Bye bye Suez Canal? Has the time come for the Arctic route as an alternative passage for freight transport between Asia and Europe? Are the Mediterranean and Italian ports really at risk of losing their centrality?

The issue has forcefully returned to the center of debate in recent days because on the coming September 20th, a cargo ship is set to depart from the Chinese port of Qingdao bound for Europe, but not via the Red Sea or by circumnavigating Africa, but rather by sailing the Arctic route. This is a China – Europe service called China – Europe Arctic Express and operated by Haijie Shipping Company with the ship Istanbul Birdge, at almost 5,000 TEU, which has already traveled this route from west to east. More precisely, the rotation is expected to involve the ports of Ningbo-Zhoushan, Qingdao, Shanghai in Asia and Felixstowe, Rotterdam, Hamburg, and Gdansk in Europe.

The Lloyd’s Maritime Institute training center commented on the news, highlighting the difference in transit time (18 days versus 28 days via Suez), the possibility of avoiding the unsafe area of the Red Sea, and the future potential of plying the Arctic route thanks to the waterway created by icebreaker ships.

On the topic, Robertà Cippà, head of the Swiss shipping company Cippà Trasporti based in Lugano, also weighed in (via LinkedIn), calling it “a revolution. One of those that doesn’t cause deaths, or too much noise. But that will certainly make victims.” Regarding the Arctic route, he states that, despite having been “tested several times in recent months, now, for the first time, it will host a regular transport service. It is a Copernican revolution, determined by three factors: with the melting of the ice due to global warming, the Arctic route is more easily navigable; the journey is shorter (18 days versus 28); the risk of encountering Houthi pirates or terrorists is zero.”

Cippà even goes so far as to hypothesize some possible consequences: “The ports of Hamburg and Antwerp will become even more central in the Eurasian logistics chessboard, as will the Scandinavian ports. The ports of the Mediterranean, on the contrary, will become residual.” A novelty, in short, but also new questions: “On medium-to-long-term sustainability (in winter, icebreakers will be needed); on the capacity of Northern European ports to absorb and distribute even more goods; on the conversion of Mediterranean ports, called to truly systemize to avoid gradually fading away.”

But what are the real risks and opportunities of this new waterway through the far northern seas today? A first answer can be found in the numbers published by the Centre for High North Logistics, a Norwegian public-private foundation that monitors water conditions and merchant transits in the Arctic region by analyzing ships’ AIS tracks.

This center has detected so far this year, from June to the end of August, a total of 52 voyages, of which 17 are completed, 10 are in the process of being completed, 12 are currently underway in the North Sea Route area, and 13 voyages have recently begun.

In terms of direction, the ships undertaking these voyages are distributed quite evenly: 28 ships are headed east and 24 are headed west.

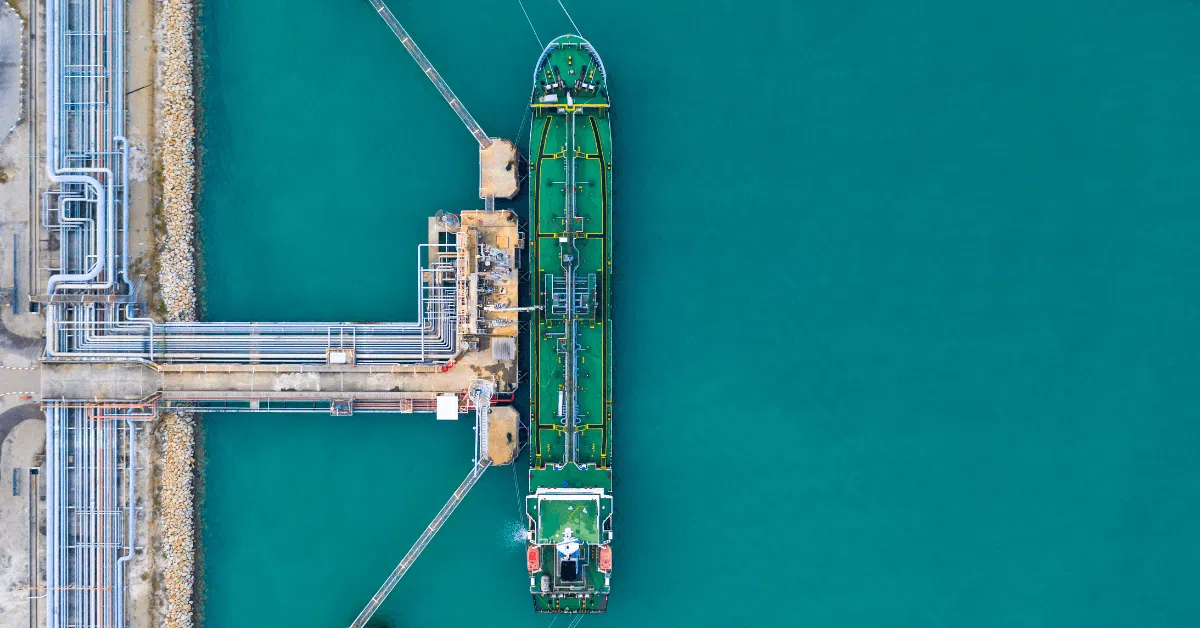

Regarding the vessel types, the passage of 13 tankers, 10 bulk carriers, 10 container ship voyages, 9 general cargo ship voyages, 2 LNG tanker voyages, 2 research vessels, 5 fishing vessels, and 1 refrigerated cargo ship voyage was recorded. According to estimates from the Centre for High North Logistics, 25 ships sailed in ballast, while 27 were carrying cargo. The total estimated volume of cargo at this stage could amount to approximately 1.3 million tons from June to the end of August. The destination ports have always been Russian ports in the Baltic Sea or the Barents Sea.

Based on these findings, the Centre for High North Logistics concludes that the main flow of transit goods in 2025, as in 2024, will be eastbound, from Russia to China. The most transported cargo is crude oil (54% of the total in terms of tonnage), followed by dry bulk (21%) and other types such as general cargo, LNG, and refined products (14%). Container transport has so far accounted for only about 11%, although an increase in unitized cargo traffic on the North Sea Route has been observed this year. Westbound shipments represent only about 3% of the total estimated cargo volume.

The coming months (September, October, and for some vessel types, even November) represent the active period for transits in the Arctic seas.

To date, no Western shipping company has tried the Arctic route, with the exception of Maersk, which in 2018 explored northern navigation between the ports of Vladivostok and St. Petersburg with the 3,500 TEU vessel Venta Maersk. This test remained an isolated episode for the Danish carrier.