Fitch Ratings expects the large banks in China to maintain a broadly stable performance in 2023 while smaller banks – especially those more concentrated in less economically advantageous regions where property stress is more prominent – face rising profitability and asset-quality challenges. Growing global challenges and continued Covid-related restrictions also pose risks to the sector.

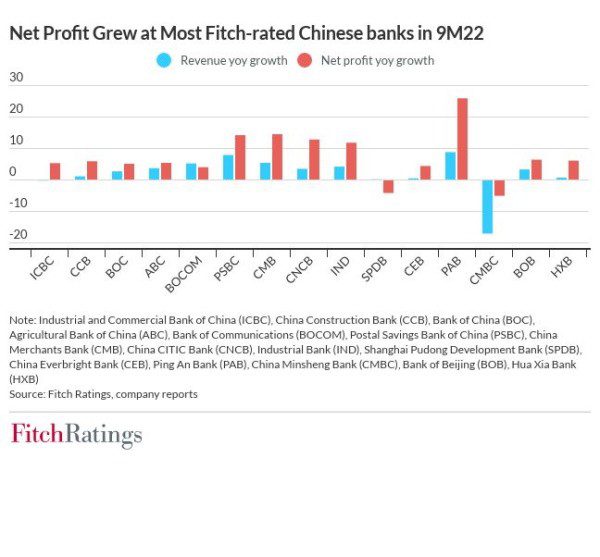

Reported revenue and net profit for Fitch-rated Chinese banks grew by around 2% and 7%, respectively, on average year-on-year (yoy) during 9M22. Still, some banks’ net profit declined over the same period due to narrower margin and higher impairments.

The contraction in net interest margin in the third quarter varied, reflecting a combination of tepid retail loan demand, loan prime rate reductions, and policymakers’ initiatives to lower funding costs for micro- and small-enterprises (MSEs). We expect margins to narrow further in 2023 as mortgage loans are repriced, but potential cuts in the reserve requirement ratio and deposit rates should mitigate the decline.

Broad questions about a delayed property-market recovery and unfavourable employment conditions still overhang China’s banking sector. Total loans grew by 11.2% yoy in 9M22, similar to the prior year’s level, but 2022’s growth was driven largely by corporate borrowers, including those in infrastructure, manufacturing, ‘green’ finance, and MSEs. Meanwhile, China’s GDP growth slowed to 3.0% yoy over the same period, implying that credit growth alone is likely insufficient to reignite the economic momentum.

Retail loan growth has decelerated this year, up only 7.2% yoy in the first nine months, as mortgage loan demand and consumption activities remain affected by pandemic restrictions. Sluggish retail loan demand is likely to linger for the remainder of 2022 and into 2023, while corporate lending is likely to dominate the sector’s loan growth in the next year or so.

Property development loans have slowed down even more sharply, up by only 2.2% yoy, as banks remain cautious toward new property exposures. The regulators have asked the six state banks to grant another CNY600 billion in new lending for the property sector before end-2022, but the amount is equivalent to only 2% of their outstanding property loans. The amount is likely insufficient to meet the homebuilders’ refinancing need and support a recovery in their funding access.

Most private homebuilders’ credit profiles show no sign of recovery. So long as homebuyer confidence hovers around low levels, banks will probably continue to face muted demand for mortgage loans, especially in the lower-tier cities. This year’s RMBS issuance has dropped significantly in the first nine months, although the delinquency ratio has remained generally benign. The majority of mortgage loans at our rated banks originate from tier-1 and tier-2 cities, where housing transactions have been more resilient.

The reported non-performing loan (NPL) ratio for our rated banks were generally stable and averaged around 1.3% at end-September 2022, supported partly by sustained NPL resolutions. We estimate NPL resolution at around CNY4 trillion each in 2022 and 2023, up from CNY3.1 trillion in 2021. However, the banking sector still faces lingering risks with ongoing stalled home projects. Failure to restore homebuyer confidence resulting in prolonged property-market stress beyond 2023 could test the banking system’s resilience.