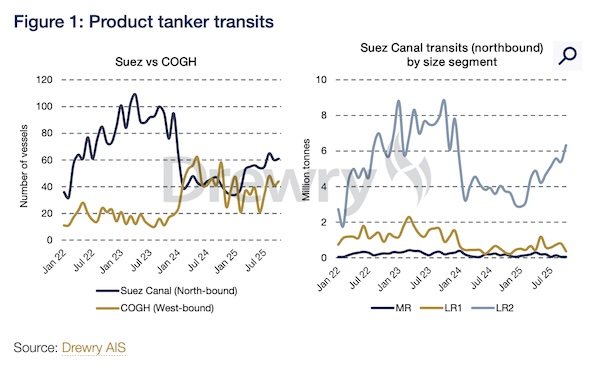

Following the escalation of conflict in Yemen in late 2023, many product tankers began re-routing via the Cape of Good Hope (COGH) instead of using the Suez Canal, with the most pronounced effects felt in the LR tanker segment. This increased the Middle East to Northwest Europe diesel voyage by roughly 4,700 nautical miles. The longer COGH route added more than 30 round-voyage days for LR tankers on this trade, absorbing additional tonnage and supporting higher freight rates.

The rise in transportation costs also altered trade patterns. Europe’s diesel imports from North America increased in 2024, partly displacing flows from Asia. Yet, despite higher freight costs, Middle Eastern diesel remained competitive in the European market, keeping Middle East–Europe diesel trade volumes stable through 2024.

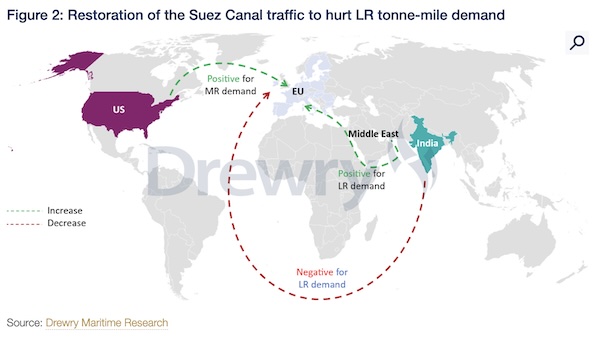

Although Drewry’s investigation into oil tanker transits through the Suez Canal indicates a gradual improvement in the share of product tankers transiting the Canal in recent months, especially after the ceasefire in Gaza, a possible complete restoration of the traffic to pre-crisis levels will further hurt the tonne-mile demand for product tankers, in turn squeezing rates.

Suez Canal reopening to impact EU-ETS

A sharp reduction in voyage duration from 82 days via the COGH to around 50 days through the Suez Canal will not only enhance tonnage availability in the LR tanker market but also lower EU-ETS costs for shippers. Based on our estimates, the EU-ETS cost for LR tankers on the Jubail–Rotterdam route in 2026 would fall to about USD 129,000 via the Suez Canal, compared with roughly USD 215,000 when routed through the COGH.

Shorter voyages and reduced ETS liabilities could encourage greater use of the Canal for East–West (and West–East) refined product flows, provided the security situation in the Red Sea stabilises. At the same time, Europe’s upcoming restrictions on refined products processed from Russian crude are expected to curb the region’s diesel imports from India in 2026. This will likely shift incremental demand back towards Middle Eastern suppliers especially if Suez Canal traffic normalises.

Source: Drewry