Marco Polo Marine Ltd., a reputable regional integrated marine logistics company, is pleased to announce its financial results for the financial year ended 30 September, 2022 (“FY2022”).

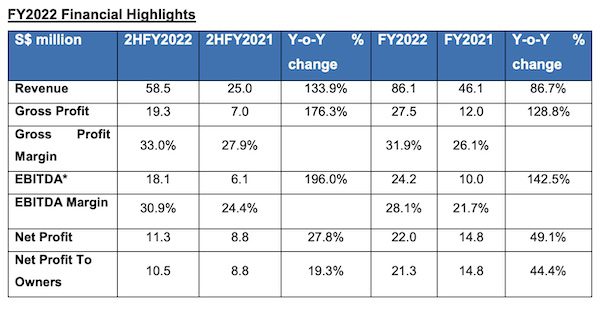

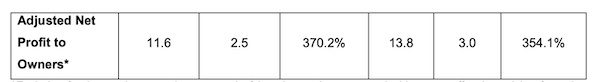

2HFY2022 Net profit jumped more than 20% y-o-y to S$11.3 million driven by a doubling in revenue and a significant expansion in gross profit margins. Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) rose 196% y-o-y to S$18.1 million in 2HFY2022. Adjusted net profit to owners for 2HFY2022 surged 370% to S$11.6 million from a year ago. For FY2022, the Group’s EBITDA more than doubled from a year ago to S$24.2 million on the back of an 86.7% increase in revenue. Adjusted net profit to owners also increased more than 300% to S$13.8 million in FY2022.

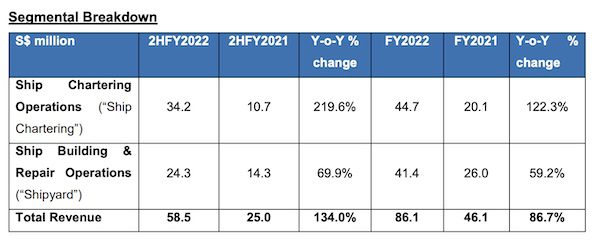

Revenue from ship chartering surged more than 200% to S$34.2 million in 2HFY2022, denoting an increase of 122.3% y-o-y to S$44.7 million in FY2022 from S$20.1 million in FY2021. This increase was mainly as a result of the acquisition of PT BBR and PKRO in March and May 2022 respectively. In addition, the Group recorded higher average utilization rates and charter rates for its fleet of offshore vessels during the year. Revenue from the Group’s shipyard business also rose nearly 70% y-o-y to S$24.3 million in 2HFY2022, and an increase of 59.2% y-o-y to S$41.4 million in FY2022. The surge in revenue was mainly attributed to the increase in contract volume and value of repair projects during the year.

“FY2022 was a monumental year as we accelerated our expansion into the offshore windfarm sector. Our joint venture with Oceanic Crown Offshore Marine Services Ltd. and the acquisition of PKR Offshore Co. Ltd. has cemented our position as one of the leading OSV service providers supporting the offshore windfarms in Taiwan. Together with our growing ship repair business, we have delivered a commendable performance for the year despite a challenging macroeconomic outlook.” said Sean Lee, CEO of Marco Polo Marine.

Moving Forward

The offshore and shipping industries continues to face uncertainties amidst the challenging macroeconomic and geopolitical landscape. The Group will continue to improve its operational efficiency to enhance its competitiveness, as well as accelerate its expansion into the renewable energy sector. For the ship chartering business, the Group will continue to explore opportunities to support the booming offshore windfarm market. In the near term, rising oil prices due to ongoing geopolitical tensions is also expected to positively benefit the Group’s daily charter rates and utilisation rates for its fleet of OSVs.

For the shipyard division, the Group has expanded its dry-docking capacity with the dock 1 extension program, which was completed since 2HFY2022. The Group will continue to focus on securing new ship repair and maintenance orders by expanding its customer base internationally and stepping up its marketing effort to actively engage with ship owners in Indonesia. “As an overall strategy, we are committed to targeting our collective efforts and resources towards meaningful change in the renewables sector. We hope to deepen our push into this space through synergistic partnerships and the addition of new stateof-the-art vessels, including our self-developed commissioning service operation vessel which is currently under construction, to further support the growing demand from offshore windfarm projects.” Mr Lee added.