New separate reporting from the International Council on Clean Transportation (ICCT) and the UCL Energy Institute question the long-term benefits of LNG as bunker fuel.

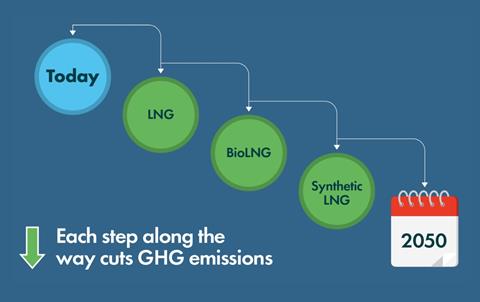

The ICCT states that the idea that LNG can help mitigate the climate impacts of the maritime shipping sector rests on the assumptions that ships can switch to bio and e-LNG in the future and that switching would result in GHG emissions. For this to happen, there must be enough renewable LNG to meet future demand and using it must result in a substantial reduction in GHG emissions on a life-cycle basis compared to fossil LNG.

“The LNG stairway” “/ /

Source: ICCT

The LNG stairway

The newly released ICCT report, Comparing the Future Demand for, Supply of, and Life-Cycle Emissions from Bio, Synthetic, and Fossil LNG, focuses on ships trading with the European Union. It predicts a tripling of demand for LNG as marine fuel between 2019 and 2030, based on trends in fuel consumption. It also estimates that renewable LNG will cost seven times more than fossil LNG in 2030 and, therefore, subsidies or other policies would be needed to encourage its use.

Using renewable LNG could cut well-to-wake (WtW) CO2e emissions by 38% based on 100-year global warming potentials (GWP) but raise emissions 6% based on 20-year GWP because of methane’s strong near-term warming effects. Even using 100% renewable LNG doubles methane emissions compared to 2019 – primarily because of methane slip from marine engines.

SEA-LNG sees flaws

Industry body SEA-LNG has responded to the report saying it is underpinned by old data and unrealistic assumptions. It significantly understates the potential availability of bioLNG for shipping in Europe and massively overstates its costs. It estimates that a maximum of 700 PJ (Peta Joules) of bioLNG could be available in 2030 if shipowners, operators, and charterers are willing to pay up to €/GJ. This compares to the current volumes of European biomethane production of 690 PJ – from anaerobic digestion, only – at a cost of €/GJ as reported by the European Biogas Association in December 2021.

“As the ICCT correctly states the supply of e-LNG is potentially unlimited but, as with other electro fuels such as e-methanol, e-ammonia and e-diesel, it will be extremely expensive. Approximately 80% of the cost of producing these fuels is associated with the cost of producing the common renewable hydrogen feedstock. Predicting the production costs of these fuels in 2030, let alone 2050, is highly problematic and dependent on many different assumptions.”

The ICCT’s estimates of life-cycle, or WtW, CO2e emissions for LNG-fuelled vessels in 2030 are based on historic vessel fleet data that is dominated by older, obsolete 4-stroke low pressure dual fuel diesel electric engine technologies which have relatively high levels of methane slip, says SEA-LNG.

Current DNV data on the LNG order book shows that approximately 75% of the LNG-fuelled new builds will use 2-stroke engines. These 2-stroke engines are used in deep sea shipping where 70%-80% of marine fuel is burned and the majority of GHG emissions generated. Of the 2-strokes on order, about 70% are high pressure diesel technologies which have negligible methane slip.

Further, in terms of their WtW GHG emissions calculations, the ICCT appears to use secondary data based on old engine technologies which suggest a maximum lifecycle benefit of a 15% reduction in CO2e emissions when using fossil LNG as a marine fuel compared to marine gas oil (MGO). This compares to reductions of up to 23% in GHG emissions calculated by Sphera in its 2021 study which is based on primary data from all major engine manufacturers and includes methane emissions. This study, widely recognised as the most definitive analysis of the GHG emissions of LNG as a marine fuel is not referenced.

It should also be noted that the ICCT emphasises the calculation of GHG emissions on 20-year global warming potential basis when the United Nations Framework Convention on Climate Change (UNFCCC) has adopted the 100-year GWP as the most relevant metric for national inventory reporting as it maintains policy focus on carbon dioxide as the main GHG to address.

