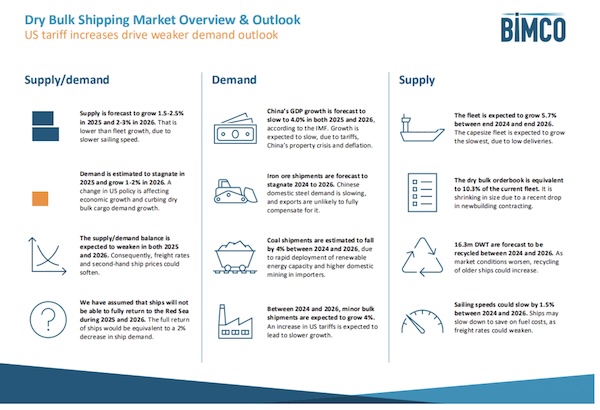

The tariff increases by the US and China in effect as of 25 April are estimated to directly affect 4% of dry bulk tonne mile demand. They are expected to impact the growth of minor bulk cargo volumes, as shipments to the US may stagnate or decrease. On the other hand, China is expected to increase purchases of dry bulk cargoes from other countries, leading the US to seek alternative markets.

The demand outlook is weakest for iron ore and coal shipments, the two largest dry bulk commodities. Iron ore shipments are expected to stagnate in 2025 and 2026, as Chinese domestic steel demand slips, partly due to China’s property sector crisis. Coal shipments are estimated to drop 2-3% in 2025 and 1-2% in 2026, amid rapid deployment of renewable energy capacity and stronger domestic coal mining in China and India, the two largest importers.

On the supply side, an expected decrease in freight rates could lead to a decrease in sailing speeds, as this would allow for savings in fuel costs. Consequently, we expect supply to grow at a slower rate than the dry bulk fleet.

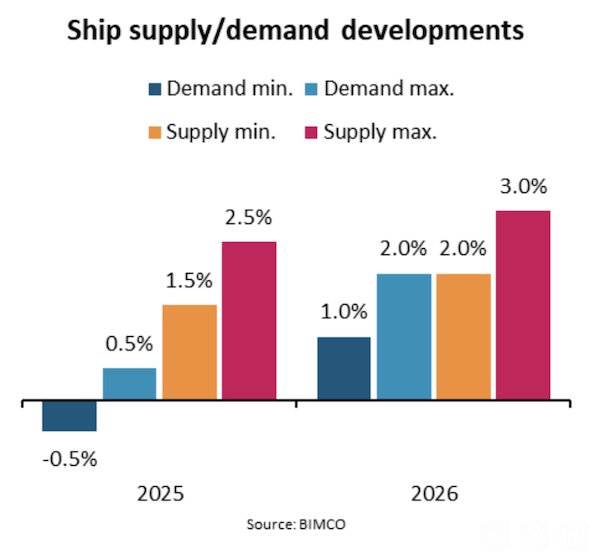

Overall, ship demand is estimated to stagnate in 2025 and grow 1-2% in 2026, whereas ship supply is expected to grow 1.5-2.5% in 2025 and 2-3% in 2026.

“Amid a poorer outlook for the dry bulk market, we expect that freight rates will remain lower in 2025 and 2026, than in 2024. We forecast that the outlook for the panamax segment will be the weakest, as coal accounts for over half of the cargo it transports. Conversely, low fleet growth in the capesize segment could keep that segment’s freight rates higher compared to other segments,”says Gouveia.

The weaker /demand outlook should also impact asset prices. Amid weaker freight rates, second-hand ship prices could weaken. Newbuilding prices have fallen since the start of the year, and we do not currently expect them to revert to previous highs.

“In this update,we are assuming that ships are unable to fully return to the Red Sea during the current and next year and reroutings via the Cape of Good Hope will continue. The full return of ships would be equivalent to a 2% decrease in ship demand. If this occurs, the demand outlook will be weaker than our baseline forecast,”says Gouveia.

So far in 2025, the Baltic Dry Index (BDI) has fallen on average 36% y/y, due to a weakening in freight rates across all segments. The Baltic Capesize Index has dropped 43%, the most of all segments, as rates weakened from 2024 highs. Panamax freight rates have been weak since the second half of 2024, amid weak demand growth.

The outlook seems poorest for panamax freight rates, as over half of the cargo they transport is coal, and we currently forecast a decrease in coal shipments. Smaller segments could fare worse than in our previous update, due to weaker demand growth for minor bulk cargoes. Low fleet growth in the capesize segment could keep freight rates higher compared to other segments. However, they might not rise to 2024 highs, due to a weaker Chinese economy.

Forward Freight Agreements (FFA) indicate that the market expects freight rates could increase for capesize ships during the rest of the year, compared to current levels. They further indicate that panamax and supramax rates may marginally increase. However, the FFAs indicate lower rate levels than in 2024, especially for supramaxes.

Second-hand prices could weaken over the current and next year, together with freight rates. Since the start of the year, they have

increased 0.8%. In April 2025, a five-year-old ship sold on average for 88.4% of the price of a newbuild. Newbuilding prices have fallen 1.5% since the start of the year and we do not currently expect them to revert to previous highs. Over the past quarter, contracting from dry bulk and tanker sharply dropped, while container contracting slowed thus reducing the global order book and shipyards’ forward cover.

Recycling prices may remain low amid strong low-price Chinese and Vietnamese steel exports to South Asia. However, Indian

recycling prices could perform better, as the country imposed a 12% tariff on some flat steel imports in April.

Source: BIMCO