Mitsui O.S.K. Lines, Ltd. announced the establishment of a comprehensive Sustainable Finance Framework (Note 1) in line with its Key Principles (Note 2), including the “Climate Transition Finance Handbook 2023” of the International Capital Markets Association (ICMA).

The company has also obtained a second-party opinion (Note 3) from DNV Business Assurance Japan K.K. (DNV), an international third-party certification organization, regarding its eligibility. The MOL can flexibly and continuously use this framework to raise funds through sustainable finance.

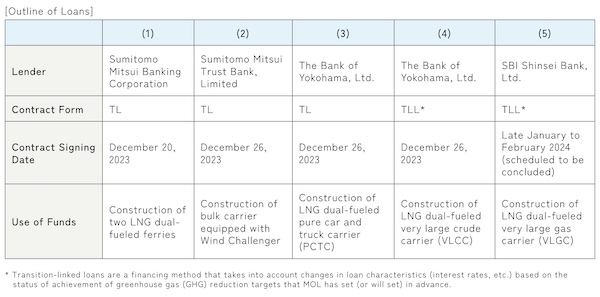

In addition, based on the Framework, the MOL Group has completed the signing of three Transition Loans (TL) and one Transition Linked Loan (TLL) financing agreement, as described below, and is scheduled to sign another TLL financing agreement as well.

The MOL Group has positioned environmental strategy as one of its major strategies and has set “marine and global environmental conservation” as one of sustainability issues (materiality) in the group management plan “BLUE ACTION 2035” formulated last year.

We aim to achieve “Net zero GHG emissions by 2050” and will work collaboratively with our partners and stakeholders with creativity to resolve environmental issues.

We will continue efforts toward sustainable finance by utilizing this framework in a funds procurement as well.

Source: Mitsui O.S.K. Lines