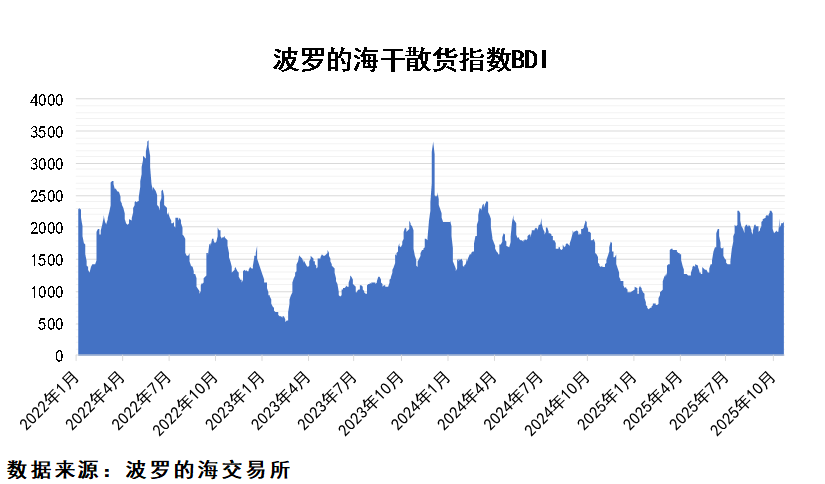

As of October 22, 2025, the Baltic Dry Index (BDI) closed at 2092 points, an increase of 169 points from October 9, representing a gain of 8.79%. Among the components, the Capesize Index (BCI) rose by 373 points, or 13.39%, and the Panamax Index (BPI) increased by 174 points, or 10.06%.

In the iron ore market, seaborne ore shipments increased by 1.26 million tons month-on-month to 33.335 million tons, remaining at a high level compared to the same period in recent years. Arrivals of iron ore at domestic ports saw a decline. On the demand side, daily hot metal production decreased by 5,900 tons month-on-month to 2.4095 million tons, indicating a continued slight decline in hot metal output, while steel mill profit margins continued their downward trend. After the holiday, the apparent demand for the five major steel products rebounded month-on-month but still remained below the levels of previous years during the same period. Production saw a slight decrease, inventories declined somewhat, and overall terminal demand remained relatively weak. In summary, there are expectations of increased supply in the iron ore sector, while terminal demand remains weak, posing a risk of a weakening fundamental outlook for iron ore. Additionally, the ongoing Sino-US trade disputes still carry significant uncertainty. It is expected that iron ore prices will fluctuate.

In the coal market, a complex pattern has emerged, characterized by “widespread price declines at production areas, a slight rebound in port coal prices, and stable import coal prices.” In the short term, coal prices are under some pressure due to stable supply from production areas and relatively weak demand. Regarding imported coal, prices have remained stable, influenced by the rainy season in Indonesia and domestic safety regulations. With the gradual release of winter heating demand and growing expectations of supply contraction, coal prices are expected to experience a phased increase.

In the grain market, comprehensive suspension of purchases of U.S. soybeans has been in effect since May 2025, with a shift towards expanding imports from South America. China’s share of soybean imports from the United States has decreased from 24.7% to less than 10%. However, recent offers for Brazilian soybeans to China have been soaring, with the unit price for some varieties approaching $3 per bushel, showing a significant difference compared to U.S. soybean prices.

This article was compiled and edited by “Zhejiang Paichuan Wang Shipping Exchange Co., Ltd.” Please indicate the source when reposting. Some narratives or data in the article are from public information. If there are any inaccuracies, please contact us, and we will promptly revise or delete them.