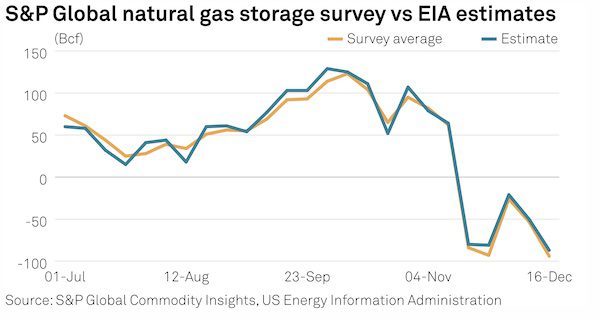

The US Energy Information Administration reported an 87 Bcf withdrawal from working underground natural gas storage for the week ended Dec. 16, marking the third straight week in which withdrawals have fallen short of historical norms.

The 87-Bcf draw is smaller than the five-year average drawdown of 124 Bcf for the corresponding week and brings total US gas inventories to 3.325 Tcf—a 0.7% surplus to the five-year average for this time of year. Weekly withdrawals have trailed the five-year average for three consecutive weeks, bringing inventories back to a surplus for the first time since mid-January, according to EIA data.

The 87 Bcf estimated withdrawal for the Dec. 16 week fell short of industry expectations. S&P Global Commodity Insights’ weekly survey of gas market analysts yielded a 94 Bcf consensus forecast withdrawal for the week.

Cold weather-linked demand across much of the Lower-48 states propelled gas storage withdrawals across the Dec. 16 week. S&P Global data shows heating-driven gas demand in the US residential-commercial area rose by 19% in the Dec. 16 week compared to the previous week to 43.7 /d. An uptick in LNG feedgas demand also contributed to an overall 7% week-on-week increase in total US gas demand, to 118.6 /d.

Market reaction

Gas futures markets have brushed off a stretch of brutally cold weather observed across much of the US in recent days, with prompt-month prices hovering around $5/MMBtu despite sub-freezing temperatures in multiple regions. Concerns over the health of the global economy, high US gas production, and a delayed restart at Freeport LNG in Texas have all contributed to softer prices, despite higher residential-commercial gas demand recently seen in a few regions in the US.

The slighter-than-expected net withdrawal reported by the EIA exerted bearish pressure on futures pricing in early Dec. 22 trading, with the Henry Hub January futures contract shedding around 33 cents before settling at $/MMBtu on session close, according to CME Group data.

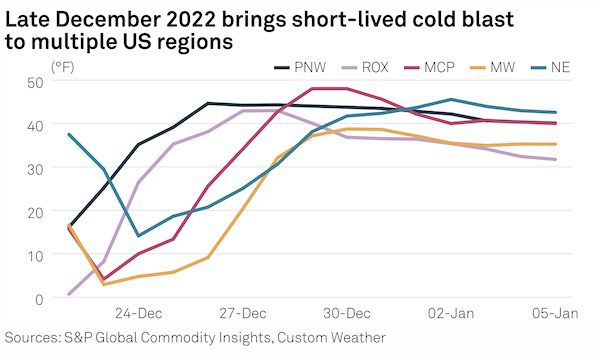

Skyrocketing res-comm demand and weather-related impacts on production have created conditions for an upward swing in spot gas pricing at key hubs this week, but futures markets may expect the recent tightness to be a short-lived phenomenon. Forecasts from weather data provider CustomWeather project an ongoing stretch of single-digit temperatures in the Midwest, Midcontinent, and Rockies to end following Dec. 26, potentially offering some relief to the recent gas demand surge in the res-comm sector.

Outlook

Short-lived or not, the recent stretch of nasty weather hitting much of the country is still expected to stoke robust withdrawals from storage across the week in progress. For the week ending Dec. 23, S&P Global forecasts a 201 Bcf withdrawal from US working gas stocks, nearly double the 106 Bcf withdrawal recorded for the corresponding week over the last five years.

But some market watchers expect that robust withdrawal demand could subside across the following week, in part because of declining industrial gas demand coinciding with the Christmas holiday.

“Everybody is concerned about these chilling temperatures that are going to take place across wide swaths of the country, especially those that typically don’t see freezing temperatures, let alone single-digit temperatures,” Nina Fahy, director of energy and resources at consultancy Baringa, told S&P Global in a Dec. 22 interview. “However, the timing as far as price formation is concerned is particularly interesting because heading into any holiday or into a weekend we typically see lulls in demand.”

Fahy added that futures markets have likely already accounted for weather-related impacts on production in key gas-producing pads in Texas, New Mexico, Oklahoma, Colorado, and the Bakken.

“I would peg total visible [production] impacts today north of 3 /d, but I also think that that is likely something that the market has already priced in,” Fahy said Dec. 22.

Total US dry gas production has averaged 96.6 /d across the seven-day period ended Dec. 22, a 900 /d decrease from the prior week, according to S&P Global data. Production losses in the Bakken have been most dramatic over that period, with production dropping to a 1.64 /d average over the seven-day period ending Dec. 22, a roughly 300 /d dip compared to the prior week.