According to Bloomberg, Russia’s seaborne crude oil exports have reached a 16-month peak over the last four weeks, with U.S. President Donald Trump struggling to persuade key buyers to abandon Russian oil. The average shipments from Russian ports stood at 3.62 million barrels per day as of September 28, matching levels not seen since May 2024.

This uptick in exports comes despite ongoing pressure from the U.S., particularly targeting nations like India and Turkey to cease their purchases of Russian oil. Notably, Indian officials have indicated that significantly reducing imports would require sourcing alternatives from sanctioned countries such as Iran and Venezuela.

China has emerged as the largest importer of Russian crude and is actively seeking to strengthen its energy partnership with Moscow rather than diminish it. The Chinese Ministry of Commerce recently stated its commitment to safeguarding national interests amidst calls for increased tariffs on Chinese goods by the G-7 nations.

In August, India faced an additional tariff on its exports to the U.S., aimed at curbing its reliance on Russian oil. While there has been a noticeable decline in shipments directly heading for Indian ports, many vessels are now en route without specified destinations beyond the Suez Canal—indicating that much of this crude may still end up in Indian refineries.

The situation is further complicated by sanctions imposed on Nayara Energy Ltd., an Indian refinery that has increasingly turned towards Russian crude following these restrictions.

In Europe, both Hungary and Slovakia have resisted calls from Trump’s administration to halt their imports of Russian fuel. Hungarian Prime Minister Viktor Orban argued that stopping piped fuel imports could lead to a significant economic downturn for his country—projected at around 4%.

Similarly, Slovakia’s President Peter Pellegrini highlighted technological limitations and insufficient capacity in alternative supply routes as barriers against compliance.

The Turkish government under President Recep Tayyip Erdogan continues importing approximately 300,000 barrels daily from Russia despite international pressures.

Meanwhile, Ukraine persists with drone strikes targeting Russian refineries; this disruption may be influencing recent increases in export volumes as damaged facilities divert more crude towards export terminals—a situation whose sustainability remains uncertain given limited spare capacity at Russia’s export terminals.

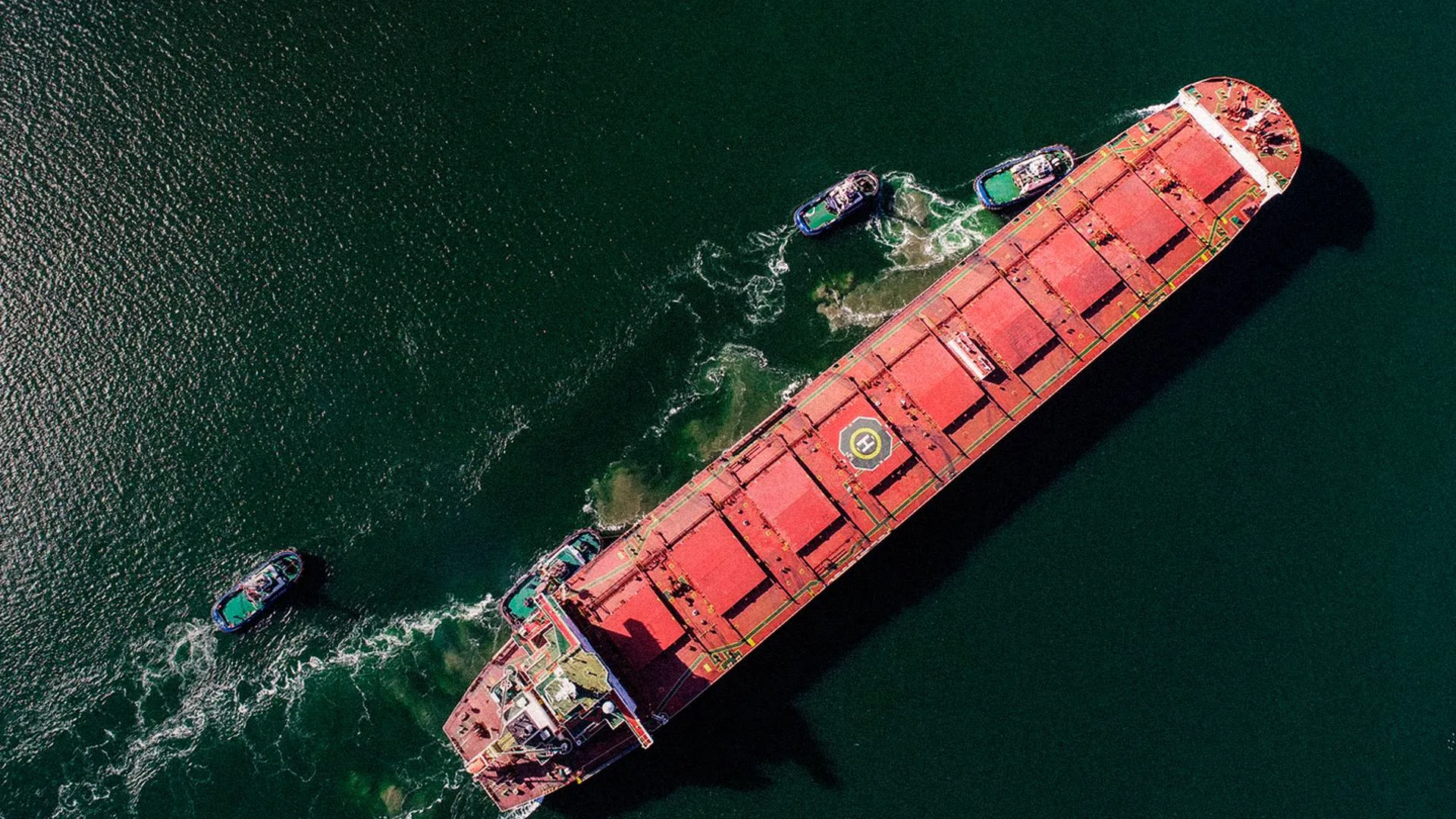

A total of 36 tankers loaded approximately 26.75 million barrels of crude during the week ending September 28—an increase compared to previous weeks’ figures which reported only about 23.69 million barrels across fewer vessels.

The gross value derived from these exports surged by roughly $240 million within one week alone—reaching $1.57 billion—the highest recorded over three weeks according to vessel-tracking data combined with port-agent reports.

The price per barrel for Urals cargoes rose slightly during this period: Baltic prices averaged $56.38 while Black Sea prices were around $56.59 per barrel.

However, Pacific grade ESPO saw a minor decline averaging $62.65 per barrel during this timeframe.

Indian delivered prices also increased significantly by about $1.90 per barrel reaching an eight-week high at $67.18 per barrel based on Argus Media statistics.

Total shipments directed toward Asian markets—including those without final destinations—increased slightly reaching an average of about 3.23 million barrels daily through late September—the highest since May last year.

While direct flows into India appear reduced currently due largely due regulatory pressures there remains substantial quantities aboard ships yet unassigned final delivery points which could reverse current trends if demand spikes again.

Shipments signaling Indian ports dropped downwards nearing just under one million barrels daily; however more than one million additional barrels remain aboard vessels awaiting destination confirmation indicating potential future activity levels might stabilize or even rise again soon enough depending upon market dynamics moving forward.

Flows into Turkey edged upwards slightly while those directed towards Syria decreased notably during this same period.