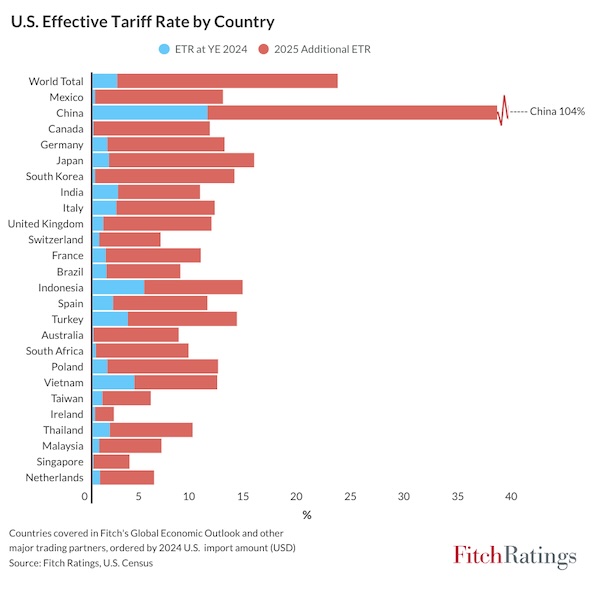

The current U.S. effective tariff rate (ETR) of 22.8% will undoubtedly fluctuate as tariff policy is modified, Fitch Ratings says. The ETR increased sharply from 2.3% earlier this year before Trump began raising tariffs in March. It will rise further if current carveouts are tariffed, reciprocal rates are reinstated, or additional tariffs are imposed on trading partners and targeted sectors.

Fitch has developed an interactive tariff tool, the U.S. Effective Tariff Rate Monitor, to calculate the ETR on imports from all U.S. trading partners and quantify current duties. The ETR calculation considers exclusions like carveouts for oil and gas, copper, and pharmaceutical imports. The tool will be updated whenever significant changes in U.S. tariff policy occur.

The spreadsheet allows users to adjust tariff calculations, such as changing reciprocal rates and import amounts, to create hypothetical tariff scenarios.

For example, an additional 25% tariff on pharmaceuticals and electronics would increase the U.S. ETR to 27.2% from 22.8%. The ETR represents total duties as a percentage of total imports and changes with shifts in import share by country of origin and product mix.

The ETR for China is the highest at 103.6%. Japan, Mexico, Canada and Germany, which have the next highest exports to the U.S., have ETRs exceeding 10.5%.

The tool also separately calculates the United States-Mexico-Canada Agreement (USMCA) tariff and duty estimates for Canada and Mexico, incorporating the 10% tariff on potash and oil and gas, as well as carveouts of the U.S. content in autos and USMCA-compliant auto parts.

If import volumes and the country and product mix remain unchanged, the U.S. will collect approximately $748 billion in duties in 2025, which is equal to about 2.5% of GDP. Nevertheless, we anticipate lower import volumes, due to the effect of higher prices on demand, will reduce this figure.

Fitch has sharply lowered its world GDP growth forecast to 1.9% from 2.9% in 2024 in response to increased trade protectionism.

Source: Fitch Ratings