The Atlanta-based company experienced 30% year-over-year (y/y) increases in revenue the previous two quarters.

Adjusted earnings per share (EPS) grew 32% from $3.15 in the first quarter of 2021 to $4.17 in Q2 of 2022. Fleetcor’s retention rate remained steady at 92% while net income increased to $262 million in the second quarter, a 34% y/y rise.

“We continue to satisfy and retain clients,” Clarke said.

“The Accrualify acquisition provides workflow and process automation software that AP [accounts payable] departments are looking for and rounds out our ‘process to execution’ AP payment solution set,” Clarke said. “We expect this capability to increase demand and revenue per client for our corporate payments product line.”

During the earnings call, Clarke described Q2 results as “frankly outstanding.” He said the company boasted more than 50,000 new accounts on the books in the second quarter.

“We are adjusting our guidance to reflect our second-quarter outperformance and our updated outlook,” Clarke said. “Our preliminary July results remain positive and support our guidance for the second half of the year.”

Q3 outlook

Fleetcor expects third-quarter revenues to fall between $870 million and $890 million. It predicted adjusted EPS between $4.15 and $4.25.

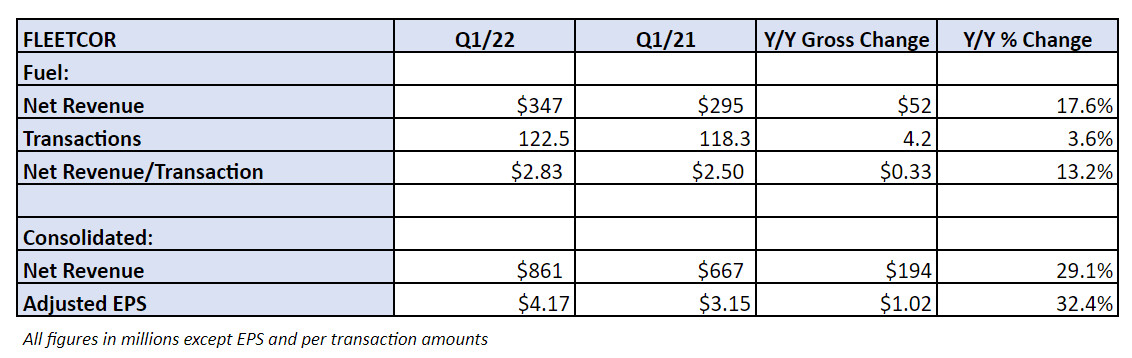

Table: Fleetcor’s key performance indicators

Table: Fleetcor’s key performance indicators