You can’t see it in container shipping, though. At least, not yet.

“The charter market is undeterred by the weaker sentiment across the global shipping industry and remains extremely strong,” affirmed data provider Alphaliner on Wednesday. “Charter rates continue to evolve at historic highs with, remarkably, some further gains achieved by certain sizes.” There is “a continued bonanza.”

Operators still hungry for ships

Alphaliner reported that BAL Container Line has just chartered the Northern Prelude (built in 2009, capacity: 4,600 twenty-foot equivalent units) for $160,000 per day for 40-60 days.

It also reported that Sinotrans has chartered the 2021-built, 2,743-TEU X-Press Mekong for $149,000 per day for 40-45 days. “This rate … is not far off the historical high of $175,000 per day [for that size category] obtained in January,” said Alphaliner.

Even the very smallest ships — in the sub-1,000-TEU category — “continue to generate staggering rates.” Ships with capacities of just 700-800 TEUs are being employed at $20,000-$30,000 per day. Most recently, SITC chartered the 2008-built, 724-TEU Atlantic Pioneer for $30,000 per day.

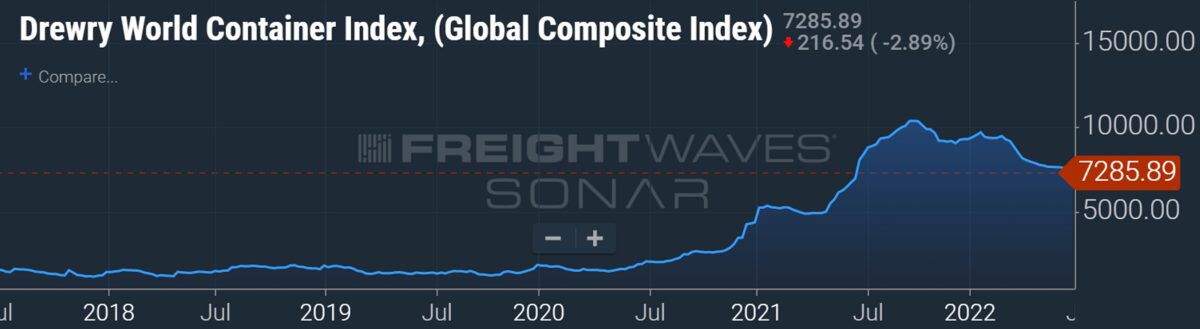

Weekly spot freight rate assessment in $ per FEU. Chart: SONAR

Weekly spot freight rate assessment in $ per FEU. Chart: SONAR

According to Alphaliner, “The continued fall in spot rates on most major routes is obviously a concern, but they remain at historical highs for now, giving both NOOs [non-operating owners, the companies that lease ships to liners] and charterers confidence in short-term market prospects.”

For NOOs, “the short term remains bright.”

No collapse in charter rates yet

Data from companies that track charter rates does not indicate a market collapse. On the contrary, it shows a market that’s holding at or near the high point.

Alphaliner tracks average rates over time, estimating rates for 12-month charter durations. (These figures are assessments only, given the lack of available ships for rent and the rarity of 12-month deals.)

For 8,500-TEU container vessels, it currently assesses rates at $150,000 per day, just below the $155,000-per-day record hit in late March to mid-April. The current rate is up 114% year on year (y/y).

For 5,600-TEU ships, it puts rates at $130,000 per day. That’s the all-time high and up 110% y/y. It assesses 4,000-TEU ships at $110,000 per day, an all-time high and up 93% y/y, and 2,500-TEU ships at $76,000 per day, just below the peak of $80,000 per day in February to early May and up 105% y/y.

Alphaliner puts one-year rates for 1,700-TEU ships at $58,000 per day, near the all-time high of $62,500 per day in late February to mid-May and up 71% y/y. It estimates charter rates for 1,000-TEU container ships at $32,000 per day, down materially — 36% — from a brief high of $50,000 per day reached in early March, albeit still up 68% y/y.