China’s manufacturing steel consumption reached the highest level in nearly six years in March, government data analyzed by Platts showed, but tariff headwinds cast a shadow over near-term export prospects.

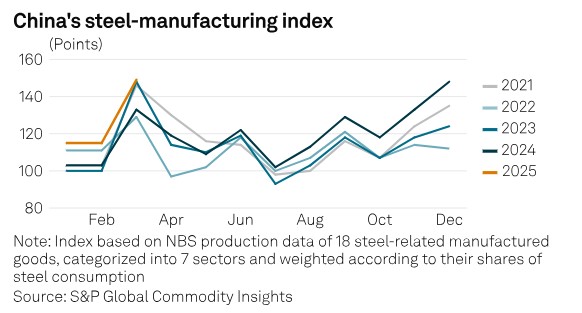

The manufacturing production index of Chinese steel consumption produced by Platts, part of S&P Global Commodity Insights, stood at 149 points in March, up 16 points year over year.

The production index is based on production data from China’s National Bureau of Statistics for 18 steel-intensive manufactured goods, categorized into seven sectors and weighted according to their share of steel consumption. The monthly production average in 2018 is used as the baseline of 100.

Major growth contributors were the government’s hike in subsidies for domestic equipment renewals and consumer goods trade-ins, steel market participants told Platts in the week to April 25.

A short-term rush to export steel-intensive goods ahead of the escalation of US-China trade tensions also helped the manufacturing sector, they said.

However, the headwinds that Chinese manufacturers(opens in a new tab) face in the export markets have intensified significantly since April, when the US increased tariffs against the country to 145%. This may lead to a notable decline in manufacturing activities and steel demand in April or May.

Some sources believed the Chinese government could further boost its policy support for domestic consumption. But it remains to be seen how much the domestic stimulus could offset the adverse impacts from overseas, added sources.

Manufacturing in March

In March, all seven manufacturing sectors — including machinery, vehicles, shipbuilding, home appliances, power generation, containers and railway facilities — posted a year-on-year increase in output, according to NBS data.

Behind the strong manufacturing production, the value of domestic equipment purchases in the first quarter of 2025 rose 19% from a year ago. The Q1 growth was better than an 18% year-over-year increase in January-February and 15.7% in the full year 2024, according to NBS.

Also, in the first quarter, the total domestic retail sales of consumer goods increased 4.2% on the year, accelerating further from a 4% year-over-year growth in January-February and 3.5% in full-year 2024.

NBS cited increased policy support behind the growing domestic consumption, including the government subsidies for domestic equipment renewals and consumer goods trade-ins.

Meanwhile, China’s export markets were exceptionally strong in March, as exporters rushed to ship their already-signed export orders amid escalating trade tensions.

The export value in dollar terms of China’s mechanical and electrical products, the most steel-intensive manufacturing sector, increased 14% in March from a year ago. This was higher than the 4.2% growth in January-February and 7.5% in the full year 2024, customs data showed.

However, the strong momentum in manufacturing export markets is about to taper off from April, given the US tariff hikes on China, as well as highly uncertain global trade policy, said steel market sources.

Falling orders and domestic stimulus

Mill sources said downstream manufacturing clients have already seen their overseas orders falling since early March when the US raised its tariffs to 20% on all imports from China.

With the US tariffs rising to 145% in early April, most Chinese manufacturers at least will need some time either to find re-routing channels to the US or alternative buyers. Thus, the manufacturing activity and its steel demand are likely to slow notably in April or May, said sources.

Moreover, US trade policy uncertainty could also slow the global economy, further weakening demand for Chinese manufactured goods and steel.

“Our silicon steel orders totaled around 60,000 mt/month in early 2025 but have now fallen to just 20,000 mt/month,” a mill source said, adding some of his downstream manufacturing clients were facing shrinking export orders.

Silicon steel is widely used in electric machines or motors, which convert electrical energy into mechanical energy or vice versa. It is key to mechanical and electrical products.

China planned to boost its subsidies for consumer goods trade-ins to Yuan 300 billion in 2025 from Yuan 150 billion ($20.51 billion) in 2024 to boost domestic consumption. With a full-blown trade conflict with the US, some steel market participants expect a further boost in government subsidies.

However, Chinese steel prices have remained in a downtrend amid fears the potential stimulus will fail to cushion China’s export markets.

The Platts-assessed domestic HRC prices fell to Yuan 3,/mt on April 22, down Yuan /mt from end-March and 15% lower than a year ago, according to Commodity Insights data.

Source: Platts