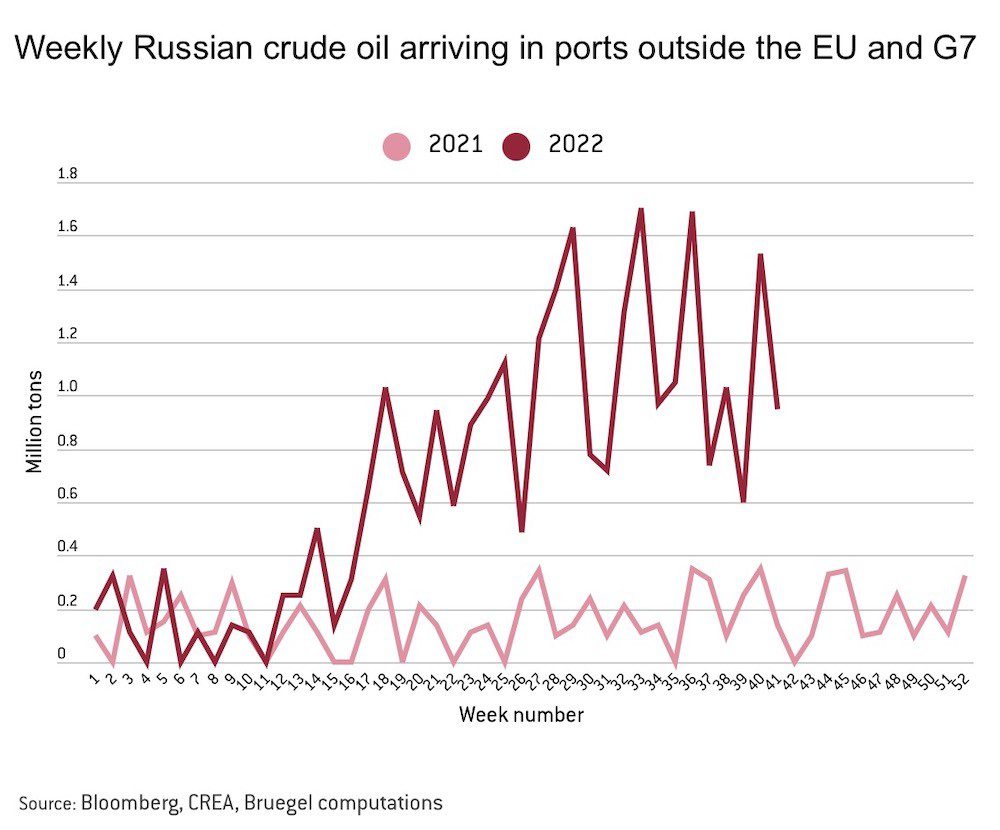

With six weeks to go until Europe’s ban on Russian crude kicks in, the scale of the global tanker fleet rejig Moscow is attempting is coming into focus.

By December 5, tanker owners that fly any European Union flag or carry P&I insurance from an EU club can no longer have crude oil onboard that originated in Russia, unless Russia has sold the crude to the buyer at or under an agreed price cap.

With 42 days to go, Russian oil exporters are shelling out significant sums on ships and overseas operations with Dubai emerging as a key centre for a new chapter in Russian tanker trades.

“The Russian government has had some time to prepare for the EU import ban and the associated restrictions on financial and maritime services, including cargo and vessel insurance,” pointed out analysts at tanker brokers Poten & Partners in their latest weekly report, questioning whether the Russians will have built up enough “alternative capacity” and how willing countries such as Denmark and Turkey would be to allow a growing fleet of older, less well maintained, maybe underinsured tankers pass through the Danish Straits and the Bosporus.

Anticipating China will increase its imports of Russian crude, while Turkey and nations in South and Southeast Asia will sustain their purchases analysts at brokers Braemar anticipate a capacity equivalent to nearly 300 aframaxes will be required to carry the 3.5m barrels per day of Russian export trade at an average speed of 10 knots. This further breaks down into 18 VLCCs, 65 suezmaxes and 157 aframaxes – an estimate from Braemar which includes an allowance for additional time for ship-to-ship operations.

Braemar calculates that Russia currently faces a shortfall of nearly 70 aframaxes and 35 suezmaxes to move the trade in its entirety. Braemar believes the dedicated Russian controlled fleet is 50 /LR2s and 10 suezmaxes. This includes the shuttle tanker fleet, not all of which be available for international voyages.

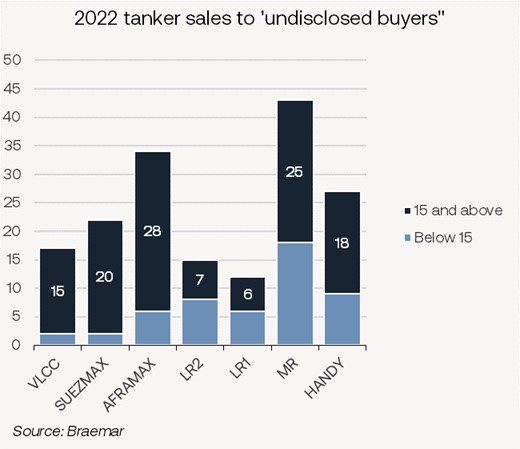

In addition to the Russian-controlled fleet, Braemar counts 35 /LR2s of the 15 years and older vintage sold to ‘undisclosed’ buyers this year. Another 20 suezmaxes and 15 VLCCs in the same age band have been similarly bought by undisclosed buyers this year, all of which are likely ready to deploy into the Russian trade in addition to some migration of the fleet from the Iranian trade.

“There remain many more ageing vessels that could yet change hands,” Braemar suggested in a tanker update.

This extensive Russian tanker buying has helped prop up tanker prices a great deal of late.

The Baltic Exchange revealed on Friday that five-year-old secondhand values for VLCCs surpassed the threshold of $90m for the first time since March 2009.

Since the end of last year, VLCCs have increased in price 24.4%, suezmaxes 26.5%, aframaxes 40.9% and MR tankers 37.8%.