Orient Overseas (International) Limited (OOIL) said it scored the highest first-half revenue in its history but is unsure if it can maintain the record-breaking ways.

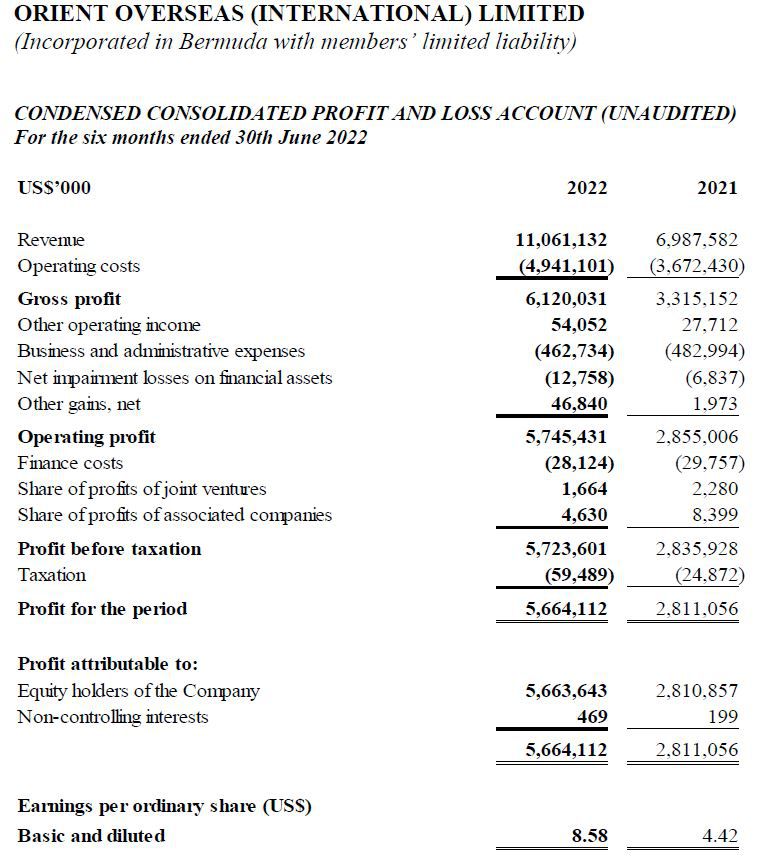

The Hong Kong-headquartered ocean carrier announced a profit attributable to equity holders of $5.66 billion for the six-month period that ended June 30, compared to a profit of $2.8 billion for the same period in 2021.

The first six months of 2022 produced the highest half-year revenue in OOIL’s history, climbing from just under $7 billion in 2021 to $11 billion this year. Revenue per twenty-foot equivalent unit increased by 74%, OOIL said.

Earnings before interest, taxes, amortization and depreciation also nearly doubled, from $3.11 billion in the first six months of 2021 to $6.16 billion this year.

“Yet at the same time, consumers are still purchasing new goods, even if not necessarily the same goods they were buying last year, and thus far there has not been a complete return of pre-pandemic patterns of spending on services as opposed to goods. Furthermore, forecasts from various port and retail sources in the U.S. suggest ongoing resilience in the demand for imported goods.”

OOIL is the parent company of Orient Overseas Container Line (OOCL) and OOCL (Europe) Limited and is part of the COSCO Shipping Group.

Headwinds in the first half of 2022 included the average price of bunker fuel, which was up year over year from $449 per ton to $729 per ton, OOIL said.

“The price increase of 62% in the first half of 2022 has led to a 46% increase in total bunker costs for the first half of 2022, as compared to the corresponding period in 2021, even though consumption of both fuel oil and diesel oil were lower in the first half of 2022 than in the corresponding period in 2021,” OOIL said.