Norway’s Johan Sverdrup crude oil (JS Blend) has replaced Urals for many refiners in northwest Europe well ahead of a planned EU embargo on Russian crude, while a pending rise in output should help it solidify its position, according to traders and shipping data.

JS Blend, which made its market debut in late 2020, found demand in Asia and such arbitrage shipments accounted for 60% of sales.

From this March, however, supply to Europe surged, reaching record levels in the summer.

JS Blend supply to Europe between April and September ranged from 1.65 million to 1.95 million tonnes per month (476,000 barrels per day), according to shipping data via the Refinitiv Eikon terminal.

Shipments to Europe in January-September accounted for 73% of total production, up from 35% in the same period a year earlier.

Supplies to Asia over the same period fell to just 24% with no arbitrage loadings between June and August.

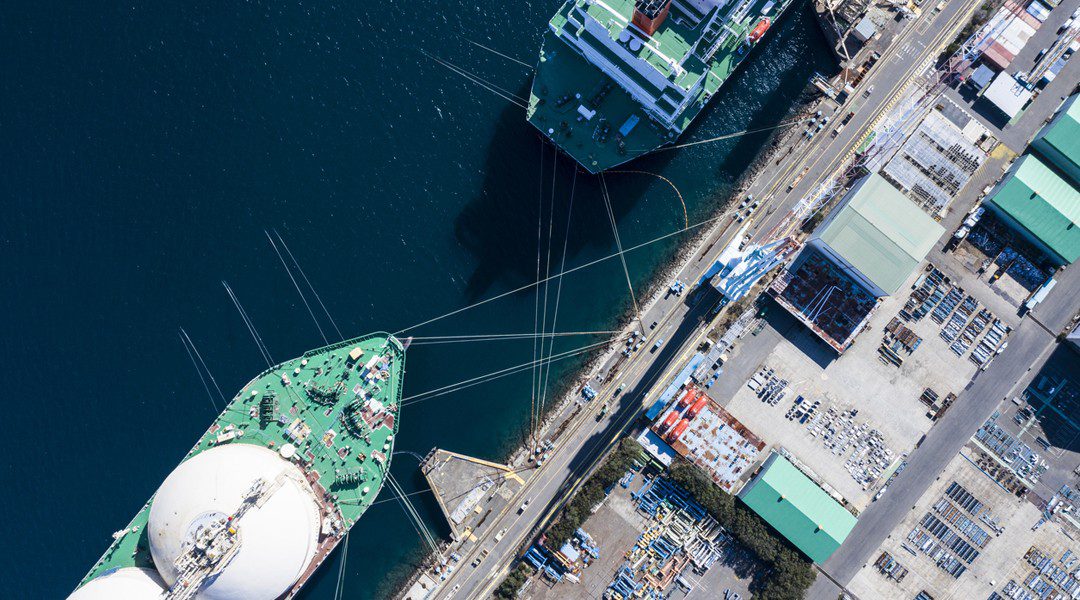

John Sverdrup crude oil deliveries

Johan Sverdrup output is expected to rise by more than 200,000 barrels per day to 755,000 bpd when its Phase 2 development starts by the end of 2022, operator Equinor has said.

If production increases in line with plans, JS Blend output in 2023 will be as much as a half of Urals Baltic exports, according to Reuters calculations.

Supply is not enough to fully replace Urals, but the grade has already become a worthy alternative due to cheap logistics and Urals-like quality, traders said.

Traditional importers of Urals cruse such as Finland, Lithuania and Germany have ramped JS Blend purchases this year.

Turkey sharply decreased purchases of the grade as it ramped up imports of Russian oil.

Asian buyers such as India and China which ramped up purchases of Russian Urals this year also significantly decreased buying of JS Blend, Refinitiv Eikon data showed.