Copper prices fell on Tuesday due to worries about the trade tensions between the United States and China, the world’s two largest economies, with their potential effect on demand prospects for growth-dependent metals.

Three-month copper on the London Metal Exchange HG1! eased 2.3% to $10,570 a metric ton in official open-outcry trading.

Copper, used in power and construction, is down 4% since worries about the reduced mine supply after disruptions in Indonesia, the Democratic Republic of Congo and Chile drove the metal to its 16-month high of $11,000 on Oct. 9.

“Demand is not so good for copper, even though we have all these supply challenges,” said Dan Smith, managing director at Commodity Market Analytics.

On the technical front, the nearest moving average, providing support to copper, is the 21-day one, currently at $10,373.

In top metals consumer China, the Yangshan copper premium (SMM-CUYP-CN), which reflects demand for copper imports, fell 8% to a two-month low of $45 a ton.

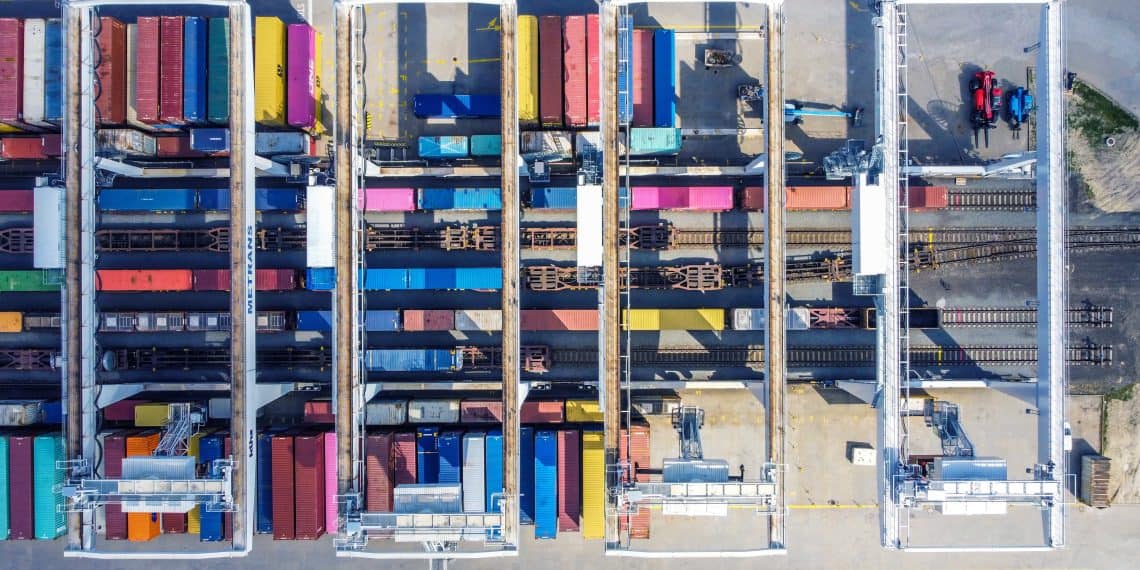

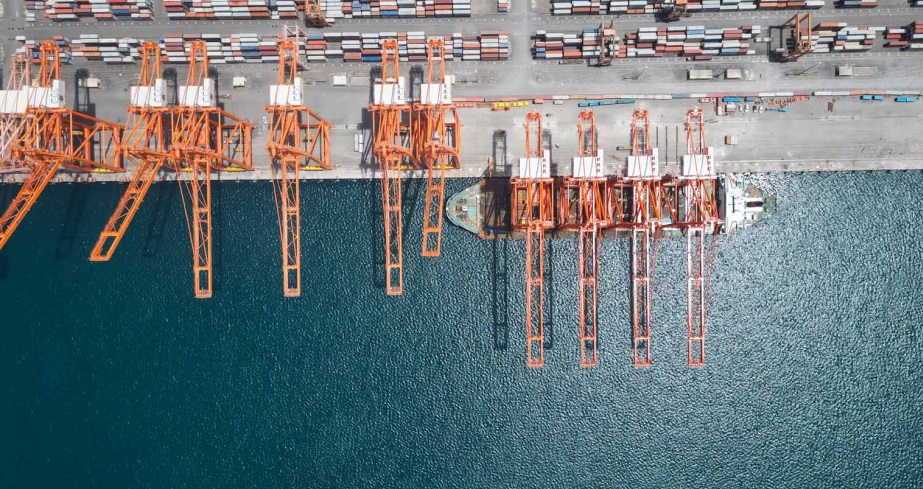

The U.S. and China on Tuesday began charging additional port fees on ocean shipping firms that move everything from holiday toys to crude oil.

On Monday, the spreads between the LME cash contract against the three-months one for copper, aluminium and zinc widened due to activity ahead of this Wednesday, when short position holders have to cut or rollover their contracts.

The premium for the cash copper against the three-month contract was last at $45 a ton after hitting $227, its highest since June, on Monday.

For zinc, the premium fell to $100 a ton from Monday’s $202. Zinc stocks in LME-registered warehouses (MZNSTX-TOTAL) are at their lowest level since early 2023, prompting concerns about the availability of the metal on the LME market.

The LME declined to comment.

LME aluminium ALI1! fell 1.2% to $2,730 a ton in official activity, zinc ZNC1! lost 2.9% to $2,935, nickel NICKEL1! dipped 0.7% to $15,100, tin FTIN1! slid 1.5% to $35,200 and lead LEAD1! eased 0.5% to $1,980.

Lead and nickel hit their lowest since September 10 and 11, respectively, while zinc touched lowest since September 30.

Source: Reuters