Over the weekend, several ships bound for China reversed course after Beijing unveiled retaliatory measures against vessels linked to the United States.

Beginning tomorrow, to coincide with Washington’s new port fee increases on Chinese tonnage, China will impose an additional RMB400 ($56) per net ton on all ships built, operated, flagged, or even listed in the US. The move adds another layer of uncertainty to an already tense global shipping environment.

Although few ships are US-flagged or owned by American companies, the inclusion of US-listed operators significantly broadens the scope of affected vessels. According to Jefferies, the sectors facing the greatest impact include crude tankers (16% of the global fleet), LPG carriers (14%), product tankers (13%), and containerships (11%)—a disruption large enough to ripple through global trade flows.

China’s Ministry of Transport confirmed that the new fee will gradually increase each year, reaching RMB1,120 by 2028.

The China Shipowners Association (CSA) condemned Washington’s measures, calling them violations of World Trade Organization principles and examples of “US hegemonic practices.” The association said Beijing’s response is a legitimate move to “defend fair competition, safeguard maritime security, and uphold global trade order,” warning that America’s unilateralism “will only lift a stone to drop it on its own foot.”

Industry observers warned of administrative chaos once the new rules take effect. “The market impact could be substantial, depending on how the new rules are implemented,” noted broker Arrow in a report, adding that unclear guidance could lead to delays as port authorities verify vessel ownership details to avoid liability.

Dr. Roar Adland, head of research at broker SSY, commented on LinkedIn, “Will all of this survive beyond Tuesday? We do not know, but our overall position is that we will see more of this bifurcation of global trade and, with it, the shipping industry.”

Meanwhile, the Trump administration has adjusted its own port fee policy, tripling service charges for foreign-built vehicle carriers while loosening export restrictions on LNG shipments made by non-US-built vessels.

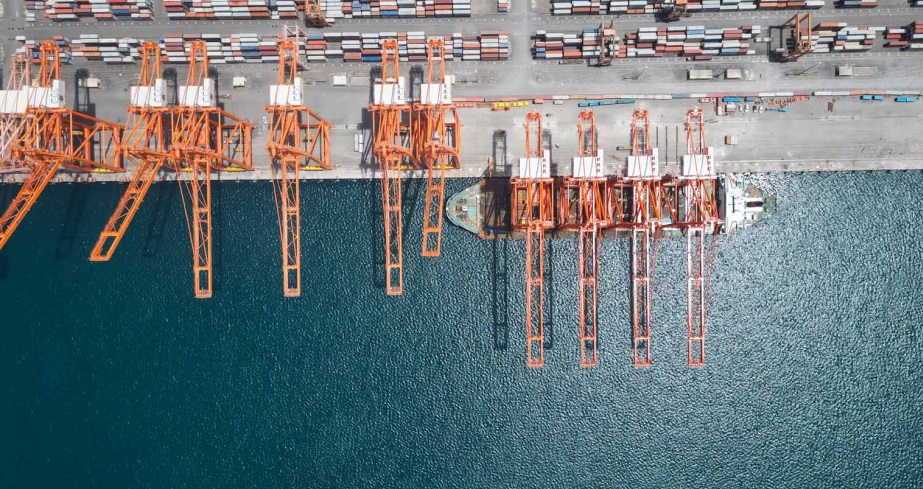

The US Trade Representative also announced a 100% tariff on Chinese-made port equipment, including ship-to-shore cranes and intermodal chassis.

Tensions between the two nations continue to escalate, with Washington warning it may raise tariffs on all Chinese imports to 100% amid disputes over China’s rare earth export controls.