Eagle Bulk Shipping Inc., one of the world’s largest owner-operators within the midsize drybulk vessel segment, reported financial results for the quarter ended June 30, 2022.

Quarter highlights:

• Generated Revenues, net of $198.7 million

o Achieved TCE(1) of $30,/day basis TCE Revenue(1) of $138.2 million

• Realized record net income of $94.5 million, or $7.27 per basic share

o Adjusted net income(1) of $81.6 million, or $6.28 per adjusted basic share(1)

• Generated EBITDA(1) of $113.9 million

o Adjusted EBITDA(1) of $102.6 million

• Published 2022 ESG Sustainability Report

• Declared a quarterly dividend of $2.20 per share for the second quarter of 2022.

o Dividend is payable on August 26, 2022 to shareholders of record at the close of business on August 16, 2022

Recent Developments:

• Coverage position for the third quarter 2022 is as follows:

o 72% of available days fixed at an average TCE of $29,024

Eagle’s CEO Gary Vogel commented, “I am really proud of our team’s collective efforts this quarter which enabled us to achieve our best-ever results, with record net income of $94.5 million and a TCE of $30,207. Focused execution, including our ability to successfully trade our ships in a volatile commercial environment, contributed to this outperformance.

“We believe our differentiated business model, combined with our exclusive focus on the midsize drybulk vessel segment and market-leading fleet scrubber position, has enabled us to generate outsized returns, as compared to the broader drybulk market.

“Given our strong cash generation, solid balance sheet, and constructive outlook on the market, the Board of Directors declared a dividend of $2.20; equal to 30% of net income, which implies a yield of approximately 18% as of market close today.”

1 These are non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures has been provided in the financial tables included in this press release. An explanation of these measures and how they are calculated are also included below under the heading “Supplemental Information – Non-GAAP Financial Measures.”

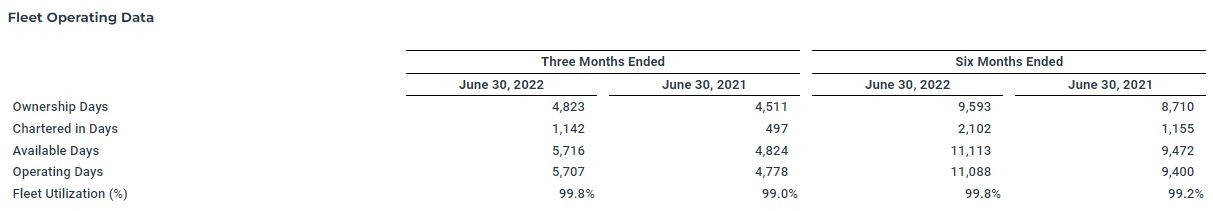

Fleet Operating Data

Vessel sold and expected to be delivered in the third quarter of 2022

Cardinal, a Supramax (55K DWT / 2004-built) for a total consideration of $15.8 million

Results of Operations for the three and six months ended June 30, 2022 and 2021

For the three months ended June 30, 2022, the Company reported net income of $94.5 million, or basic and diluted income of $7.27 per share and $5.77 per share, respectively. In the comparable quarter of 2021, the Company reported net income of $9.2 million, or basic and diluted income of $0.76 per share and $0.74 per share, respectively.

For the three months ended June 30, 2022, the Company reported adjusted net income of $81.6 million, which excludes unrealized gains on derivative instruments of $12.8 million, or basic and diluted adjusted net income of $6.28 per share and $4.98 per share, respectively. In the comparable quarter of 2021, the Company reported adjusted net income of $40.3 million, which excludes unrealized losses on derivative instruments of $31.0 million, or basic and diluted adjusted net income of $3.31 per share and $2.63 per share, respectively.

For the six months ended June 30, 2022, the Company reported net income of $147.5 million, or basic and diluted income of $11.36 per share and $9.01 per share, respectively. In the comparable period of 2021, the Company reported net income of $19.1 million, or basic and diluted income of $1.60 per share and $1.58 per share, respectively.

For the six months ended June 30, 2022, the Company reported adjusted net income of $146.1 million, which excludes unrealized gains on derivative instruments of $1.4 million, or basic and diluted adjusted net income of $11.26 per share and $8.93 per share, respectively. In the comparable period of 2021, the Company reported adjusted net income of $49.6 million, which excludes unrealized losses on derivative instruments of $30.5 million, or basic and diluted adjusted net income of $4.15 per share and $3.31 per share, respectively.

Revenues, net

Revenues, net for the three months ended June 30, 2022 were $198.7 million compared to $129.9 million in the comparable quarter in 2021. The increase in revenues was primarily attributable to higher charter rates as a result of the market recovery with increase in demand for drybulk products and an increase in available days due to an increase in owned days and chartered-in days.

Revenues, net for the six months ended June 30, 2022 and 2021 were $383.1 million and $226.4 million, respectively. The increase in revenues was primarily due to higher charter rates and an increase in available days due to an increase in owned days and chartered-in days.

