Fitch Rating expects a modest recovery in China’s retail sales in 2023, as our base case of less severe Covid-19 pandemic-related controls is likely to underpin a pick-up in discretionary spending. However, the pace of recovery may be slow and volatile, given that our base case assumes many restrictions will remain in place for most of next year.

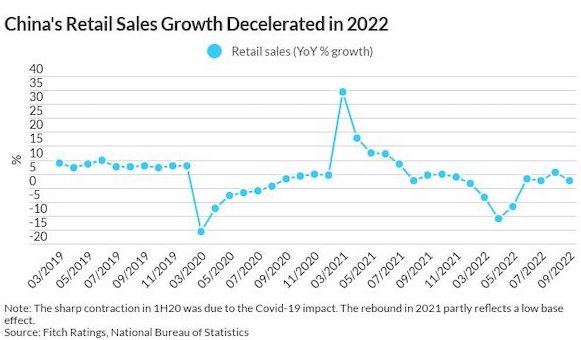

Our base case forecasts mid-single-digit growth in retail sales in 2023, up modestly from a low base in 2022, which was heavily affected by ongoing pandemic restrictions and testing requirements under China’s “dynamic zero-Covid” strategy, most notably in 2Q22.

The rebound is likely to be more muted than in 2021 amid a weaker consumer outlook for employment and household income, which we believe hinges on China’s pandemic-related polices. We assume China will stick with its current approach, with possible finetuning to better target containment measures and reduce economic disruption, as shown in the 20 measures unveiled by central policymakers on 11 November 2022.

A modest pick-up in discretionary spending should benefit sectors that were hit hardest by mobility restrictions and weak consumer sentiment in 2022, such as apparel, cosmetics and restaurants. This will help restore revenue growth to issuers such as hot-pot restaurant chain, Haidilao International Holding Ltd. (/Negative), and department store operator, Golden Eagle Retail Group Limited (/Stable); we expect revenue at the two issuers to decline by 18% and 16% yoy, respectively, in 2022.

Vehicle sales may buck the trend within the discretionary category and register a low-single-digit decline as policy stimulus for traditional internal combustion engine vehicles winds up and price competition on new energy vehicles intensifies. The price competition could also spill over to traditional models and pressure the margins at automakers such as Beijing Automotive Group Co Ltd (/Stable), China FAW Group Co., Ltd. (A/Stable) and Dongfeng Motor Group Company Limited (A/Stable). Traditional automakers’ market shares are at risk because of lagged electrification and strategies to prioritise profit over volume.

We believe growth in retail sales of essential goods, including food and beverages, will remain strong and close to 2022 levels, and may reflect modest inflation as higher-priced raw material inputs are passed through to consumers. However, hog prices could fall on normalisation of hog supply. Higher retail sales could underpin the resilient domestic-business revenue generation at WH Group Limited (/Stable) and Bright Food (Group) Co., Ltd. (A-/Stable), while lower hog prices may pressure the margin of Wens Foodstuff Group Co., Ltd. (/Negative).

Online retail sales are likely to continue outpacing offline sales, but we expect the segment’s market share growth to decelerate, as refinements of pandemic-related mobility restrictions could incentivise offline spending. This would be similar to the reversion noted in 2021 following the initial pandemic impact. Our expectation also recognises our forecast online retail penetration rate of 29% in 2022, which is high in comparison with other countries.

A large deviation from our base case could alter the trajectory of China’s retail sales. An accelerated and consistent loosening of pandemic containment measures could boost economic factors, including reducing unemployment and eventually driving a more robust rebound in consumer sentiment and expenditure in the latter part of 2023 – especially in discretionary items – after an initial period of heightened economic volatility jolted by wider virus circulation. By contrast, a more prolonged period of strict controls, including the recurrence of hard lockdowns as seen in 1H22, would diminish consumer confidence and the prospects of a recovery in spending.