“Based on its flawed analysis on the availability and cost of bioLNG and estimates of GHG emissions, the ICCT misleadingly suggests levels of public support required for the LNG pathway amounting to approximately €18 billion pa in Europe in 2030. In addition to the numbers being highly questionable they are also stated without any context. All future alternative fuel solutions will be more expensive than continuing to use fossil fuels.”

It is SEA-LNG’s view that waiting is not an option – LNG as a marine fuel delivers immediate GHG benefits and a lower risk, lower cost, incremental pathway to zero emissions through bioLNG in the near term and e-LNG as and when plentiful supplies of renewable electricity come on stream. Waiting or committing to solutions which rely on alternative fuels which will not be available at commercial scale in a renewable form for the foreseeable future, means owners locking in higher emissions and higher cost decarbonisation pathways.

UCL wades in

A new UCL Energy Institute study claims that the world’s rapidly growing fleet of ships that can run on LNG are at risk of financial losses of $850 billion by 2030.

The study, titled Exploring methods for understanding stranded value: case study on LNG-capable ships found that, if policies that incentivise shipping to decarbonise in line with the Paris Agreement were in place by the end of the decade, the LNG-capable fleet would compete against zero emissions shipping, whilst also being incentivised to switch away from the use of fossil fuel.

Whilst policy and competition would affect all ships built to use fossil fuels, the analysis suggests that more expensive LNG dual-fuel assets would see reductions in their value to match the value of similar aged but lower cost conventional vessels designed to use fuel oil.

The report found that the write-down of the full $850 billion value at risk would not be not realised if LNG-capable vessels were retrofitted to run on scalable zero emission fuels (hydrogen and hydrogen-derived fuels such as ammonia). Under these circumstances, the potential loss is estimated at approximately 15-25% of their value (£113 billion-£185 billion if the LNG-capable fleet grows strongly this decade).

There has been a boom in the ordering of LNG vessels over recent years, with 65% of the newbuilding deliveries by 2025 being capable of running on LNG as a marine fuel, up from only 10% a couple of years ago. Yet, the size of the LNG-capable fleet (by deadweight tonnage cargo carrying capacity and number of ships) is currently small, therefore the report authors state that there is still time to anticipate regulatory and technology developments and manage exposure to a class of assets that may be particularly exposed to stranded value risk (that is, their economic return may not last as long as expected).

Public funding has played a major role in financing LNG vessels through various government run schemes, directives and export credit agencies, such as the NOx Fund in Norway, the European Union’s directive on the deployment of alternative fuels infrastructure, the European Investment Bank and the Japanese and Korean Export Credit Agencies.

Co-author Dr Tristan Smith, Reader in Energy and Shipping at UCL Energy Institute, said: “As this decade proceeds, we will continue to experience more and more severe impacts from climate change. This will further grow pressure both in markets and policy negotiations to align assets to a rapid shift to zero emissions. Anticipating this pressure is straightforward, and whilst the best solutions for zero emissions international shipping are still emerging, it is already clear that LNG-capable shipping is not well positioned and faces a higher risk of stranded value during the transition.”

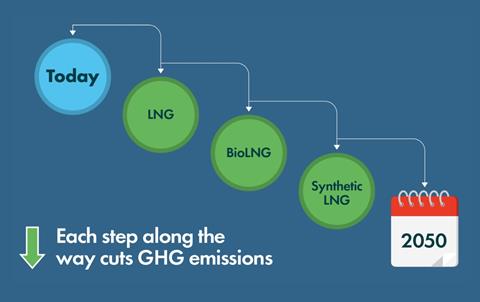

“The LNG stairway” “/ /

LNGs-stairway@2x-copy-1536×968

Source: ICCT

The LNG stairway

The study argues that governments should not use public funding to exacerbate the creation of stranded value and identifies methods that investors can use to identify the risks posed by climate change on shipping assets.

Instead, shipowners and financiers should consider not ordering LNG-capable ships and investing in conventionally fuelled ships which are designed for retrofit to zero-emission fuels. For existing LNG-capable ships, investors should consider ways to manage the risk of stranded value – e.g. factoring in the cost of retrofit (or other actions to remain compliant) at the point of newbuild or using a steeper than linear depreciation curve.

For policy makers the report asks for urgency and clarity of future regulations, especially around when and how methane emissions will be considered, to help investors in both existing ships and newbuilds consider and anticipate the potential impact of regulation.