India will likely see robust growth in oil product demand in the second quarter, led by wedding season, summer holiday travel and agricultural activity, however, uncertainty related to trade policies and tariffs could cast a shadow on exports, analysts and trade sources told Platts.

The 10-month high domestic oil products consumption seen in March will likely spill over to subsequent months, as easing global crude values would help bring down domestic retail fuel prices and support sales, analysts and sources said.

India’s demand for oil products is expected to grow by more than 100,000 b/d in the April-June quarter, compared with the same quarter a year earlier, according to data from S&P Global Commodity Insights. While diesel consumption is expected to grow by 70,000 b/d in Q2 from a year ago, gasoline demand is anticipated to grow by more than 55,000 b/d in the quarter.

“The growth is being driven by continued strength in manufacturing and construction activities, while agricultural activities typically increase during this period as well. While summer holidays and the wedding season in India are expected to boost gasoline demand, the ongoing heat wave conditions in northern and northwestern India are leading to higher usage of oil products,” said Himi Srivastava, principal oil research analyst for South Asia at Commodity Insights.

Support from transport fuels

Additional support for oil product demand is expected to come from the aviation sector, which continues to show resilience as domestic and international travel grows amid summer vacations and wedding festivities, she added.

“This will prompt refiners to keep runs at a high level in the quarter,” said an Indian refining source.

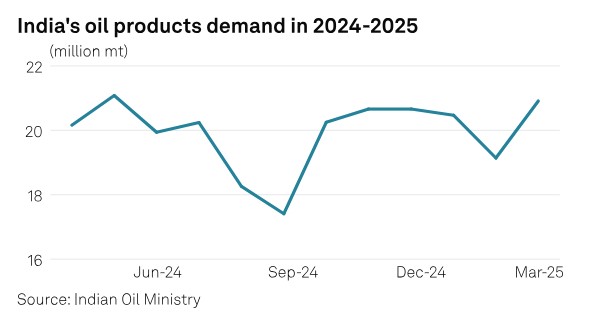

India’s monthly demand for oil products rose 9.3% to 20.91 million mt (5.3 million b/d) in March, while it fell 3.1% from a year ago, data from the oil ministry’s Petroleum Planning and Analysis Cell showed. In March, demand for diesel and gasoline rose 10% and 10.6% month over month, respectively, while it was up 0.9% and 5.7% year over year.

“India’s oil demand might get influenced in the short run by uncertainty in the global markets due to tough US trade decisions, including imposing tariff rates for various countries,” an oil ministry official said.

Global trade uncertainties will likely pressure some oil products, with the most significant impact expected on diesel due to the potential direct impact on export-oriented industries, mainly in the second half of the year, according to Commodity Insights. The risks are further skewed to the downside if reciprocal tariffs come into effect after 90 days or if new policies emerge.

“For India, the relatively higher effective tariffs on its regional competitors and the ongoing bilateral trade agreement discussions with the United States are expected to mitigate the initial impact of the 26% reciprocal tariff,” Srivastava said.

India, the world’s third-biggest crude importer, meets over 85% of its domestic crude oil requirements via overseas purchases. In 2024, India’s oil product demand rose 3.9% year over year to 240 million mt, or 5.1 million b/d, data from the Petroleum Planning and Analysis Cell showed.

Lower prices to aid demand

Weakening global demand is likely to exert further downward pressure on energy and food prices — assuming no major weather disruptions occur — which would help control domestic inflation and provide additional room for monetary policy support, Srivastava added.

“Falling crude oil prices would undoubtedly be a positive development for India. With over 85% of its crude requirements coming through imports, lower oil prices are expected to ease inflationary pressures and offer broad-based support to the economy,” said Rajat Kapoor, managing director for oil and gas at Synergy Consulting.

The sweeping reciprocal tariffs announced by the US government on April 2, followed by China’s retaliatory levies against US imports, along with other trade uncertainties, sent Platts Dated Brent to its lowest level since April 2021. Prices hit $63/b on April 9 before recovering to $68/b recently.

Commodity Insights expects Platts Dated Brent to average $68/b for the year under the preliminary base-case scenario, notably lower than the average Platts Dated Brent price of $81/b for 2024. This trend is expected to continue into 2026.

On April 3, OPEC+ said it would hike output in May far more than previously signaled. Looking ahead, Commodity Insights expects global oil and liquids production to grow faster than global oil demand this year, exerting downward pressure on prices.

“Oil prices may soften further as the global impact of trade wars deepens, progress is made in nuclear negotiations between the US and Iran, and OPEC+ is expected to significantly hike output starting in May. This would lead to further softening of crude prices and if this benefit is passed on to consumers, lower fuel prices could help consumption at the local level,” Kapoor said.

Source: Platts