Container xChange on Wednesday released the findings of its container logistics analysis for the Indian container logistics market.

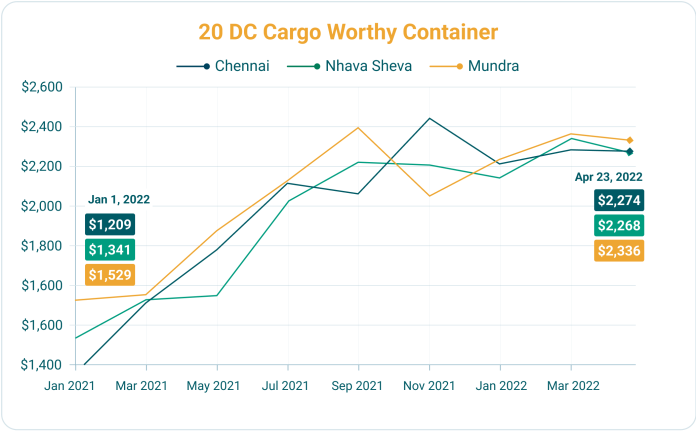

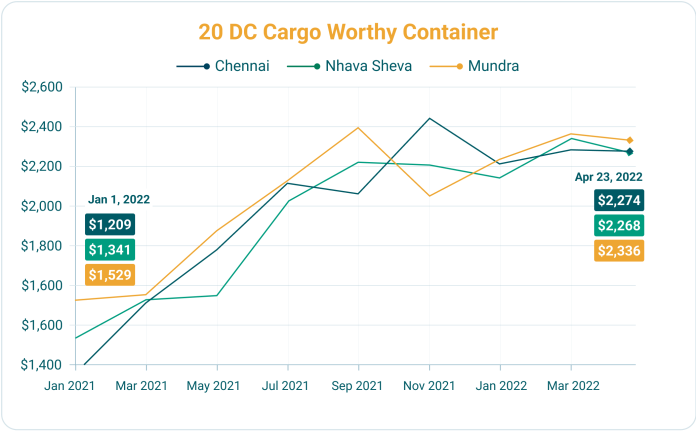

Key findings from the analysis show that there has been a general decline in average prices of 20 ft DC and 40 ft HC standard shipping containers across the ports of Chennai, Nhava Sheva and Mundra from Mid-January 2022 till date, after having peaked in the months of August- September 2021.

However, the prices are much higher than the prices from January 2021 (40% higher in Chennai, 36% higher in Nhava Sheva and 36% in Mundra for 40 ft HC containers). The average prices have increased by 41% from $1341 on 1st January 2021 to $2269 as on 23 April 2022 at the port of Nhava Sheva for 20 ft DC cargo worthy container.

The average price of 40 ft HC container in Chennai were $5127 in mid-January 2022 which fell to $4297 on 18th April 2022. A fall of 16% since 17th January 2022.

Another key finding is the rise in Container Availability Index (CAx) values from week 14 (4 April till date). The CAx (Container Availability Index) is a tool that allows container logistics businesses to monitor the import and export moves of full containers around major ports. A CAx value of 0.5 means that the same number of containers leave and enter a port in the same week. CAx values of > 0.5 means that more containers enter and CAx values of < 0.5 means more containers leave a specific port.

CAx values rise when there are more inbounds than outbounds and if the CAx values maintain at a higher level, then that means that there is a problem of containers piling up, or there is a rise in blank sailings or carriers missing calls at the Indian ports while the containers that are transported are not moving out back at the same speed.

“This has an explanation that corroborates well with the macro-economic factors. The Colombo crisis has led to more transshipment containers being directed to the east coast ports in India.” said Christian Roeloffs, founder and CEO, Container xChange.