Copper prices rose on Monday as falling inventories in top consumer China lent support, while disappointing factory data pointed to a weak demand outlook.

Three-month copper on the London Metal Exchange CMCU3 rose 0.1% to $7,923 a tonne by 0554 GMT, and the most-traded September copper contract on the Shanghai Futures Exchange SCFcv1 rose 2.4% to 61,090 yuan ($9,041.93) a tonne.

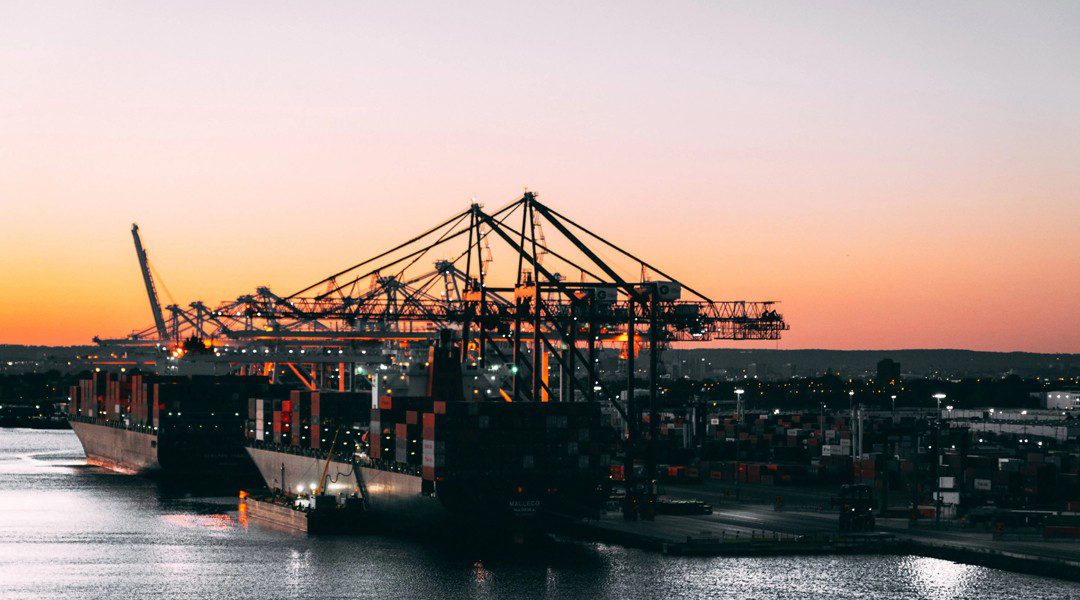

Yangshan copper premium SMM-CUYP-CN rose to $94 a tonne, highest since December 2021, indicating rising demand to import the metal into China.

The LME copper cash premium over the three-month contract MCU0-3 was at $13.80 a tonne, highest since May 23.

“This resilience in prices and strengthening premium could be linked to drawing inventories and falling margins for smelters due to drop in by-product prices,” said analyst Soni Kumari of ANZ.

“There have also been some restocking from end-users at lower price levels,” she said, adding that the move by Chinese authorities to support the property sector should see demand improving later this quarter.

ShFE copper inventories CU-STX-SGH dropped to 37,025 tonnes, lowest since Jan. 21, and a 78% drop from March.

Elsewhere, miners reported falling output.

Leading producer Codelco’s output in January-June dropped 7.5% year-on-year to 736,000 tonnes of copper, while Glencore GLEN.L cut its full-year copper outlook.

But weak metals demand outlook continued to weigh on prices, with China’s factories reporting subdued activities in July with persistent demand weakness and COVID-19 outbreaks throwing its manufacturing sector back into uncertainty.

LME aluminium CMAL3 declined 1.7% to $2,447 a tonne, zinc CMZN3 shed 0.7% to $3,285 a tonne and lead CMPB3 eased 0.3% to $2,029.50 a tonne.

ShFE aluminium SAFcv1 fell 2.5% to 18,205 yuan a tonne. Nickel SNIcv1 jumped 7.1% to 180,950 yuan a tonne and tin SSNcv1 rose 5.6% to 202,850 yuan a tonne.