly probable for 2023, which is welcome news for the broader inflation picture.”

The TL linehaul index, which excludes fuel and accessorials, was up 7.4% y/y in August but down 1.8% sequentially. August marked the third straight month of sequential declines.

“On a m/m basis, the Cass Truckload Linehaul Index fell 1.8%, similar to the declines in June and July,” Denoyer said. “The clarity of the trend change in the past three months is rather stunning: after a 22-month cycle of increases that averaged 1.2% per month, the index fell m/m 1.76%, 1.78%, and 1.83% respectively in June, July, and August.”

He noted this year’s decline in spot rates in the run-up to Labor Day bucked the trend during the past two years, which saw mid- to high-single-digit gains. While those were both active hurricane seasons, Denoyer said it’s more than just bad weather that is pressuring rates.

“We think the divergence between this year’s early September rate trend with the past two is mainly due to the looser market balance. The shipment rebound is, so far, not enough to outweigh the 4%-5% growth rates in the driver and Class 8 tractor populations presently.”

More articles by Todd Maiden