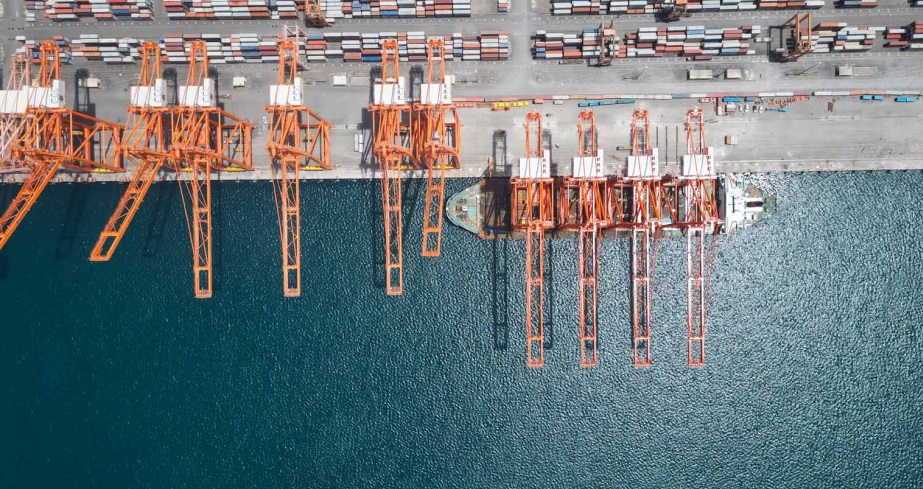

Dubai’s DP World recently announced it will inject a massive $5 billion into India’s shipping and shipbuilding industry. The agreement was signed in Mumbai during India Maritime Week and covers several key areas, including green container ship operations, infrastructure upgrades, and specialized skills training.

DP World has been operating in the Indian market for over three decades, having previously invested a cumulative $3 billion to improve the country’s supply chain network. “These investments focus on strengthening the core framework of India’s infrastructure and enhancing multimodal connectivity,” DP World emphasized in a statement. Through these initiatives, the company aims to build a more resilient and environmentally friendly logistics ecosystem for India.

One of the core projects of this investment is the cooperation between DP World’s container line operator Unifeeder and Sagarmala Finance Corporation. This partnership will be dedicated to developing and expanding green services for India’s coastal and short-sea shipping, emphasizing commercial sustainability. By introducing low-carbon technologies and efficient operational models, this project will significantly reduce the logistics industry’s carbon footprint and promote the transition to clean energy.

Furthermore, DP World will collaborate with Cochin Shipyard to expand the international ship repair facilities located in Kochi. This cooperation will also extend to the field of shipbuilding skills training, helping to cultivate more specialized talent to meet the rapidly developing industry’s demands. Simultaneously, DP World is partnering with the Cochin Port Authority to upgrade the Kochi container terminal facilities, further enhancing the port’s throughput capacity and modernization level.

It is worth mentioning that earlier this year, DP World’s subsidiary P&O Maritime Logistics (POML) acquired a 51% controlling stake in NovaAlgoma Cement Carriers. The latter is a leading operator of pneumatic cement carriers, jointly established by Canada’s Algoma Central and Switzerland’s Nova Marine Holdings. The remaining 49% minority stake will be held by a new entity based in Dubai. This acquisition further strengthens DP World’s footprint in the specialized shipping sector.

Looking back at DP World’s expansion history, the company conducted several major mergers and acquisitions between 2018 and 2019, including the acquisitions of Unifeeder, P&O Ferries, and the Middle Eastern offshore operator Topaz, which was merged with tug operator P&O Maritime Services and renamed POML. Subsequently, the company acquired a 77% stake in Singaporean feeder container operator Feedertech and further expanded Unifeeder’s footprint by acquiring the UAE and India route and logistics subsidiaries of the Transworld Group.