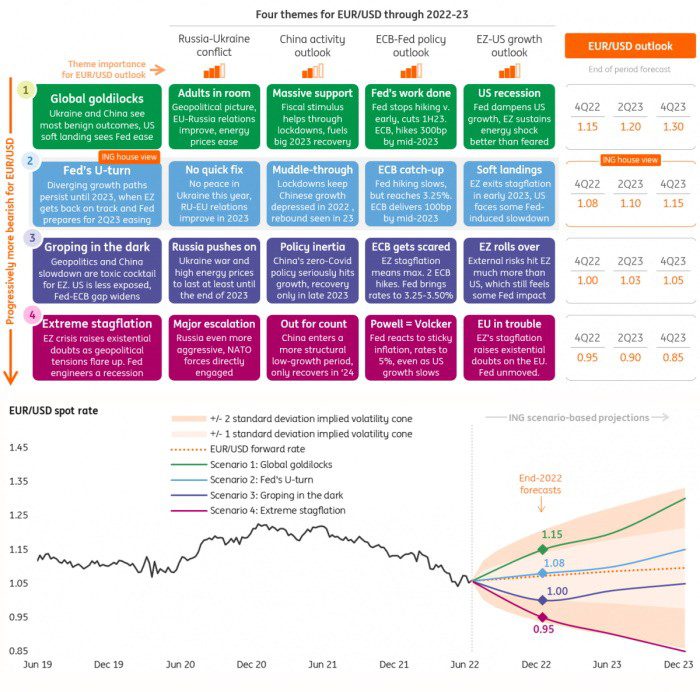

Four potential paths for /USD into 2023

Making the correct call on /USD over the next 18 months will depend on four key drivers:

• The Russian-Ukraine war and what it means for European growth and the commodity supply shock

• Chinese growth and what it means for global demand and the global supply chain shock

• The Fed-ECB policy trade-off and to what degree it pushes differentials wider still

• US-eurozone growth prospects and what it means for global equity and FDI flows

Below we outline four scenario paths for /USD into the end of 2023. We have generated the possible range of /USD end-2023 outcomes using expected volatility embedded into current FX options market pricing. The extreme ranges for end-2023 /USD levels, 1.30 under Scenario 1 and 0.85 under Scenario 4 derive from the two standard deviation outcomes.

Of the four scenarios presented, Scenario 2, ‘Fed’s U-turn’ is our baseline scenario. Given that Fed policy has been such a large driver of dollar pricing since June 2021, when Fed dot plots suggested the central bank would be normalising policy after all, a Fed shift from hiking in 2022 to cutting in 2023 should take some upside pressure off the dollar. We look for a weak /USD rally through 2023 as the Fed eases and some of the headwinds to growth, including China, abate.

Briefly discussing extremes, the most bullish /USD story (1.30) is one of global growth recovering (somehow) in 2023 at a time when the Fed feels it can cut rates back to more neutral levels near 2.00%. The most bearish /USD scenario is an early 1980s-style stagflation, where the Fed needs to continue hiking aggressively even as the global economy enters a recession. This reopens friction within the eurozone.

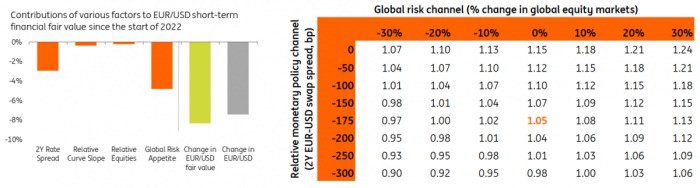

Financial fair value: Where rate spreads and equities can drag /USD

Above, we have outlined some stylised scenarios of where major drivers could place /USD over the next 18 months. Quantitatively, we do not think /USD is particularly cheap on a medium-term fundamental basis. But other shorter-term techniques also have a quantitative say in /USD pricing. Here, we use a financial fair value model to identify short-term fair value for /USD.

Typically, factors like two-year EUR-USD swap spreads or the equity environment have two of the highest betas in the model. As shown in the left-end chart below, these two factors explain nearly all the drop in /USD fair value since the start of 2022, while the other two inputs in the model – the relative shape of the yield curve and relative equity performance – have had a negligible impact, displaying considerably lower betas in the model.

In the right-end chart below, we present a matrix of swap spreads versus equity outcomes – which, as discussed, are the main drivers of /USD – to provide some flavour as to where /USD could be trading under very different market conditions.

It must be noted that this matrix looks at short-term dynamics, and its explanatory power over the medium term – i.e. beyond 12 months – would decrease substantially as other (longer-term) factors would start to play a bigger role.

The purpose of this matrix is to provide an indication of what combination of ECB-Fed monetary policy differential and global risk environment would be required to trigger some sizeable moves in /USD over the next 12 months.

In the scenario analysis outlined at the start of this article, we considered the “global Goldilocks” scenario as the most optimistic for /USD, with the pair reaching 1.20 in the next 12 months. As shown in the matrix, that would require both a rebound in global equities beyond the January 2022 peak (+30%) and a complete erosion of the ECB-Fed policy differential.

In the other extreme scenario (“extreme stagflation”), we implied a move to 0.90 by 2Q23. This would require a significant repricing higher in the Fed’s policy path relative to the ECB’s, as well as a further drop in global equities to the levels last seen in the spring of 2020.

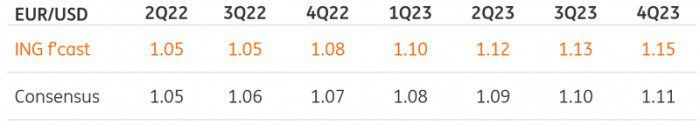

In our base-case scenario (“Fed’s U-turn”), a return to 1.08 is achievable via a gradual recovery in risk sentiment and a stabilisation in the short-term rate differentials around current levels. Below are the details of our current quarterly forecasts.