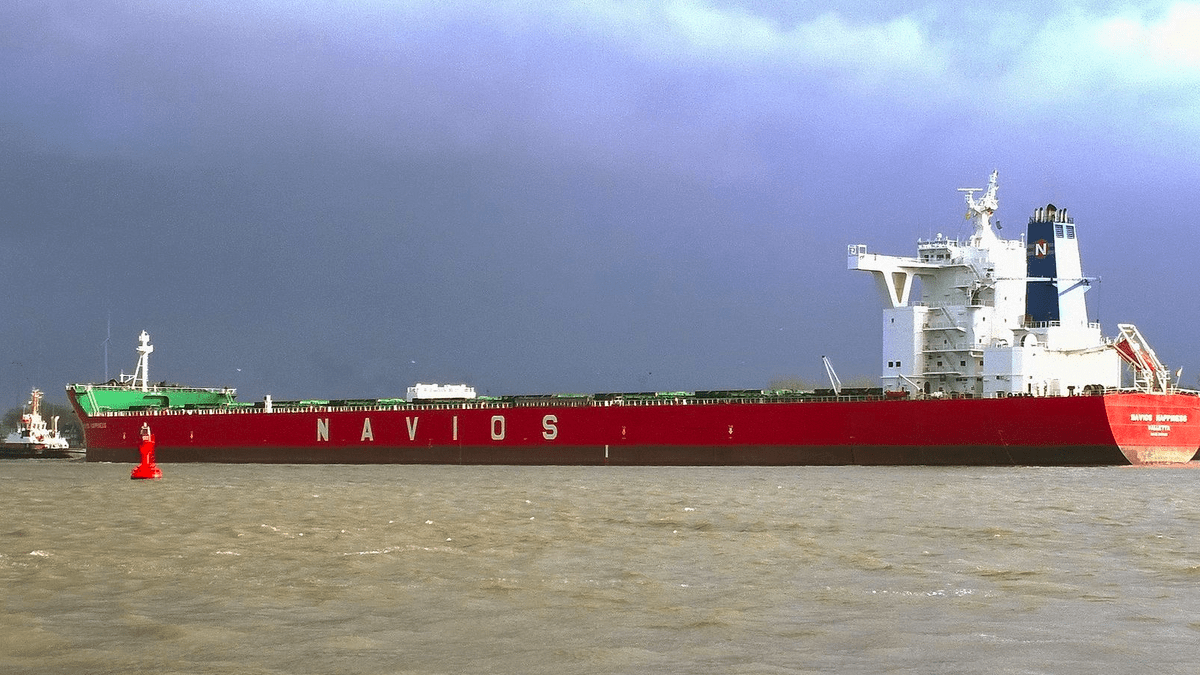

Navios Maritime Partners is buying the 36-vessel dry bulk fleet from parent company Navios Maritime Holdings for US$835M, including US$442M of bank liabilities, bareboat obligations and finance leasing obligations

The dry bulk fleet consists of 26 owned vessels and 10 chartered-in vessels, all with purchase options, with a total capacity of 3.9M dwt and an average age of 9.6 years.

The acquisition means Navios Partners will have the third-largest dry bulk fleet, and the second-largest overall fleet, among US-listed shipping companies.

The shipowner is counting on the value the vessels will generate at an optimistic time for the dry bulk market. Based on Clarksons’ one-year time charter rate as of 22 July, and certain operating cost assumptions, Navios Partners expects the acquired vessels to generate approximately US$164M of EBITDA and US$82M of estimated free cash in 2023.

The company believes Navios Holdings’ ships will increase its scale in the dry bulk market and flagged the migration to a younger fleet of more carbon-efficient ships, supported by opportunistically selling older, less carbon-efficient vessels.

Earlier this year, Navios Partners agreed to purchase four 115,000-dwt LR2 newbuilding vessels for US$59M each, plus US$4M in additional improvements, which are expected to be delivered 2024 and Q1 2025.

Following the completion of the present transaction, Navios Partners will own and operate a fleet of 90 dry bulk vessels, 49 container ships and 49 tankers, including 22 newbuilding vessels to be delivered by Q1 2025.

Marine Propulsion & Marine Lubricants Webinar Week will be held from 30 August 2022. Register your interest and access more information here