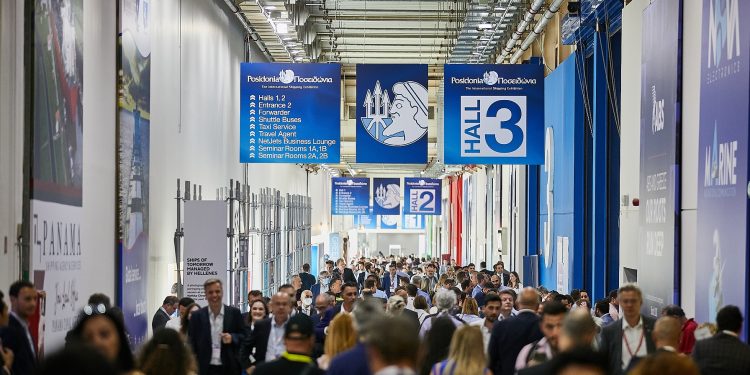

More than 40 marine fuel suppliers from around the world have gathered at this year’s Posidonia during a critical juncture for the US$300billion bunkering market, due to the double whammy of the geopolitical crisis and the uncertainty surrounding the regulatory framework pertaining to the decarbonisation of the shipping industry.

Alexander Prokopakis, CEO of probunkers, said:

Bunkering has been hit from the trickledown effect of the sanctions against Russia, and this of course has had a serious impact on prices. Pre-war, the global prices were around US$750-US$850 per ton, and now we are looking at prices above US$1,000. Since we are in unchartered territory, no one can really predict where the price will end up

His views are shared by another major bunkering player with a strong Greek presence, Baluco. Commercial Manager John Stavropoulos, who added that “the price of oil has doubled, and this has created an extra cost for ship operators because oil and lubricants account for almost 60-70% of the total vessel operational expenses.”

So, the total cost per journey has skyrocketed and that’s not just it. Credit lines for operators have also been impacted as they have to pay double the amount they used to, in order to receive the same volume as they did before the crisis

They both said that demand for bunkering fuel has not been impacted and has in fact increased at ports outside Russia, as the points of supply have been reduced.

In addition to the impact on fuel prices, shipping companies and their customers are facing increased costs due to more expensive lubricants. Major international lubes maker and supplierGulf Oil Marine, says that the price increase varies depending on the market.

According to David Price, Chief Executive Officer, there is “an increase of between 20 and 30 cents per litre, which is roughly a 20% spike,” but he also shared his fear that the world has not seen the end of this pressure on prices.

The war in Ukraine has caused supply issues in the lubes sector as well.According to Gregory Papathanassiou, Director Gulf Oil Marine Hellas, supply has been reduced because of the sanctions on Russia and insists that hard work around the clock is the remedy to ensure and safeguard supply security.

We need to ensure that lubricants are available whenever and wherever our customers need it. It causes a lot of hard work and tension. Of course, there remain many issues, but our aim is to ensure our customers don’t see or face these issues for themselves

He further added that Gulf Oil Marine has recently invested in a blending plant and R&D facility in Singapore to help it stay ahead of the curve, but acknowledges that getting a new lube to market from scratch requires a huge investment and a lot of time as the process for testing and approvals is long.

Nellos Economopoulos, General Manager Valecrest Marine Lubricants, agreed with Mr. Papathanassiou, stressing that “once the number one option for the fuel of the future is agreed upon, we then need to start preparing for it, in order to develop the suitable lubes solutions.”

But as experts say, urgency may not be an issue, as the time when shipping will rid itself from its dependence on fossil fuel is still years ahead.

More specifically, Mr. Prokopakis mentioned that:

My view, as biased as it may be, is that LNG is for now the only viable available commercial solution, and it will remain so for the next 15-25 years. The infrastructure is here, it is readily available, abundant and safe, and its environmental footprint is better than that of oil