Voyage expenses

Voyage expenses for the three months ended June 30, 2022 were $36.3 million compared to $24.5 million in the comparable quarter in 2021. The increase in voyage expenses was primarily due to an increase in bunker consumption expense as bunker fuel prices increased in the second quarter, an increase in port expenses and an increase in broker commission expense.

Voyage expenses for the six months ended June 30, 2022 were $79.9 million and $51.1 million in the comparable period in 2021. The increase in voyage expenses was primarily due to an increase in bunker consumption expense as bunker fuel prices increased in the current year compared to prior year, an increase in port expenses and an increase in broker commission expense.

Vessel operating expenses

Vessel operating expenses for the three months ended June 30, 2022 were $27.2 million compared to $23.7 million in the comparable quarter in 2021. The increase in vessel operating expenses was primarily attributable to higher owned days as well as an increase in crew expenses due to an increase in crewing costs, crew changes and expenses related to COVID-19 and the war in Ukraine. The Company also continues to face general inflationary pressures particularly impacting the cost of lubes, stores and spares. The ownership days for the three months ended June 30, 2022 and 2021 were 4,823 and 4,511, respectively.

Average daily vessel operating expenses excluding one-time, non-recurring expenses related to vessel acquisitions and charges relating to a change in the crewing manager on some of our vessels for the three months ended June 30, 2022 were $5,584 as compared to $5,020 for the three months ended June 30, 2021.

Vessel operating expenses for the six months ended June 30, 2022 and 2021 were $55.1 million and $45.2 million, respectively. The increase in vessel operating expenses was primarily attributable to higher owned days as well as an increase in crew expenses due to an increase in crewing costs, crew changes and expenses related to COVID-19 and the war in Ukraine. The Company also continues to face general inflationary pressures particularly impacting the cost of lubes, stores and spares. The ownership days for the six months ended June 30, 2022 and 2021 were 9,593 and 8,710, respectively.

Average daily vessel operating expenses excluding one-time non-recurring expenses related to vessel acquisitions and charges relating to a change in the crewing manager on some of our vessels for the six months ended June 30, 2022 and 2021 were $5,702 and $4,959, respectively.

Charter hire expenses

Charter hire expenses for the three months ended June 30, 2022 were $21.3 million compared to $6.2 million in the comparable quarter in 2021. The increase in charter hire expenses was principally due to an increase in chartered-in days as the Company took delivery of its fifth long term chartered-in vessel during the second quarter, and an increase in charter hire rates due to improvement in the charter hire market. The total chartered-in days for the three months ended June 30, 2022 were 1,142 compared to 497 for the comparable quarter in the prior year. The Company currently charters in five Ultramax vessels on a long-term basis as of the charter-in commencement date, with options to extend the charter period.

Charter hire expenses for the six months ended June 30, 2022 were $44.0 million compared to $14.6 million in the comparable period in 2021. The increase in charter hire expenses was primarily due to an increase in charter hire rates due to improvement in the charter hire market and an increase in the number of chartered-in days. The total chartered-in days for the six months ended June 30, 2022 and 2021 were 2,102 and 1,155, respectively.

Depreciation and amortization

Depreciation and amortization expense for the three months ended June 30, 2022 and 2021 was $15.3 million and $13.1 million, respectively. Total depreciation and amortization expense for the three months ended June 30, 2022 includes $11.9 million of vessel and other fixed asset depreciation and $3.4 million relating to the amortization of deferred drydocking costs. Comparable amounts for the three months ended June 30, 2021 were $11.0 million of vessel and other fixed asset depreciation and $2.1 million of amortization of deferred drydocking costs. The increase in depreciation expense is due to the acquisition of nine vessels in 2021, offset by the sale of one vessel in the third quarter of 2021. The increase in amortization of deferred drydock costs is related to completing fourteen drydocks since the second quarter of 2021.

Depreciation and amortization expense for the six months ended June 30, 2022 and 2021 was $29.8 million and $25.6 million, respectively. Total depreciation and amortization expense for the six months ended June 30, 2022 includes $23.6 million of vessel and other fixed asset depreciation and $6.3 million relating to the amortization of deferred drydocking costs. Comparable amounts for the six months ended June 30, 2021 were $21.5 million of vessel and other fixed asset depreciation and $4.1 million of amortization of deferred drydocking costs. The increase in depreciation expense is due to the acquisition of nine vessels in 2021, offset by the sale of one vessel in the third quarter of 2021. The increase in amortization of deferred drydock costs is related to completing fourteen drydocks since the second quarter of 2021.

General and administrative expenses

General and administrative expenses for the three months ended June 30, 2022 and 2021 were $9.9 million and $7.9 million, respectively. General and administrative expenses include stock-based compensation of $1.6 million and $0.6 million for the three months ended June 30, 2022 and 2021, respectively. The increase in general and administrative expenses was mainly attributable to an increase in consulting expenses, compensation and benefits, and stock-based compensation expense.

General and administrative expenses for the six months ended June 30, 2022 and 2021 were $19.9 million and $15.6 million, respectively. General and administrative expenses include stock-based compensation of $3.1 million and $1.5 million for the six months ended June 30, 2022 and 2021, respectively. The increase in general and administrative expenses was primarily attributable to an increase in consulting expenses, compensation and benefits, and stock-based compensation expense.

Other operating expense

Other operating expense for the three months ended June 30, 2022 and 2021 was $0.04 million and $0.6 million, respectively. In March 2021, the U.S. government began investigating an allegation that one of our vessels may have improperly disposed of ballast water that entered the engine room bilges during a repair. The Company posted a surety bond as security for any fines, penalties or associated costs that may be issued. Other operating expense consists of expenses relating to the incident, which include legal fees, surety bond expenses, vessel off-hire, crew changes and travel costs.

Other operating expense for the six months ended June 30, 2022 and 2021 was $0.2 million and $1.5 million, respectively.

Interest expense

Interest expense for the three months ended June 30, 2022 and 2021 was $4.3 million and $8.8 million, respectively. The decrease in interest expense is primarily due to a decrease in outstanding debt and lower interest rates due to the refinancing of the Company’s debt in the fourth quarter of 2021.

Interest expense for the six months ended June 30, 2022 and 2021 was $8.8 million and $17.1 million, respectively. The decrease in interest expense was primarily due to a decrease in outstanding debt and lower interest rates due to the refinancing of the Company’s debt in the fourth quarter of 2021.

The Company entered into interest rate swaps in October 2021 to fix the interest rate exposure on the Global Ultraco Debt Facility term loan. As a result of these swaps, which average 87 basis points, the Company’s interest rate exposure is fully fixed insulating the Company from the rising interest rate environment.

Realized and unrealized (gain)/loss on derivative instruments, net

Realized and unrealized gain on derivative instruments, net for the three months ended June 30, 2022 was $9.9 million compared to a realized and unrealized loss on derivative instruments, net of $35.9 million for the three months ended June 30, 2021. The $9.9 million gain is primarily related to $7.6 million in gains earned on our freight forward agreements as a result of the decrease in charter hire rates during the second quarter and $2.3 million in bunker swap gains for the three months ended June 30, 2022. For the three months ended June 30, 2021, the Company had $37.2 million in losses on our freight forward agreements due to the sharp increase in charter hire rates during the second quarter of 2021, and $1.3 million in bunker swap gains.

Realized and unrealized gain on derivative instruments, net for the six months ended June 30, 2022 was $2.0 million compared to a realized and unrealized loss on derivative instruments, net of $36.6 million for the six months ended June 30, 2021. The $2.0 million gain is primarily attributable to $6.9 million in bunker swap gains, offset by $4.9 million in losses incurred on our freight forward agreements as a result of the increase in charter hire rates in the current year. For the comparable period in the prior year, the Company had $38.9 million in losses on our freight forward agreements due to the sharp increase in charter hire rates in 2021, and $2.3 million in bunker swap gains. The non-cash unrealized losses on forward freight agreements (“FFA”) for the remaining six months of 2022 amounted to $1.1 million based on 3,045 days hedged at a weighted average FFA contract price of $22,893 per day.

The following table shows our open positions on FFAs as of June 30, 2022:

As of June 30, 2022, our cash and cash equivalents including restricted cash was $141.5 million compared to $86.2 million as of December 31, 2021.

In addition, as of June 30, 2022, we had $100.0 million in an undrawn revolver facility available under the Global Ultraco Debt Facility.

As of June 30, 2022, the Company’s outstanding debt of $376.8 million, which excludes debt discount and debt issuance costs, consisted of $262.7 million under the Global Ultraco Debt Facility and $114.1 million under the Convertible Bond Debt.

We continuously evaluate potential transactions that we believe will be accretive to earnings, enhance shareholder value or are in the best interests of the Company, including without limitation, business combinations, the acquisition of vessels or related businesses, repayment or refinancing of existing debt, the issuance of new securities, share repurchases or other transactions.

Capital Expenditures and Drydocking

Our capital expenditures relate to the purchase of vessels and capital improvements to our vessels, which are expected to enhance the revenue earning capabilities and safety of the vessels.

In addition to acquisitions that we may undertake in future periods, the Company’s other major capital expenditures include funding the Company’s program of regularly scheduled drydocking necessary to comply with international shipping standards and environmental laws and regulations. Although the Company has some flexibility regarding the timing of its drydocking, the costs are relatively predictable. Management anticipates that vessels are to be drydocked every two and a half years for vessels older than 15 years and five years for vessels younger than 15 years. Funding of these requirements is anticipated to be met with cash from operations. We anticipate that this process of recertification will require us to reposition these vessels from a discharge port to shipyard facilities, which will reduce our available days and operating days during that period.

Drydocking costs incurred are deferred and amortized to expense on a straight-line basis over the period through the date of the next scheduled drydocking for those vessels. In the six months ended June 30, 2022, seven of our vessels completed drydock and we incurred drydocking expenditures of $16.1 million. In the six months ended June 30, 2021, four of our vessels completed drydock and we incurred drydocking expenditures of $6.4 million.